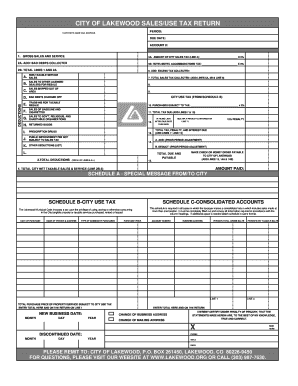

City of Lakewood Sales Tax Form

What is the City of Lakewood Sales Tax

The City of Lakewood sales tax is a tax imposed on the sale of goods and services within the city limits. This tax is a crucial source of revenue for local government, funding essential services such as public safety, infrastructure, and community programs. The current sales tax rate in Lakewood is a combination of state, county, and city taxes, which collectively contribute to the total sales tax charged to consumers. Understanding this tax is important for both residents and businesses operating in the area.

How to Use the City of Lakewood Sales Tax

Using the City of Lakewood sales tax involves understanding how it applies to various transactions. Businesses must collect sales tax on taxable sales, which includes most retail sales of tangible personal property and certain services. It is essential for businesses to accurately calculate and remit the correct amount of sales tax to avoid penalties. Consumers should be aware of the sales tax included in their purchases, as it affects the total cost of goods and services.

Steps to Complete the City of Lakewood Sales Tax

Completing the City of Lakewood sales tax involves several key steps. First, businesses should determine the applicable sales tax rate for their transactions. Next, they must collect the sales tax from customers at the point of sale. After collecting the tax, businesses need to maintain accurate records of all sales and tax collected. Finally, businesses must file sales tax returns with the appropriate authorities and remit the collected taxes by the specified deadlines to ensure compliance.

Legal Use of the City of Lakewood Sales Tax

The legal use of the City of Lakewood sales tax is governed by state and local tax laws. Businesses are required to register for a sales tax license if they sell taxable goods or services. Compliance with these laws is essential to avoid legal repercussions, including fines and penalties. Additionally, businesses should be aware of exemptions that may apply, such as sales to non-profit organizations or certain types of goods that are exempt from sales tax.

Filing Deadlines / Important Dates

Filing deadlines for the City of Lakewood sales tax are critical for businesses to adhere to. Typically, sales tax returns must be filed on a monthly, quarterly, or annual basis, depending on the volume of sales. It is important for businesses to keep track of these deadlines to avoid late fees. Important dates may also include the beginning of the tax year, changes in tax rates, and any special reporting requirements that may arise throughout the year.

Required Documents

To properly manage the City of Lakewood sales tax, businesses should maintain several key documents. These include sales receipts, tax exemption certificates, and records of all sales transactions. Additionally, businesses must keep copies of filed sales tax returns and any correspondence with tax authorities. Having these documents organized and readily available can facilitate compliance and streamline the filing process.

Penalties for Non-Compliance

Failure to comply with the City of Lakewood sales tax regulations can result in significant penalties. Businesses may face fines for late filings, underreporting sales tax, or failing to collect the appropriate amount of tax from customers. In severe cases, persistent non-compliance can lead to legal action or loss of the right to operate within the city. Understanding these penalties emphasizes the importance of adhering to all sales tax requirements.

Quick guide on how to complete city of lakewood sales tax

Effortlessly Prepare City Of Lakewood Sales Tax on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle City Of Lakewood Sales Tax on any device using airSlate SignNow's Android or iOS applications and streamline any document-based workflow today.

The Easiest Way to Modify and eSign City Of Lakewood Sales Tax Without Any Hassle

- Obtain City Of Lakewood Sales Tax and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and has the same legal validity as a traditional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign City Of Lakewood Sales Tax and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of lakewood sales tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Lakewood CO sales tax rate for businesses?

The current Lakewood CO sales tax rate for businesses is a crucial factor to consider for compliance and financial planning. It includes both state and local taxes, which can vary based on the type of transactions being conducted. To ensure accurate calculations and avoid penalties, businesses should regularly check for updates on the Lakewood CO sales tax rate.

-

How does airSlate SignNow help in managing sales tax documentation?

AirSlate SignNow streamlines the management of sales tax documentation by allowing businesses to create, send, and eSign tax-related documents effortlessly. This helps businesses to maintain accurate records regarding Lakewood CO sales tax, making it easier for audits and reviews. With signNow, you can ensure timely submissions and enhance compliance.

-

Are there any fees associated with using airSlate SignNow for sales tax documents?

Using airSlate SignNow comes with a straightforward pricing model tailored to fit various business needs. While there may be a monthly subscription fee, the savings on administrative tasks and compliance can signNowly offset costs associated with handling Lakewood CO sales tax documentation. This value ensures that businesses can manage their sales tax effectively without breaking the bank.

-

Can airSlate SignNow integrate with accounting software to track Lakewood CO sales tax?

Yes, airSlate SignNow can seamlessly integrate with various accounting software solutions, enabling businesses to track Lakewood CO sales tax efficiently. This integration simplifies the process of managing sales tax records and ensures that all documents are easily accessible within your existing accounting framework. This helps in maintaining clear visibility over tax obligations.

-

What features of airSlate SignNow support compliance with Lakewood CO sales tax regulations?

AirSlate SignNow provides features like secure eSigning, document templates, and audit trails that are essential for compliance with Lakewood CO sales tax regulations. These features ensure that documents are signed promptly and stored securely, minimizing the risk of errors. Additionally, the platform offers reminders for tax filing deadlines, aiding businesses in staying compliant.

-

How user-friendly is airSlate SignNow for handling sales tax documents?

AirSlate SignNow is designed with an intuitive user interface that makes it easy for businesses to handle sales tax documents. Regardless of technical expertise, users can navigate the platform to create, manage, and eSign documents related to Lakewood CO sales tax efficiently. The ease of use reduces training time and boosts productivity.

-

What benefits can businesses expect when using airSlate SignNow for tax documentation?

By using airSlate SignNow for tax documentation, businesses can expect increased efficiency, reduced paperwork, and improved accuracy in managing Lakewood CO sales tax. The platform automates many processes, allowing teams to focus on core business activities rather than administrative tasks. Ultimately, this leads to better compliance and saved resources.

Get more for City Of Lakewood Sales Tax

- Two year permit application abusable volatile chemical avc dshs texas form

- Tax file number application or enquiry for individuals living outside australia form

- Copyright glencoe mcgraw hill answer key form

- Pbby form

- Verification of mortgage form

- Nhpri prior authorization forms

- Usa funds forbearance form

- Exclusive partnership agreement template form

Find out other City Of Lakewood Sales Tax

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer