Form FT 941612Terminal Operator's Monthly Report of Diesel Tax Ny

What is the Form FT 941612 Terminal Operator's Monthly Report Of Diesel Tax Ny

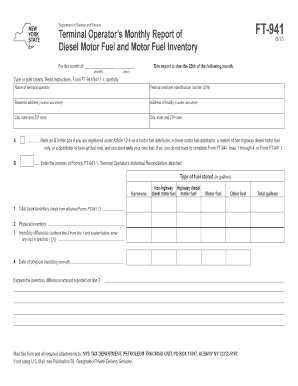

The Form FT 941612 Terminal Operator's Monthly Report Of Diesel Tax Ny is a document required by the New York State Department of Taxation and Finance. It is used by terminal operators to report the volume of diesel fuel received and distributed within the state. This form helps ensure compliance with state tax regulations related to diesel fuel sales and usage. Accurate reporting is essential for maintaining proper tax records and fulfilling legal obligations.

How to use the Form FT 941612 Terminal Operator's Monthly Report Of Diesel Tax Ny

To use the Form FT 941612, terminal operators must first gather all relevant data regarding diesel fuel transactions for the reporting period. This includes the total volume of diesel received, sold, and any losses incurred. Once the data is collected, operators can fill out the form, ensuring that all sections are completed accurately. After completing the form, it must be submitted to the appropriate state authority, either electronically or by mail, depending on the submission guidelines provided by the New York State Department of Taxation and Finance.

Steps to complete the Form FT 941612 Terminal Operator's Monthly Report Of Diesel Tax Ny

Completing the Form FT 941612 involves several key steps:

- Gather necessary documentation, including records of diesel fuel transactions for the month.

- Fill out the form with accurate data, ensuring all required fields are completed.

- Double-check the entries for accuracy to avoid any discrepancies.

- Submit the completed form by the specified deadline, following the submission method outlined by the state.

Legal use of the Form FT 941612 Terminal Operator's Monthly Report Of Diesel Tax Ny

The legal use of the Form FT 941612 is crucial for compliance with New York State tax laws. Terminal operators must ensure that the information provided is truthful and accurate, as any false reporting can lead to penalties. The form serves as an official record of diesel fuel transactions, and its proper completion is necessary to avoid legal repercussions. Adhering to the guidelines set forth by the New York State Department of Taxation and Finance ensures that the form is used legally and effectively.

Filing Deadlines / Important Dates

Filing deadlines for the Form FT 941612 are typically set on a monthly basis. Terminal operators must submit their reports by the end of the month following the reporting period. For example, the report for January must be filed by the end of February. It is essential to keep track of these deadlines to avoid late fees or penalties associated with non-compliance.

Form Submission Methods (Online / Mail / In-Person)

The Form FT 941612 can be submitted through several methods. Operators may choose to file online via the New York State Department of Taxation and Finance's e-filing system, which provides a quick and efficient way to submit reports. Alternatively, the form can be mailed to the designated address provided by the state. In-person submissions may also be possible at local tax offices, but it is recommended to verify this option beforehand.

Quick guide on how to complete form ft 941612terminal operators monthly report of diesel tax ny

Easily Prepare Form FT 941612Terminal Operator's Monthly Report Of Diesel Tax Ny on Any Device

Digital document management has become favored by businesses and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed paperwork, enabling you to locate the right template and securely store it online. airSlate SignNow equips you with all the tools you require to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage Form FT 941612Terminal Operator's Monthly Report Of Diesel Tax Ny on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Simplest Way to Edit and Electronically Sign Form FT 941612Terminal Operator's Monthly Report Of Diesel Tax Ny without Hassle

- Locate Form FT 941612Terminal Operator's Monthly Report Of Diesel Tax Ny and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for such tasks.

- Generate your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form FT 941612Terminal Operator's Monthly Report Of Diesel Tax Ny and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ft 941612terminal operators monthly report of diesel tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form FT 941612 Terminal Operator's Monthly Report Of Diesel Tax Ny?

Form FT 941612 Terminal Operator's Monthly Report Of Diesel Tax Ny is a document required by New York State for terminal operators to report and pay gasoline and diesel fuel taxes. The form helps ensure compliance with tax regulations and provides a clear record of fuel activities for operators. Properly completing this form can save businesses from potential penalties and fines.

-

How can airSlate SignNow simplify the submission of Form FT 941612?

airSlate SignNow streamlines the process of completing and submitting Form FT 941612 Terminal Operator's Monthly Report Of Diesel Tax Ny by providing an intuitive eSignature platform. Users can easily fill out, sign, and send the form electronically, saving time and reducing paperwork. This efficiency can greatly enhance accuracy and compliance.

-

What are the pricing options for using airSlate SignNow for form submissions?

airSlate SignNow offers various pricing plans suitable for different business needs, enabling flexible access to features needed for managing Form FT 941612 Terminal Operator's Monthly Report Of Diesel Tax Ny. Pricing often includes options for individual users and teams, making it cost-effective regardless of the size of your operation. Visit our pricing page to find the best plan for your business.

-

Is airSlate SignNow compliant with New York State regulations regarding Form FT 941612?

Yes, airSlate SignNow is designed to comply with the regulations set forth by New York State for handling documents like Form FT 941612 Terminal Operator's Monthly Report Of Diesel Tax Ny. Our platform ensures that users can manage their forms while adhering to legal standards, which minimizes compliance risks. Leveraging our solution means you're in line with what’s required by the state.

-

What features does airSlate SignNow provide for managing Form FT 941612?

airSlate SignNow offers a range of features that simplify managing Form FT 941612 Terminal Operator's Monthly Report Of Diesel Tax Ny, including custom templates, team collaboration tools, and secure cloud storage. Users can track submission statuses and receive notifications to ensure timely submission. These features enhance productivity and make form management easier than ever.

-

Can I integrate airSlate SignNow with my existing accounting software when handling Form FT 941612?

Absolutely! airSlate SignNow supports integration with various accounting and business applications, enabling seamless data transfer for handling Form FT 941612 Terminal Operator's Monthly Report Of Diesel Tax Ny. This helps streamline your workflow and reduces the need for manual data entry, improving overall efficiency and accuracy in your reporting.

-

What are the benefits of using airSlate SignNow for Form FT 941612?

Using airSlate SignNow for Form FT 941612 Terminal Operator's Monthly Report Of Diesel Tax Ny brings numerous benefits, including increased efficiency, improved accuracy, and enhanced security. The platform allows for easy access to forms, electronic signatures, and real-time collaboration, which can speed up the filing process. Additionally, the secure document storage ensures your information remains confidential.

Get more for Form FT 941612Terminal Operator's Monthly Report Of Diesel Tax Ny

- The science of ecology worksheet answer key form

- Wildlife survey protocols pinedale field office bureau of land blm form

- Writ of execution form kansas

- Ds sample pdf form

- Form it 360 1 new york change of city resident in lacerte

- Asset agreement template form

- Asset loan agreement template form

- Asset management agreement template form

Find out other Form FT 941612Terminal Operator's Monthly Report Of Diesel Tax Ny

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later