AMENDED IRS Form W 8BEN SEDM Sedm

What is the AMENDED IRS Form W-8BEN SEDM

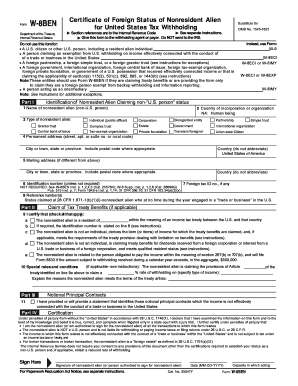

The AMENDED IRS Form W-8BEN SEDM is a tax form used by foreign individuals and entities to certify their foreign status for tax withholding purposes in the United States. This form is essential for claiming a reduced rate of withholding tax on certain types of income, such as dividends and interest, under an applicable tax treaty. The amended version reflects updates or corrections to previously submitted information, ensuring compliance with IRS regulations. It is particularly relevant for non-resident aliens and foreign businesses engaged in transactions with U.S. entities.

Steps to complete the AMENDED IRS Form W-8BEN SEDM

Completing the AMENDED IRS Form W-8BEN SEDM involves several key steps to ensure accuracy and compliance. Begin by gathering necessary personal and tax information, including your name, address, and taxpayer identification number (if applicable). Next, fill out the form by providing details about your foreign status and the specific income types you are claiming tax treaty benefits for. Make sure to review the form for any errors or omissions before signing and dating it. Finally, submit the completed form to the U.S. withholding agent or financial institution that requested it, rather than sending it directly to the IRS.

Legal use of the AMENDED IRS Form W-8BEN SEDM

The AMENDED IRS Form W-8BEN SEDM is legally recognized as a valid document for establishing foreign status and claiming tax treaty benefits. It must be completed accurately to avoid issues with tax withholding. The form must be signed by the individual or authorized representative, affirming that the information provided is true and correct. Compliance with IRS guidelines is crucial, as improper use of the form can lead to penalties or increased withholding rates. It is advisable to consult with a tax professional if there are uncertainties regarding the form's legal implications.

How to obtain the AMENDED IRS Form W-8BEN SEDM

The AMENDED IRS Form W-8BEN SEDM can be obtained directly from the IRS website or through authorized tax professionals. The form is available in a downloadable PDF format, which allows for easy printing and completion. Ensure that you are using the most current version of the form to comply with IRS requirements. If you are working with a financial institution or withholding agent, they may also provide the form or assist you in obtaining it.

Key elements of the AMENDED IRS Form W-8BEN SEDM

Several key elements must be included in the AMENDED IRS Form W-8BEN SEDM for it to be valid. These include the name and address of the individual or entity, the country of citizenship or incorporation, and the specific income types for which treaty benefits are being claimed. Additionally, the form requires a declaration of the individual's foreign status and a signature to affirm the accuracy of the information. It is important to ensure that all sections are completed thoroughly to avoid delays or issues with tax withholding.

Form Submission Methods (Online / Mail / In-Person)

The AMENDED IRS Form W-8BEN SEDM can be submitted through several methods, depending on the requirements of the withholding agent. Typically, the form is submitted directly to the U.S. entity requesting it, either via mail or electronically, if permitted. Some financial institutions may offer online submission options through secure portals. It is important to confirm the preferred submission method with the requesting party to ensure compliance and timely processing.

Quick guide on how to complete amended irs form w 8ben sedm sedm

Complete AMENDED IRS Form W 8BEN SEDM Sedm effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents rapidly without delays. Manage AMENDED IRS Form W 8BEN SEDM Sedm on any device using airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to alter and eSign AMENDED IRS Form W 8BEN SEDM Sedm with ease

- Find AMENDED IRS Form W 8BEN SEDM Sedm and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Alter and eSign AMENDED IRS Form W 8BEN SEDM Sedm and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the amended irs form w 8ben sedm sedm

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AMENDED IRS Form W 8BEN SEDM Sedm?

The AMENDED IRS Form W 8BEN SEDM Sedm is a specific version of the IRS Form W 8BEN, designed for non-U.S. residents to signNow their foreign status for tax withholding purposes. This amended form allows individuals and entities to receive benefits under the tax treaties. With airSlate SignNow, you can easily fill out and eSign this form securely.

-

How can airSlate SignNow help in managing the AMENDED IRS Form W 8BEN SEDM Sedm?

airSlate SignNow provides a user-friendly platform to create, fill out, and eSign the AMENDED IRS Form W 8BEN SEDM Sedm efficiently. The software ensures compliance with IRS regulations while simplifying each step of the document process, making it easier for businesses and individuals to manage their tax-related documentation.

-

Is airSlate SignNow a cost-effective solution for signing the AMENDED IRS Form W 8BEN SEDM Sedm?

Yes, airSlate SignNow offers competitive pricing plans that make it a cost-effective solution for eSigning the AMENDED IRS Form W 8BEN SEDM Sedm. With various subscription tiers, you can find a plan that fits your needs and budget while streamlining your document management process without hidden fees.

-

Does airSlate SignNow integrate with other software for handling the AMENDED IRS Form W 8BEN SEDM Sedm?

Absolutely! airSlate SignNow seamlessly integrates with various business applications, allowing you to manage the AMENDED IRS Form W 8BEN SEDM Sedm alongside your existing workflows. This integration ensures that you can easily access and send your documents wherever you need them without switching platforms.

-

What features does airSlate SignNow offer for the AMENDED IRS Form W 8BEN SEDM Sedm?

airSlate SignNow provides features like customizable templates, automatic reminders, and real-time tracking for the AMENDED IRS Form W 8BEN SEDM Sedm. These features ensure that you can efficiently manage your documents while staying compliant with all applicable regulations.

-

Can I store my completed AMENDED IRS Form W 8BEN SEDM Sedm documents securely?

Yes, airSlate SignNow offers secure storage for all your completed documents, including the AMENDED IRS Form W 8BEN SEDM Sedm. With industry-standard encryption and robust security measures, you can be confident that your sensitive information is protected.

-

What are the benefits of using airSlate SignNow for the AMENDED IRS Form W 8BEN SEDM Sedm?

Utilizing airSlate SignNow for the AMENDED IRS Form W 8BEN SEDM Sedm streamlines your document process, enhances efficiency, and reduces the risk of errors. Additionally, the platform's ease of use and accessibility from any device means that you can manage your tax documents on the go, saving you valuable time.

Get more for AMENDED IRS Form W 8BEN SEDM Sedm

Find out other AMENDED IRS Form W 8BEN SEDM Sedm

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors