Mn Extension Form

What is the Minnesota Extension Payment Voucher?

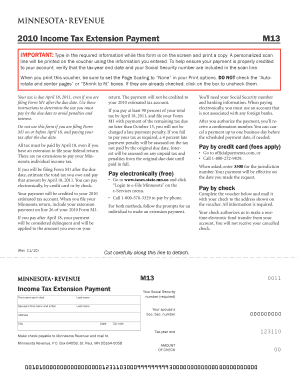

The Minnesota Extension Payment Voucher is a crucial document for taxpayers seeking to extend their income tax filing deadline in the state of Minnesota. This form allows individuals and businesses to request an extension for filing their state income tax returns, providing them with additional time to prepare their financial information without incurring penalties. The voucher is specifically designed for those who anticipate that they will owe taxes and need to make a payment by the original due date to avoid interest and penalties.

How to Use the Minnesota Extension Payment Voucher

Using the Minnesota Extension Payment Voucher involves a straightforward process. Taxpayers must complete the form with their personal information, including name, address, and Social Security number or Employer Identification Number. Additionally, they need to estimate their tax liability and include any payment due with the voucher. Once completed, the voucher should be submitted along with the appropriate payment to ensure compliance with state tax regulations.

Steps to Complete the Minnesota Extension Payment Voucher

Completing the Minnesota Extension Payment Voucher requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather necessary financial documents, including income statements and previous tax returns.

- Fill in your personal information accurately, ensuring that your name and address match your official records.

- Estimate your total tax liability for the year and calculate any payment you need to submit.

- Double-check all entries for accuracy, particularly your Social Security number or EIN.

- Sign and date the voucher before submitting it.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Minnesota Extension Payment Voucher. Generally, the voucher must be submitted by the original due date of the tax return, which is typically April 15 for individuals. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers should also note that while the extension allows for additional time to file, any taxes owed must still be paid by the original deadline to avoid penalties.

Legal Use of the Minnesota Extension Payment Voucher

The Minnesota Extension Payment Voucher is legally binding when completed correctly and submitted on time. It is essential to comply with all state regulations regarding extensions and payments. The use of electronic signatures is permitted, provided that the signer meets the necessary legal requirements. Utilizing a reliable eSignature platform can enhance the security and validity of the submission, ensuring that all legal stipulations are met.

Who Issues the Minnesota Extension Payment Voucher?

The Minnesota Department of Revenue is responsible for issuing the Minnesota Extension Payment Voucher. This state agency oversees the administration of tax laws and ensures that taxpayers have the necessary forms and information to fulfill their obligations. Taxpayers can access the voucher through the Minnesota Department of Revenue's official website or by contacting the agency directly for assistance.

Quick guide on how to complete mn extension form

Effortlessly prepare Mn Extension Form on any device

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed papers, allowing you to access the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Mn Extension Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Mn Extension Form with ease

- Find Mn Extension Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Mn Extension Form and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mn extension form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Minnesota extension payment voucher?

The Minnesota extension payment voucher is a document that allows taxpayers to submit extension payments for their state income taxes. By using this voucher, you can easily calculate and remit your payment while ensuring compliance with Minnesota tax regulations. It is an essential tool for anyone seeking to extend their filing deadline.

-

How can airSlate SignNow help with Minnesota extension payment vouchers?

airSlate SignNow simplifies the process of completing and signing Minnesota extension payment vouchers. You can fill out the necessary information digitally and eSign the form, which saves time and reduces the chances of errors. With our platform, you can manage your forms efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for Minnesota extension payment vouchers?

Yes, airSlate SignNow offers various pricing plans depending on your needs, including options for individuals and businesses. The investment in using our services for Minnesota extension payment vouchers is cost-effective, considering the time savings and efficiency gains. You can choose a plan that best fits your requirements and budget.

-

What features does airSlate SignNow offer for managing Minnesota extension payment vouchers?

airSlate SignNow features intuitive document creation tools that let you easily generate Minnesota extension payment vouchers. Our platform includes options for eSigning, sharing, and tracking your documents, ensuring that you have full control over the process. Additionally, our templates streamline your workflow to expedite preparation and submission.

-

Can I integrate airSlate SignNow with other tools for managing Minnesota extension payment vouchers?

Absolutely! airSlate SignNow seamlessly integrates with various applications, allowing you to manage your Minnesota extension payment vouchers alongside other business processes. Popular integrations include CRM systems, project management tools, and cloud storage services, enhancing your overall productivity.

-

What are the benefits of using airSlate SignNow for Minnesota extension payment vouchers?

Using airSlate SignNow for Minnesota extension payment vouchers provides numerous benefits, such as improved efficiency, reduced paperwork, and enhanced security. With our easy-to-use platform, you can complete and submit your vouchers quickly, ensuring timely compliance with state deadlines. Additionally, our secure encryption protects your sensitive information throughout the process.

-

How does eSigning a Minnesota extension payment voucher work?

eSigning a Minnesota extension payment voucher with airSlate SignNow is straightforward. After filling out your document electronically, you can add your signature with just a few clicks. The process is legally binding and secure, ensuring that your submission meets all state requirements for authenticity.

Get more for Mn Extension Form

- Hackmaster character sheet form

- Return to work form after fmla ynhh

- Stratford police vulnerable sector check form

- Confession of judgment promissory note form

- In the court eighteenth judicial circuit brevard county form

- Court disposition examples form

- State court of henry county state of georgia form

Find out other Mn Extension Form

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document