Delaware Division of Revenue 8th Monthly Form

What is the Delaware Division Of Revenue 8th Monthly

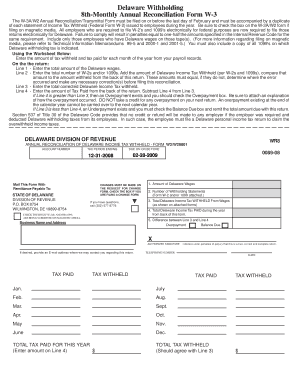

The Delaware Division of Revenue 8th Monthly form is a specific document used for tax reporting purposes by businesses operating in Delaware. This form is typically required for businesses to report their monthly tax obligations, including sales tax and withholding tax. It serves as a vital tool for compliance with state tax regulations, ensuring that businesses accurately report their earnings and remit the appropriate taxes to the state.

How to use the Delaware Division Of Revenue 8th Monthly

To utilize the Delaware Division of Revenue 8th Monthly form effectively, businesses must gather all necessary financial data for the reporting period. This includes total sales, taxable sales, and any applicable deductions. Once the data is compiled, businesses can fill out the form, ensuring all figures are accurate and complete. After completing the form, it can be submitted electronically, which streamlines the process and provides a secure method of filing.

Steps to complete the Delaware Division Of Revenue 8th Monthly

Completing the Delaware Division of Revenue 8th Monthly form involves several key steps:

- Gather financial records for the reporting period, including sales and tax information.

- Access the form through the Delaware Division of Revenue's website or a trusted electronic document service.

- Fill in the required fields, ensuring accuracy in all reported figures.

- Review the completed form for any errors or omissions.

- Submit the form electronically for timely processing.

Legal use of the Delaware Division Of Revenue 8th Monthly

The legal use of the Delaware Division of Revenue 8th Monthly form is crucial for maintaining compliance with state tax laws. Businesses must ensure that the form is filled out accurately and submitted by the designated deadlines to avoid penalties. Electronic signatures can be used to validate the submission, provided that they comply with relevant eSignature laws, such as ESIGN and UETA. This legal framework ensures that electronically signed documents hold the same weight as traditional paper forms.

Filing Deadlines / Important Dates

Filing deadlines for the Delaware Division of Revenue 8th Monthly form are typically set by the state and may vary based on the specific reporting period. It is essential for businesses to stay informed about these deadlines to avoid late fees or penalties. Generally, the form must be submitted by the 20th of the month following the reporting period. Keeping a calendar of important dates can help ensure timely submissions.

Form Submission Methods (Online / Mail / In-Person)

The Delaware Division of Revenue 8th Monthly form can be submitted through various methods, offering flexibility to businesses. The preferred method is online submission, which allows for immediate processing and confirmation. Alternatively, businesses may choose to mail the completed form or submit it in person at designated state offices. Each method has its own advantages, with online submission being the most efficient and secure option.

Quick guide on how to complete delaware division of revenue 8th monthly

Access Delaware Division Of Revenue 8th Monthly effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent eco-friendly option to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools needed to create, edit, and eSign your documents quickly and without delay. Handle Delaware Division Of Revenue 8th Monthly from any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest method to modify and eSign Delaware Division Of Revenue 8th Monthly effortlessly

- Locate Delaware Division Of Revenue 8th Monthly and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or conceal sensitive information using tools specifically provided by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or disorganized files, tedious form searches, or errors needing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Delaware Division Of Revenue 8th Monthly and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the delaware division of revenue 8th monthly

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Delaware Division of Revenue 8th monthly submission?

The Delaware Division of Revenue 8th monthly submission refers to the tax filings that businesses must complete each month. This submission is crucial for maintaining compliance with state tax regulations and ensuring proper record-keeping. Failing to file can lead to penalties, making it essential to stay on top of these deadlines.

-

How can airSlate SignNow assist with the Delaware Division of Revenue 8th monthly process?

airSlate SignNow streamlines the process of sending and eSigning documents associated with the Delaware Division of Revenue 8th monthly submission. Our platform simplifies document management, allowing businesses to swiftly complete and submit required forms. With intuitive features, you can reduce the time spent on paperwork and focus more on your business operations.

-

What are the pricing options for using airSlate SignNow for the Delaware Division of Revenue 8th monthly submissions?

airSlate SignNow offers a variety of pricing plans to suit different business needs, making it an affordable solution for managing Delaware Division of Revenue 8th monthly submissions. You can choose from monthly or annual plans depending on your usage and requirements. Each plan comes with features that enhance document workflows, providing great value.

-

What features does airSlate SignNow provide for the Delaware Division of Revenue 8th monthly submissions?

With airSlate SignNow, you gain access to features such as customizable templates, secure eSignature capabilities, and workflow automation. These tools are specifically designed to assist with Delaware Division of Revenue 8th monthly submissions by ensuring that documents are completed accurately and efficiently. Additionally, you can track the progress of your submissions in real-time.

-

What are the benefits of using airSlate SignNow for tax submissions?

Using airSlate SignNow for your Delaware Division of Revenue 8th monthly submissions enables better organization and efficiency. You can eliminate paper clutter and reduce turnaround times with our digital solutions. Moreover, managing your submissions electronically enhances security and provides easy access to all your important documents.

-

Does airSlate SignNow integrate with other tools for the Delaware Division of Revenue reporting?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software, making it easier to manage your Delaware Division of Revenue 8th monthly submissions. This integration ensures that data flows smoothly between platforms, reducing the chances of errors. You'll have a more cohesive system for handling all aspects of your financial reporting.

-

How does using airSlate SignNow improve compliance with Delaware tax laws?

airSlate SignNow helps improve compliance with Delaware tax laws by providing reliable audit trails and secure storage for your documents. You can ensure that all Delaware Division of Revenue 8th monthly submissions are completed according to the state's regulations. Our solution also allows you to easily access important documents for review or audits.

Get more for Delaware Division Of Revenue 8th Monthly

- Playbill rubric flushing high school form

- Worklife balance action plan braganb bstoreb form

- Lapd 77th division map form

- Us bully registry po box 1180 temecula ca 92593 us form

- Ada health history form gantz dental

- Soonersave withdrawal form

- Pca supp rev 11 18 indd form

- Get pressure washing service agreement form

Find out other Delaware Division Of Revenue 8th Monthly

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast