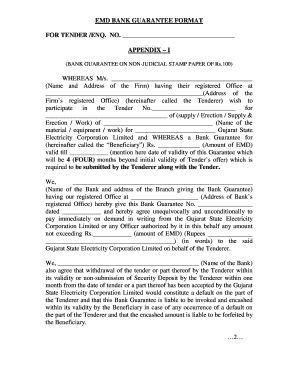

Bank Guarantee Format for Tender

What is the bank guarantee format for tender

A bank guarantee letter for tender is a formal document issued by a bank on behalf of a client, ensuring that the client will fulfill their contractual obligations in a tender process. This document serves as a safety net for the party requesting the guarantee, typically a project owner or contractor. If the client fails to meet the terms of the contract, the bank is obligated to pay a specified amount to the beneficiary. The format of this letter generally includes essential details such as the parties involved, the amount guaranteed, the conditions under which the guarantee can be invoked, and the validity period.

Key elements of the bank guarantee format for tender

When drafting a bank guarantee letter for tender, it is crucial to include specific key elements to ensure its validity and effectiveness. These elements typically consist of:

- Parties involved: Clearly identify the beneficiary, the applicant (client), and the issuing bank.

- Amount: Specify the monetary value of the guarantee.

- Conditions: Outline the conditions under which the guarantee can be claimed, such as default or non-performance.

- Validity period: State the duration for which the guarantee is valid, including start and end dates.

- Signature and seal: Include the signatures of authorized bank representatives and the bank's official seal.

Steps to complete the bank guarantee format for tender

Completing a bank guarantee letter for tender involves several important steps to ensure accuracy and compliance. The process typically includes:

- Gather necessary information: Collect all relevant details about the tender, including the amount, parties involved, and specific terms.

- Draft the letter: Use a clear and concise format, incorporating all key elements mentioned above.

- Review for accuracy: Ensure all information is correct and that the document adheres to any legal or organizational requirements.

- Obtain signatures: Have the authorized representatives from the bank and the client sign the document.

- Submit the guarantee: Provide the completed bank guarantee letter to the relevant parties involved in the tender process.

Legal use of the bank guarantee format for tender

The legal use of a bank guarantee letter for tender is governed by various regulations and standards. In the United States, it is essential that the document complies with the Uniform Commercial Code (UCC) and any specific state laws that may apply. The guarantee must be executed properly to be enforceable in a court of law. Additionally, it is advisable to consult with legal counsel to ensure that the terms of the guarantee align with the contractual obligations and protect the interests of all parties involved.

How to obtain the bank guarantee format for tender

Obtaining a bank guarantee letter for tender typically involves working directly with your banking institution. Here are the steps to follow:

- Contact your bank: Reach out to your bank’s representative or customer service to inquire about their process for issuing a bank guarantee.

- Provide necessary documentation: Submit any required documents, such as proof of identity, financial statements, and details of the tender.

- Complete application forms: Fill out any application forms provided by the bank for the issuance of the guarantee.

- Review terms and fees: Understand the terms of the guarantee and any associated fees before finalizing the request.

- Receive the guarantee: Once approved, the bank will issue the bank guarantee letter for tender, which you can then present as needed.

Examples of using the bank guarantee format for tender

Bank guarantee letters for tender are commonly used in various industries, including construction, procurement, and service contracts. For instance:

- Construction projects: A contractor may need to provide a bank guarantee to a project owner to assure them of the contractor's commitment to completing the work as specified in the tender.

- Supply contracts: Suppliers often issue bank guarantees to buyers to secure their obligations in delivering goods or services as outlined in the tender agreement.

- Service agreements: Service providers may be required to submit a bank guarantee to clients to ensure adherence to service level agreements during the contract period.

Quick guide on how to complete bank guarantee format for tender

Complete Bank Guarantee Format For Tender effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Bank Guarantee Format For Tender on any platform with airSlate SignNow's Android or iOS apps and streamline any document-related tasks today.

How to modify and eSign Bank Guarantee Format For Tender effortlessly

- Locate Bank Guarantee Format For Tender and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method of sending the form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns of lost or misfiled documents, tedious form searches, or errors that require reprinting document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Alter and eSign Bank Guarantee Format For Tender and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bank guarantee format for tender

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a bank guarantee and how does it work?

A bank guarantee is a financial promise made by a banking institution to cover a loss if the borrower fails to meet contractual obligations. In essence, if you have a bank guarantee, the bank assures that it will pay a specified amount if needed. This financial instrument is commonly used in business transactions to provide reassurance to parties involved.

-

How can airSlate SignNow help with bank guarantees?

AirSlate SignNow simplifies the process of sending and eSigning documents related to bank guarantees. With our platform, you can easily create, manage, and securely share documents that include bank guarantees, ensuring that all parties have access to the necessary information. This streamlines the workflow and enhances collaboration among stakeholders.

-

What are the key features of airSlate SignNow for managing bank guarantees?

AirSlate SignNow offers features such as customizable templates, advanced eSigning options, and real-time document tracking, all tailored for bank guarantees. These features ensure that you can create accurate agreements quickly while maintaining compliance and security. Our platform also supports multiple document formats, making it versatile for various business needs.

-

Is there a cost associated with using airSlate SignNow for bank guarantees?

Yes, there are costs associated with using airSlate SignNow, but our pricing is designed to be cost-effective. You can choose from various plans based on your business size and usage, ensuring you get the best value for managing bank guarantees. Additionally, we offer a free trial so you can explore our features before committing.

-

Can airSlate SignNow integrate with other financial software for managing bank guarantees?

Absolutely! airSlate SignNow integrates seamlessly with many popular financial and CRM software platforms, facilitating the management of bank guarantees. This integration allows you to connect your existing systems, reducing manual entries and enhancing efficiency. Our API also allows for custom integrations tailored to your specific needs.

-

What benefits can I expect from using airSlate SignNow for bank guarantees?

Using airSlate SignNow for bank guarantees provides benefits like increased efficiency in document processing, reduced paperwork, and enhanced security for sensitive information. This cost-effective solution helps minimize errors during the transaction process while ensuring all documents are easily accessible and trackable. Your business can focus on growth rather than paperwork.

-

How secure is airSlate SignNow for transactions involving bank guarantees?

Security is a top priority at airSlate SignNow, especially for sensitive transactions like bank guarantees. Our platform uses advanced encryption and secure data storage practices to protect your documents and information. Additionally, we comply with industry standards and regulations to ensure that your transactions remain confidential and secure.

Get more for Bank Guarantee Format For Tender

- Dufferin peel flexible boundary form

- Mw506r maryland tax forms and instructions the comptroller of

- Cipa botswana forms

- Sta application for employment solano transportation authority sta ca form

- Delta pilot disability guide form

- Pasco county street parking permit form

- English in flight form two sided pdf format hawaii tourism hawaiitourismauthority

- Heartshare apply online form

Find out other Bank Guarantee Format For Tender

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form