Online Tax Ohio it 1040ez the Ohio Department Form

What is the Online Tax Ohio IT 1040EZ The Ohio Department Form

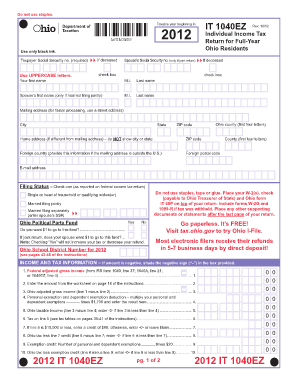

The Online Tax Ohio IT 1040EZ form is a simplified tax return designed for individual taxpayers in Ohio. This form allows eligible residents to report their income and claim deductions in a straightforward manner. It is primarily intended for those with a basic tax situation, making it an efficient option for many taxpayers. The Ohio Department of Taxation provides this form to facilitate easier filing for individuals who meet specific criteria, such as income limits and filing status.

How to use the Online Tax Ohio IT 1040EZ The Ohio Department Form

Using the Online Tax Ohio IT 1040EZ form involves a few simple steps. First, taxpayers need to access the official Ohio Department of Taxation website where the form is available. Once there, users can fill out the form electronically, entering their personal information, income details, and any applicable deductions. After completing the form, it can be submitted directly online, ensuring a quick and efficient filing process. It is essential to review all information for accuracy before submission to avoid any potential issues with the tax return.

Steps to complete the Online Tax Ohio IT 1040EZ The Ohio Department Form

Completing the Online Tax Ohio IT 1040EZ form involves several key steps:

- Gather necessary documents, including W-2s and any other income statements.

- Access the form on the Ohio Department of Taxation website.

- Fill out personal information, including name, address, and Social Security number.

- Enter your total income as reported on your W-2 forms.

- Claim any eligible deductions and credits.

- Review the completed form for accuracy.

- Submit the form electronically through the website.

Legal use of the Online Tax Ohio IT 1040EZ The Ohio Department Form

The Online Tax Ohio IT 1040EZ form is legally recognized as a valid tax return when completed and submitted according to the guidelines set by the Ohio Department of Taxation. To ensure its legal standing, taxpayers must provide accurate information and meet the eligibility criteria outlined for the form. Compliance with state tax laws is essential, and any discrepancies or inaccuracies could lead to penalties or delays in processing.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Online Tax Ohio IT 1040EZ form. Typically, the deadline for filing is April 15 of each year, coinciding with the federal tax deadline. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any updates or changes to these dates to avoid late filing penalties.

Required Documents

To complete the Online Tax Ohio IT 1040EZ form accurately, taxpayers should have several documents ready:

- W-2 forms from employers.

- Any 1099 forms for additional income.

- Records of any deductions or credits being claimed.

- Personal identification information, including Social Security number.

Quick guide on how to complete online tax ohio it 1040ez the ohio department form

Effortlessly prepare Online Tax Ohio It 1040ez The Ohio Department Form on any device

Digital document management has become favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Handle Online Tax Ohio It 1040ez The Ohio Department Form across any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Online Tax Ohio It 1040ez The Ohio Department Form with ease

- Locate Online Tax Ohio It 1040ez The Ohio Department Form and click on Get Form to begin.

- Employ the tools we provide to complete your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal standing as a conventional wet signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, onerous form searching, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Online Tax Ohio It 1040ez The Ohio Department Form and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the online tax ohio it 1040ez the ohio department form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Online Tax Ohio It 1040ez The Ohio Department Form?

The Online Tax Ohio It 1040ez The Ohio Department Form is a simplified income tax return designed for residents of Ohio with straightforward tax situations. This form allows individuals to easily report their income and claim deductions, making the filing process more accessible and efficient.

-

How does airSlate SignNow help with the Online Tax Ohio It 1040ez The Ohio Department Form?

airSlate SignNow streamlines the process of completing and submitting the Online Tax Ohio It 1040ez The Ohio Department Form by providing tools for electronic signatures and document management. Users can fill out their forms securely online and ensure that they are submitted on time, reducing the hassle of paper submissions.

-

Is there a cost associated with using airSlate SignNow for the Online Tax Ohio It 1040ez The Ohio Department Form?

Yes, airSlate SignNow offers various pricing plans tailored to different user needs, allowing individuals and businesses to choose the best option for handling the Online Tax Ohio It 1040ez The Ohio Department Form. Pricing is competitive, ensuring a cost-effective solution for document management and eSignatures.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as secure eSignature capabilities, template management, and document tracking specifically for forms like the Online Tax Ohio It 1040ez The Ohio Department Form. These features enhance efficiency and allow users to manage their tax documents with ease.

-

Can I integrate airSlate SignNow with other software tools for my tax documentation?

Absolutely! airSlate SignNow supports integrations with popular software tools, enhancing the functionality for users completing the Online Tax Ohio It 1040ez The Ohio Department Form. This allows for seamless workflows and improved productivity.

-

How does airSlate SignNow ensure the security of my tax information?

airSlate SignNow prioritizes the security of your documents and personal information through advanced encryption methods and compliance with industry standards. When using the Online Tax Ohio It 1040ez The Ohio Department Form, users can trust that their data is protected.

-

What are the benefits of using airSlate SignNow for the Online Tax Ohio It 1040ez The Ohio Department Form?

Using airSlate SignNow for the Online Tax Ohio It 1040ez The Ohio Department Form provides benefits such as time-saving features, simplified eSignature processes, and secure document handling. These advantages help users complete their tax filings efficiently and with confidence.

Get more for Online Tax Ohio It 1040ez The Ohio Department Form

- Phs officers device supply center form

- Practice worksheet graphing square root functions answer key form

- Lic 447 7 rev 1018 form

- Wc164 form

- City of wilton manors permit search form

- Dbpr vm 4905 board of veterinary medicine licensure verification form

- Permit forms search

- City of delray beach fl building department information

Find out other Online Tax Ohio It 1040ez The Ohio Department Form

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge

- How Do I Sign North Dakota Notice to Stop Credit Charge

- How To Sign Oklahoma Notice of Rescission

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo