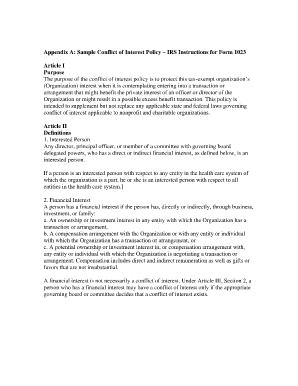

Appendix a Sample Conflict of Interest Policy IRS Instructions for Form

Understanding the IRS Conflict of Interest Policy Sample

The IRS conflict of interest policy sample serves as a guideline for organizations to establish their own conflict of interest policies. This document outlines the expectations for employees and board members regarding transparency and ethical behavior when dealing with personal interests that may conflict with their professional responsibilities. The policy typically includes definitions of conflicts of interest, procedures for disclosure, and consequences for failing to adhere to the policy.

Key Elements of the IRS Conflict of Interest Policy Sample

When creating or reviewing an IRS conflict of interest policy sample, several key elements should be included:

- Definition of Conflict of Interest: Clearly define what constitutes a conflict of interest within the organization.

- Disclosure Procedures: Outline the steps employees must take to disclose potential conflicts, including timelines and responsible parties.

- Review Process: Describe how disclosed conflicts will be evaluated and managed by the organization.

- Enforcement: Specify the consequences for failing to disclose conflicts or violating the policy.

- Training Requirements: Include provisions for training employees on recognizing and managing conflicts of interest.

Steps to Complete the IRS Conflict of Interest Policy Sample

To effectively implement the IRS conflict of interest policy sample, organizations should follow these steps:

- Review Existing Policies: Assess current policies to identify gaps or areas for improvement.

- Draft the Policy: Use the sample as a foundation, tailoring it to the specific needs of the organization.

- Consult Stakeholders: Involve key stakeholders in the review process to ensure buy-in and compliance.

- Finalize the Document: Make necessary revisions based on feedback and finalize the policy.

- Communicate the Policy: Distribute the policy to all employees and provide training on its importance and implementation.

Legal Use of the IRS Conflict of Interest Policy Sample

The legal use of the IRS conflict of interest policy sample hinges on its alignment with federal and state regulations. Organizations must ensure that their policy complies with applicable laws, such as the Sarbanes-Oxley Act, which emphasizes transparency and accountability in financial reporting. Additionally, organizations should regularly review and update their policies to reflect changes in legislation or organizational structure.

How to Obtain the IRS Conflict of Interest Policy Sample

Organizations can obtain the IRS conflict of interest policy sample through various channels:

- IRS Website: Access sample policies and guidelines directly from the IRS official website.

- Professional Associations: Many industry-specific associations provide templates and resources for their members.

- Legal Advisors: Consult with legal experts who specialize in nonprofit or corporate governance for tailored advice and samples.

Examples of Using the IRS Conflict of Interest Policy Sample

Utilizing the IRS conflict of interest policy sample can vary based on organizational context. For instance, a nonprofit organization may adapt the sample to address specific funding sources and donor relationships, while a corporation might focus on vendor contracts and employee stock ownership. By customizing the policy to fit the unique circumstances of the organization, leaders can foster a culture of integrity and accountability.

Quick guide on how to complete appendix a sample conflict of interest policy irs instructions for

Complete Appendix A Sample Conflict Of Interest Policy IRS Instructions For with ease on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Manage Appendix A Sample Conflict Of Interest Policy IRS Instructions For on any device using airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

How to modify and eSign Appendix A Sample Conflict Of Interest Policy IRS Instructions For effortlessly

- Find Appendix A Sample Conflict Of Interest Policy IRS Instructions For and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Alter and eSign Appendix A Sample Conflict Of Interest Policy IRS Instructions For and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the appendix a sample conflict of interest policy irs instructions for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sample conflict of interest policy and why is it important?

A sample conflict of interest policy outlines guidelines for identifying and managing conflicts of interest within an organization. It's essential for maintaining transparency and integrity, ensuring that all employees understand their responsibilities in avoiding potential conflicts that could compromise their judgment.

-

How can airSlate SignNow help in drafting a sample conflict of interest policy?

airSlate SignNow offers templates and tools that simplify the process of drafting a sample conflict of interest policy. With our user-friendly interface, businesses can easily customize templates to fit their specific needs, streamlining document preparation and approval.

-

What features does airSlate SignNow offer for managing policies like a sample conflict of interest policy?

AirSlate SignNow provides advanced features such as document editing, electronic signatures, and secure storage. These functionalities make it easy to manage a sample conflict of interest policy from creation to execution, ensuring compliance and accessibility.

-

What are the benefits of using airSlate SignNow for my sample conflict of interest policy?

Using airSlate SignNow for your sample conflict of interest policy enhances efficiency and accuracy. Our platform allows for swift document processing, reduces paperwork, and provides a secure way to manage sensitive information, all while facilitating compliance with organizational standards.

-

Is there a cost associated with using airSlate SignNow to create a sample conflict of interest policy?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. The cost effective solutions we provide ensure that even small businesses can access the necessary tools to draft and manage their sample conflict of interest policy efficiently.

-

Can I integrate airSlate SignNow with other software to manage my sample conflict of interest policy?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to incorporate your sample conflict of interest policy into existing workflows. This integration helps streamline processes while keeping your documents organized and easily accessible.

-

How long does it take to implement a sample conflict of interest policy with airSlate SignNow?

Implementing a sample conflict of interest policy with airSlate SignNow can be done in just a few hours, depending on your specific requirements. Our platform is designed for quick setup and user-friendly navigation, enabling you to have your policy ready for review and distribution in no time.

Get more for Appendix A Sample Conflict Of Interest Policy IRS Instructions For

Find out other Appendix A Sample Conflict Of Interest Policy IRS Instructions For

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer