Objection Form Tax Professionals

What is the ATO Objection Form for Tax Professionals

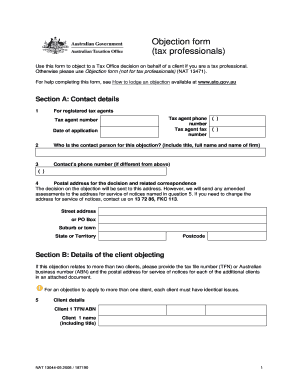

The ATO objection form for tax professionals is a crucial document used by tax professionals to formally contest decisions made by the Australian Taxation Office (ATO). This form allows tax professionals to represent their clients in disputes regarding tax assessments, rulings, or other decisions that may impact their clients' tax obligations. Understanding the purpose and function of this form is essential for tax professionals who aim to provide effective advocacy on behalf of their clients.

How to Use the ATO Objection Form for Tax Professionals

Using the ATO objection form requires careful attention to detail and adherence to specific guidelines. Tax professionals should begin by gathering all relevant documentation that supports the objection. This includes tax returns, correspondence with the ATO, and any other pertinent information. Once the form is completed, it should be submitted to the appropriate ATO office, ensuring that all submission guidelines are followed to avoid delays or rejections.

Steps to Complete the ATO Objection Form for Tax Professionals

Completing the ATO objection form involves several key steps:

- Gather all necessary documents and information relevant to the objection.

- Fill out the form accurately, ensuring all sections are completed.

- Provide a clear explanation of the reasons for the objection.

- Attach supporting documentation to substantiate the claims made in the form.

- Review the completed form for accuracy before submission.

- Submit the form through the designated ATO channels, either online or by mail.

Legal Use of the ATO Objection Form for Tax Professionals

The legal use of the ATO objection form is governed by specific regulations set forth by the ATO. It is essential for tax professionals to ensure that the form is used in compliance with these regulations to maintain its validity. The form must be submitted within the timeframes specified by the ATO, and all claims made must be supported by appropriate evidence. Failure to comply with these legal requirements may result in the objection being dismissed.

Key Elements of the ATO Objection Form for Tax Professionals

Several key elements must be included in the ATO objection form to ensure its effectiveness:

- Personal Information: Details of the tax professional and the client.

- Details of the Decision: Specifics regarding the ATO decision being contested.

- Grounds for Objection: A clear statement outlining the reasons for the objection.

- Supporting Documentation: Any relevant evidence that supports the objection.

- Signature: The form must be signed by the tax professional or authorized representative.

Filing Deadlines / Important Dates

Filing deadlines for the ATO objection form are critical to the success of the objection process. Tax professionals must be aware of the specific timeframes within which the form must be submitted. Typically, objections must be filed within a certain period following the notification of the ATO decision. Missing these deadlines can result in the loss of the right to contest the decision, making it vital for tax professionals to stay informed about these important dates.

Quick guide on how to complete objection form tax professionals

Effortlessly Prepare Objection Form Tax Professionals on Any Device

Online document handling has gained traction among businesses and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed documents, enabling you to locate the suitable form and securely keep it online. airSlate SignNow provides all the tools necessary to generate, modify, and eSign your documents swiftly without unnecessary delays. Manage Objection Form Tax Professionals on any device using airSlate SignNow’s Android or iOS applications and simplify any document-centric process today.

The Simplest Method to Edit and eSign Objection Form Tax Professionals with Ease

- Locate Objection Form Tax Professionals and click Get Form to initiate.

- Make use of the tools we offer to complete your form.

- Emphasize relevant portions of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that task.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all details and press the Done button to finalize your changes.

- Choose your preferred method to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns of lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Objection Form Tax Professionals while ensuring excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the objection form tax professionals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an objection form for tax professionals?

An objection form for tax professionals is a document that allows tax practitioners to formally express disagreement with tax assessments or decisions. This form is essential for ensuring that clients receive fair treatment from tax authorities. Leveraging an efficient objection form can streamline the appeal process and improve client satisfaction.

-

How does the airSlate SignNow platform support the objection form for tax professionals?

The airSlate SignNow platform provides an easy-to-use interface to create, send, and eSign objection forms for tax professionals. This helps ensure that the forms are completed quickly and accurately, reducing the administrative burden on tax practitioners. With enhanced workflow capabilities, SignNow enables smoother processing of tax objections.

-

Is there a pricing plan for using the objection form for tax professionals with airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of tax professionals using objection forms. Depending on the features and volume of usage, you can choose a plan that provides excellent value for your business. Additionally, there are often discounts for annual subscriptions, making it a cost-effective solution.

-

What features make airSlate SignNow ideal for managing objection forms for tax professionals?

AirSlate SignNow offers features like customizable templates, secure eSigning, and automated workflows, which are perfect for managing objection forms for tax professionals. These features enhance efficiency and reduce errors in documentation. Additionally, the platform's compliance with legal standards ensures that your objection forms are recognized by tax authorities.

-

Can I integrate the objection form for tax professionals with other software?

Absolutely! AirSlate SignNow supports various integrations with popular software solutions that tax professionals utilize, enhancing the workflow of objection forms. You can seamlessly connect with accounting software, CRM systems, and document management tools to streamline processes and improve productivity.

-

What benefits do tax professionals gain by using airSlate SignNow for objection forms?

By using airSlate SignNow for objection forms, tax professionals gain signNow time savings and improved accuracy in document handling. The platform allows for quick eSigning and real-time tracking of forms, leading to faster resolutions of tax disputes. This effectiveness ultimately contributes to higher client trust and satisfaction.

-

Is airSlate SignNow secure for handling sensitive objection forms for tax professionals?

Yes, airSlate SignNow ensures high-level security for handling objection forms for tax professionals. The platform employs encryption and secure data storage practices to protect sensitive client information. Compliance with industry regulations further guarantees that your objection forms are handled securely.

Get more for Objection Form Tax Professionals

Find out other Objection Form Tax Professionals

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament