Ri Use Tax Form

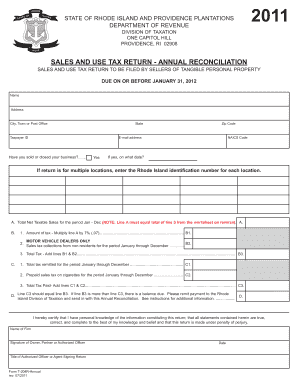

What is the RI Use Tax Form

The RI Use Tax Form is a document that allows individuals and businesses in Rhode Island to report and pay use tax on items purchased outside the state that are used, stored, or consumed within Rhode Island. This form is essential for ensuring compliance with state tax laws, particularly for those who have made purchases from out-of-state vendors that did not charge Rhode Island sales tax. The use tax rate aligns with the state's sales tax rate, making it crucial for taxpayers to understand their obligations when acquiring goods from online retailers or other sources outside Rhode Island.

How to use the RI Use Tax Form

Using the RI Use Tax Form involves a few straightforward steps. First, gather all relevant purchase documentation, including receipts and invoices for items bought from out-of-state vendors. Next, accurately complete the form by listing each item purchased, its purchase price, and the applicable use tax. After filling out the form, you can submit it either online or by mail, depending on your preference. It is important to retain copies of the completed form and any supporting documents for your records, as they may be needed for future reference or audits.

Steps to complete the RI Use Tax Form

Completing the RI Use Tax Form requires careful attention to detail. Follow these steps for accurate submission:

- Gather all purchase records, including receipts and invoices.

- Access the RI Use Tax Form from the Rhode Island Division of Taxation website.

- Fill in your personal information, including name, address, and tax identification number.

- List each item purchased, its purchase price, and calculate the use tax owed.

- Review the form for accuracy and completeness.

- Submit the form online or mail it to the appropriate tax authority.

Legal use of the RI Use Tax Form

The legal use of the RI Use Tax Form is governed by state tax laws, which require taxpayers to report and pay use tax on taxable purchases made outside Rhode Island. Failure to complete and submit this form can result in penalties and interest charges. It is important to understand that the use tax is intended to level the playing field between in-state and out-of-state retailers, ensuring that all purchases are subject to the same tax obligations. By properly using the RI Use Tax Form, taxpayers fulfill their legal responsibilities and contribute to state revenue.

Filing Deadlines / Important Dates

Timely filing of the RI Use Tax Form is crucial to avoid penalties. Generally, the form must be submitted by the same deadline as the Rhode Island personal income tax return, which is typically April fifteenth. However, if you are filing for a business, the deadlines may differ based on your business structure and fiscal year. It is advisable to check the Rhode Island Division of Taxation website for any updates or changes to these deadlines, as well as any specific instructions regarding extensions or late filings.

Form Submission Methods (Online / Mail / In-Person)

The RI Use Tax Form can be submitted through various methods, providing flexibility for taxpayers. Online submission is available through the Rhode Island Division of Taxation's e-filing system, which offers a convenient way to complete and send the form electronically. Alternatively, you can print the completed form and mail it to the appropriate tax office. In-person submissions may also be accepted at designated tax offices, but it is recommended to confirm availability and hours before visiting. Regardless of the method chosen, ensure that you keep a copy of the submitted form for your records.

Quick guide on how to complete ri use tax form

Effortlessly complete Ri Use Tax Form on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed forms, allowing you to find the necessary template and securely save it in the cloud. airSlate SignNow provides all the resources you require to create, edit, and eSign your documents quickly and efficiently. Handle Ri Use Tax Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest way to edit and eSign Ri Use Tax Form without stress

- Obtain Ri Use Tax Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or conceal sensitive details with the specialized tools provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, laborious form hunting, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Ri Use Tax Form and maintain effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ri use tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Rhode Island annual sales tax reconciliation?

Rhode Island annual sales tax reconciliation is the process of reconciling the sales tax collected by businesses over the year with the amount owed to the state. It ensures that businesses accurately report and pay their sales tax obligations to avoid penalties. Using the right tools can simplify this process signNowly.

-

How does airSlate SignNow help with Rhode Island annual sales tax reconciliation?

airSlate SignNow streamlines the document workflow for Rhode Island annual sales tax reconciliation by allowing businesses to eSign necessary documents quickly and securely. With all signatures collected electronically, you can maintain accurate records that are essential for tax filings. This enhances efficiency and reduces the risk of errors.

-

What features does airSlate SignNow offer for managing sales tax documents?

airSlate SignNow offers features such as customizable templates, automated workflows, and advanced reporting to aid in managing sales tax documents for Rhode Island annual sales tax reconciliation. These features help ensure all documents are organized, easily accessible, and compliant with state regulations.

-

Is airSlate SignNow cost-effective for small businesses handling Rhode Island annual sales tax reconciliation?

Yes, airSlate SignNow is a cost-effective solution for small businesses tackling Rhode Island annual sales tax reconciliation. Its flexible pricing plans fit various budgets while offering comprehensive features, making it accessible for businesses of all sizes. This investment can save time and reduce errors in the reconciliation process.

-

Can airSlate SignNow integrate with accounting software for sales tax reconciliation?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, which helps streamline the Rhode Island annual sales tax reconciliation process. This integration allows for easy import and export of financial data, making it simple to ensure that your sales tax records align with your financial statements.

-

What are the benefits of using airSlate SignNow for eSigning sales tax-related documents?

Using airSlate SignNow for eSigning sales tax-related documents provides numerous benefits, including enhanced security, faster turnaround times, and improved compliance. By keeping an electronic record of all signed documents, businesses can easily reference them during Rhode Island annual sales tax reconciliation, reducing the risk of discrepancies.

-

How can I ensure compliance with Rhode Island sales tax laws using airSlate SignNow?

To ensure compliance with Rhode Island sales tax laws using airSlate SignNow, you can utilize its templates and workflows that are designed to adhere to state regulations. The platform helps you keep track of deadlines and required documentation, assisting you in maintaining proper records for Rhode Island annual sales tax reconciliation to avoid potential fines.

Get more for Ri Use Tax Form

Find out other Ri Use Tax Form

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple