Svat Invoice Format

What is the SVAT Invoice Format

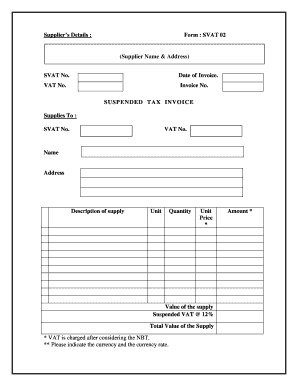

The SVAT invoice format is a specific document used in Sri Lanka for Value Added Tax (VAT) purposes. It is designed to comply with local tax regulations and serves as a formal request for payment for goods or services provided. This format ensures that all necessary information is included for both the seller and the buyer, facilitating proper tax reporting and compliance. The SVAT invoice must contain specific details such as the seller's and buyer's information, a unique invoice number, the date of issue, a description of the goods or services, and the applicable VAT rate.

Key Elements of the SVAT Invoice Format

To ensure compliance and proper processing, the SVAT invoice format must include several key elements:

- Seller Information: Name, address, and tax identification number.

- Buyer Information: Name, address, and tax identification number.

- Invoice Number: A unique identifier for tracking purposes.

- Date of Issue: The date when the invoice is generated.

- Description of Goods/Services: Clear details about what is being sold.

- Amount Charged: Total cost before tax.

- VAT Amount: The applicable VAT calculated based on the total amount.

- Total Amount Due: The final amount including VAT.

Steps to Complete the SVAT Invoice Format

Completing the SVAT invoice format involves a series of straightforward steps:

- Gather all necessary information about the seller and buyer.

- Assign a unique invoice number to the document.

- Fill in the date of issue accurately.

- Provide a detailed description of the goods or services rendered.

- Calculate the total amount due, including VAT.

- Review the completed invoice for accuracy.

- Distribute the invoice to the buyer and retain a copy for records.

Legal Use of the SVAT Invoice Format

The SVAT invoice format is legally recognized under Sri Lankan tax law. It must adhere to specific regulations to be considered valid. This includes ensuring that all required elements are present and that the invoice is issued in a timely manner. Failure to comply with these legal requirements can result in penalties or complications during tax audits. It is essential for businesses to understand the legal implications of using this format to avoid any potential issues.

How to Obtain the SVAT Invoice Format

The SVAT invoice format can typically be obtained through various channels. Businesses may download templates from official government websites or use accounting software that includes pre-designed invoice formats compliant with local regulations. Additionally, consulting with a tax professional can provide guidance on obtaining and utilizing the correct format for specific business needs.

Examples of Using the SVAT Invoice Format

Practical examples of using the SVAT invoice format include scenarios such as:

- A retail store issuing an invoice for a customer purchase that includes VAT.

- A service provider billing a client for consulting services rendered.

- A wholesaler supplying goods to a retailer and providing an invoice that details the transaction.

Each example highlights the importance of including all necessary details to ensure compliance and facilitate smooth transactions.

Quick guide on how to complete svat invoice format

Complete Svat Invoice Format effortlessly on any device

Web-based document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Svat Invoice Format on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The most efficient way to modify and electronically sign Svat Invoice Format seamlessly

- Obtain Svat Invoice Format and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional signature done in ink.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow addresses your needs in document management with just a few clicks from any device of your choosing. Adjust and electronically sign Svat Invoice Format to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the svat invoice format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a VAT invoice format in Sri Lanka?

A VAT invoice format in Sri Lanka is a specific layout used for issuing invoices that comply with the Value Added Tax regulations in the country. It must include essential details such as the seller's and buyer's information, VAT registration numbers, item descriptions, and applicable tax rates. Understanding the proper VAT invoice format ensures compliance with local laws and minimizes potential issues during audits.

-

How can airSlate SignNow help with VAT invoice format in Sri Lanka?

airSlate SignNow offers a user-friendly platform to create and send VAT invoices formatted according to Sri Lankan regulations. You can easily customize templates and include the necessary details to ensure compliance. This streamlines the invoicing process and enhances your business's efficiency in managing VAT-related documentation.

-

Is there a cost associated with creating VAT invoices in airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, which offers various pricing plans to suit different business needs. These plans provide access to features needed to create VAT invoices in Sri Lanka, including templates, eSignature capabilities, and document tracking. Investing in this solution can save you time and reduce the likelihood of errors in your VAT invoicing.

-

What features does airSlate SignNow offer for VAT invoice management?

airSlate SignNow provides several features for effective VAT invoice management including customizable templates, audit trails, real-time tracking, and electronic signatures. These features ensure that your VAT invoices meet Sri Lankan standards while also streamlining your workflow. The solution enhances collaboration with clients and speeds up the approval process.

-

Are there any integrations available for VAT invoice management with airSlate SignNow?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and business management tools, making it easier to manage your VAT invoices. These integrations facilitate the automatic transfer of data between platforms, ensuring that your invoicing remains consistent and compliant with the VAT invoice format in Sri Lanka. Integrating tools like accounting software can further simplify your invoicing process.

-

Can electronic signatures be used on VAT invoices in Sri Lanka?

Yes, electronic signatures are legally recognized in Sri Lanka and can be used on VAT invoices created with airSlate SignNow. This feature allows for faster processing and reduces the need for physical documents. By using electronic signatures, you can enhance the convenience of invoicing while complying with VAT regulations.

-

How does airSlate SignNow ensure compliance with VAT regulations?

airSlate SignNow ensures compliance with VAT regulations by providing accurate templates that reflect the required VAT invoice format in Sri Lanka. The platform also stays updated with any changes in tax regulations, helping businesses adapt their invoicing accordingly. This commitment to compliance minimizes risks and helps maintain good standing with local tax authorities.

Get more for Svat Invoice Format

Find out other Svat Invoice Format

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU