Co Dor Form Dr 1666

What is the Co Dor Form Dr 1666

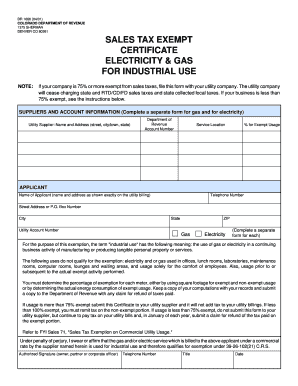

The Co Dor Form Dr 1666 is a specific document used in Colorado for various administrative purposes. This form is often required for tax-related matters, particularly in relation to property taxes. It serves as a means for individuals or businesses to report certain types of information to the state, ensuring compliance with local regulations. Understanding the purpose of this form is crucial for anyone involved in property transactions or tax filings in Colorado.

How to use the Co Dor Form Dr 1666

Using the Co Dor Form Dr 1666 involves several steps to ensure that the information provided is accurate and complete. First, gather all necessary information, including property details and personal identification. Next, fill out the form carefully, ensuring that each section is completed as required. After completing the form, review it for any errors or omissions before submission. This careful approach helps prevent delays in processing and ensures compliance with state requirements.

Steps to complete the Co Dor Form Dr 1666

Completing the Co Dor Form Dr 1666 requires attention to detail. Follow these steps:

- Gather relevant information, including property tax identification numbers and personal data.

- Access the form through official state resources or authorized platforms.

- Fill out the form, ensuring all sections are addressed accurately.

- Double-check the information provided for accuracy.

- Submit the completed form according to the instructions provided, either online or via mail.

Legal use of the Co Dor Form Dr 1666

The legal use of the Co Dor Form Dr 1666 is governed by state laws and regulations. It is essential that the form is completed and submitted according to these legal frameworks to ensure that it is recognized by the authorities. Failure to comply with the legal requirements can result in penalties or delays in processing. Therefore, understanding the legal implications of this form is vital for individuals and businesses operating in Colorado.

Key elements of the Co Dor Form Dr 1666

Key elements of the Co Dor Form Dr 1666 include specific sections that must be filled out accurately. These typically encompass:

- Property identification details, including address and tax identification number.

- Owner information, requiring names and contact details.

- Details regarding the nature of the request or submission.

- Signature and date fields to validate the form.

Form Submission Methods

The Co Dor Form Dr 1666 can be submitted through various methods, catering to the preferences of the user. Common submission methods include:

- Online submission via the official state website, which allows for quicker processing.

- Mailing the completed form to the designated state office.

- In-person submission at local government offices, providing an opportunity for immediate confirmation.

Who Issues the Form

The Co Dor Form Dr 1666 is issued by the Colorado Department of Revenue or relevant local government agencies. These authorities are responsible for overseeing the collection of property taxes and ensuring compliance with state regulations. Understanding the issuing body is important for users to know where to direct their inquiries or submissions regarding the form.

Quick guide on how to complete co dor form dr 1666

Complete Co Dor Form Dr 1666 effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents quickly without delays. Handle Co Dor Form Dr 1666 on any device using airSlate SignNow Android or iOS applications and enhance any document-oriented task today.

How to modify and eSign Co Dor Form Dr 1666 with ease

- Find Co Dor Form Dr 1666 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your preference. Edit and eSign Co Dor Form Dr 1666 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the co dor form dr 1666

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the co dor form dr 1666 used for?

The co dor form dr 1666 is utilized for various administrative and legal processes within business operations. It helps streamline workflows by providing a standardized format for document submission. By using this form, companies can ensure compliance and enhance the efficiency of their filing systems.

-

How can airSlate SignNow help with the co dor form dr 1666?

airSlate SignNow simplifies the process of filling out and signing the co dor form dr 1666 electronically. With our user-friendly interface, users can easily complete the form, add digital signatures, and save it securely. This eliminates the need for paper, making the process faster and more environmentally friendly.

-

Is there a cost associated with using the co dor form dr 1666 on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow for the co dor form dr 1666, but it is designed to be cost-effective for businesses of all sizes. Our pricing plans offer various features, ensuring you get the best value for your investment. Contact us for detailed pricing information tailored to your specific needs.

-

What features does airSlate SignNow offer for the co dor form dr 1666?

airSlate SignNow provides a range of features for the co dor form dr 1666, including template creation, automated workflows, and real-time tracking. Users can also access integrations with other software to streamline their processes further. These features help businesses manage their document signing efficiently while ensuring security and compliance.

-

Can I integrate the co dor form dr 1666 with other software tools?

Absolutely! airSlate SignNow allows for easy integration with various software tools, ensuring the co dor form dr 1666 fits seamlessly into your existing systems. Whether it's CRM platforms or project management tools, our integrations enhance productivity and workflow automation.

-

What are the benefits of using airSlate SignNow for the co dor form dr 1666?

By using airSlate SignNow for the co dor form dr 1666, businesses benefit from increased efficiency, reduced paperwork, and streamlined communication. The electronic signing process accelerates approvals, allowing you to focus on core business activities. Additionally, the platform offers enhanced security measures to protect sensitive information.

-

Is the co dor form dr 1666 compliant with legal requirements when signed on airSlate SignNow?

Yes, documents signed using airSlate SignNow, including the co dor form dr 1666, are compliant with various federal and state electronic signature laws. Our platform ensures all signatures are legally binding and secure. You can confidently rely on our solutions for your business documentation needs.

Get more for Co Dor Form Dr 1666

Find out other Co Dor Form Dr 1666

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple