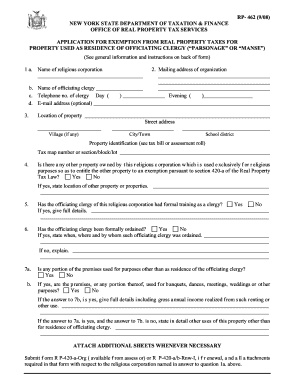

Online Rp 462 Form

What is the Online Rp 462

The Online Rp 462 is a specific form used primarily for tax-related purposes within the United States. It serves as a means for individuals or businesses to report certain financial information to the relevant authorities. This form is essential for ensuring compliance with federal and state tax regulations. By utilizing the online version, users can efficiently complete and submit their forms digitally, streamlining the process and reducing the need for paper documentation.

How to use the Online Rp 462

Using the Online Rp 462 involves several straightforward steps. First, access the form through a reliable digital platform that supports electronic signatures. Once you have the form open, carefully fill in the required fields with accurate information. It is crucial to double-check all entries for accuracy to avoid potential issues with tax authorities. After completing the form, you can electronically sign it using a secure eSignature tool, ensuring that your submission is legally binding.

Steps to complete the Online Rp 462

Completing the Online Rp 462 can be broken down into a few key steps:

- Access the form through a trusted online platform.

- Fill in all required fields with accurate and relevant information.

- Review the completed form for any errors or omissions.

- Utilize an eSignature tool to sign the document electronically.

- Submit the form electronically to the appropriate tax authority.

Legal use of the Online Rp 462

The Online Rp 462 is legally valid when completed and submitted in accordance with established regulations. To ensure its legality, users must comply with the eSignature laws outlined in the ESIGN Act and UETA. These regulations affirm that electronic signatures hold the same legal weight as traditional handwritten signatures, provided that the signer has consented to use electronic records and signatures. Utilizing a reputable platform for completion and submission enhances the form's legal standing.

Required Documents

When preparing to complete the Online Rp 462, it is important to gather all necessary documents. Typically, users may need:

- Personal identification information, such as Social Security numbers.

- Financial records relevant to the information being reported.

- Any prior tax documents that may be needed for reference.

Having these documents ready will facilitate a smoother completion process and help ensure accuracy in reporting.

Form Submission Methods

The Online Rp 462 can be submitted through various methods, primarily focusing on electronic submission. Users can complete the form online and submit it directly to the relevant tax authority. Alternatively, if preferred, the form can be printed and mailed in. However, electronic submission is often recommended due to its speed and efficiency, as well as the added benefit of receiving immediate confirmation of receipt.

Quick guide on how to complete online rp 462

Effortlessly Prepare Online Rp 462 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-conscious substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the features you require to create, modify, and electronically sign your documents swiftly without delays. Manage Online Rp 462 on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign Online Rp 462 with Ease

- Find Online Rp 462 and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any preferred device. Modify and eSign Online Rp 462 to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the online rp 462

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is online rp 462 and how does it work?

Online rp 462 is a digital solution that allows users to efficiently eSign and manage documents online. With airSlate SignNow, you can easily send, sign, and store your documents securely from anywhere, streamlining your workflow and eliminating the need for paper.

-

What are the key features of online rp 462?

The online rp 462 platform includes features such as customizable templates, real-time tracking of document status, and multiple signing options. Additionally, you can integrate it with other tools, making it a versatile choice for businesses looking to enhance their document management process.

-

How much does online rp 462 cost?

Pricing for online rp 462 varies based on the plan you choose. airSlate SignNow offers different subscription options to accommodate various business needs, including pay-as-you-go plans and monthly subscriptions, ensuring a cost-effective solution for eSigning and document management.

-

Is online rp 462 secure for my documents?

Yes, online rp 462 is designed with security in mind. It employs encryption, secure storage, and compliance with electronic signature laws to ensure that your documents are protected and that your data remains confidential.

-

Can I integrate online rp 462 with other software?

Absolutely! Online rp 462 supports integrations with multiple applications such as CRM systems, cloud storage, and productivity tools. This allows you to streamline your workflow and utilize airSlate SignNow alongside the software you already use.

-

What are the benefits of using online rp 462 for my business?

Using online rp 462 accelerates the document signing process, reduces paperwork, and enhances productivity. It allows businesses to get documents signed in real-time, improving customer satisfaction and ultimately leading to faster deal closures.

-

Can I access online rp 462 on mobile devices?

Yes, online rp 462 is accessible on mobile devices through its responsive web design and mobile app. This ensures that you can send, sign, and manage your documents on the go, providing flexibility and convenience for users.

Get more for Online Rp 462

- Que es fundempresa pdf form

- Parent portal okaloosa form

- Donation request form alaska sealife center home page alaskasealife

- Certificate of origin taiwan pdf form

- Hold harmless agreement insurance requirements form

- Monroe county government building permit application form

- Charitable solicitation permit palm beach florida form

- Buy 5 entry form buy 5 entry form girl scouts of citrus

Find out other Online Rp 462

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template