Estates and Trusts with an Adjusted Gross Income O 2024-2026

Understanding the SC Form 1041

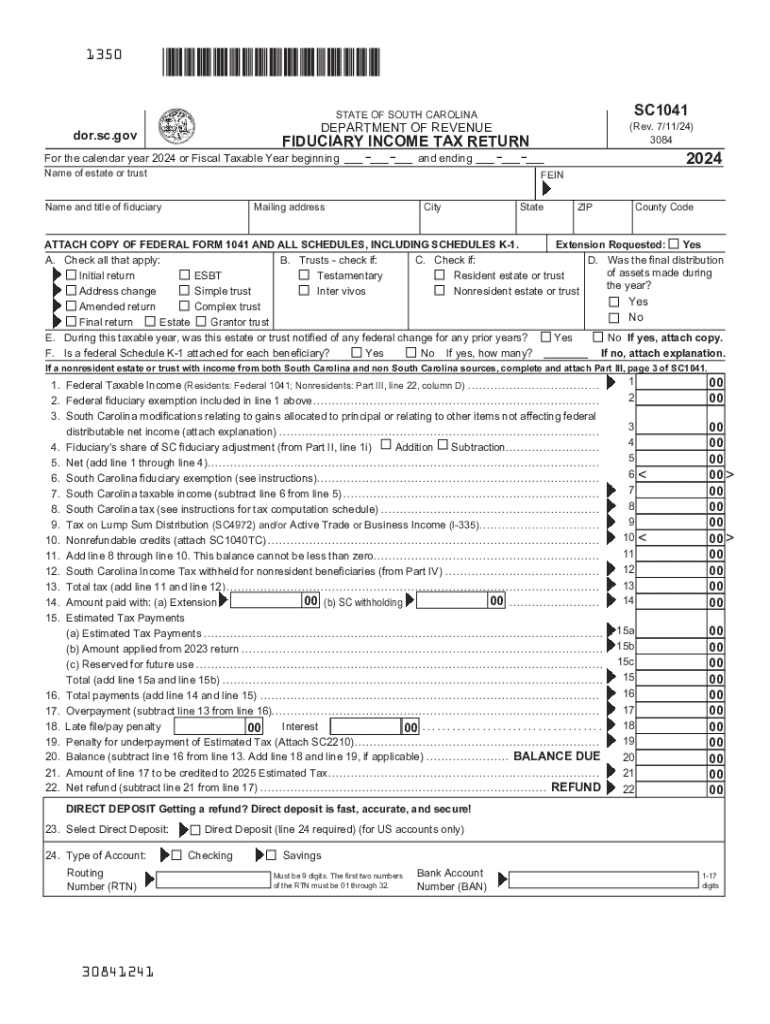

The SC Form 1041 is a tax form used in South Carolina for filing income tax returns for estates and trusts. This form is essential for fiduciaries managing the financial affairs of estates or trusts, as it reports the income generated by these entities. The form is specifically designed to calculate the state income tax owed based on the adjusted gross income of the estate or trust.

Steps to Complete the SC Form 1041

Filling out the SC Form 1041 involves several key steps:

- Gather necessary financial documents, including income statements and expense records for the estate or trust.

- Complete the form by entering the estate's or trust's income, deductions, and credits as applicable.

- Calculate the total tax liability based on the income reported.

- Review the completed form for accuracy and ensure all required signatures are included.

- Submit the form to the South Carolina Department of Revenue by the designated deadline.

Filing Deadlines for the SC Form 1041

It is crucial to be aware of the filing deadlines for the SC Form 1041 to avoid penalties. Generally, the form is due on the fifteenth day of the fourth month following the close of the tax year. For estates or trusts that operate on a calendar year, this typically means the form is due by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day.

Required Documents for Filing SC Form 1041

To successfully file the SC Form 1041, certain documents are required:

- Income statements for the estate or trust, including interest, dividends, and rental income.

- Records of any deductions, such as administrative expenses or distributions to beneficiaries.

- Previous year’s tax returns, if available, to assist with calculations.

Legal Use of the SC Form 1041

The SC Form 1041 serves a legal purpose by ensuring that estates and trusts comply with state tax laws. Fiduciaries must use this form to report income and pay taxes on behalf of the estate or trust. Failure to file accurately can result in penalties and interest on unpaid taxes, making it essential to understand the legal obligations associated with this form.

Examples of SC Form 1041 Usage

There are various scenarios in which the SC Form 1041 is utilized:

- An estate that generates rental income from properties must file the form to report this income and pay associated taxes.

- A trust that receives dividends from investments needs to report this income to the state.

- Fiduciaries managing an estate with multiple beneficiaries may need to file to ensure proper tax reporting and distribution of assets.

Create this form in 5 minutes or less

Find and fill out the correct estates and trusts with an adjusted gross income o

Create this form in 5 minutes!

How to create an eSignature for the estates and trusts with an adjusted gross income o

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SC Form 1041 and why is it important?

The SC Form 1041 is a tax form used for reporting income for estates and trusts in South Carolina. It is essential for ensuring compliance with state tax laws and accurately reporting income generated by the estate or trust. Understanding how to properly fill out the SC Form 1041 can help avoid penalties and ensure that all tax obligations are met.

-

How can airSlate SignNow help with the SC Form 1041?

airSlate SignNow simplifies the process of completing and eSigning the SC Form 1041 by providing an intuitive platform for document management. Users can easily upload, fill out, and send the form for signatures, ensuring a smooth workflow. This efficiency can save time and reduce the stress associated with tax filing.

-

What features does airSlate SignNow offer for managing the SC Form 1041?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for forms like the SC Form 1041. These tools enhance productivity and ensure that all necessary signatures are collected promptly. Additionally, users can collaborate in real-time, making it easier to finalize the form.

-

Is airSlate SignNow cost-effective for handling the SC Form 1041?

Yes, airSlate SignNow is a cost-effective solution for managing the SC Form 1041. With various pricing plans available, businesses can choose an option that fits their budget while still accessing powerful features. This affordability makes it an attractive choice for both small businesses and larger organizations.

-

Can I integrate airSlate SignNow with other software for the SC Form 1041?

Absolutely! airSlate SignNow offers integrations with popular software applications, allowing for seamless management of the SC Form 1041. This means you can connect your existing tools and streamline your workflow, making it easier to access and manage your documents in one place.

-

What are the benefits of using airSlate SignNow for the SC Form 1041?

Using airSlate SignNow for the SC Form 1041 provides numerous benefits, including enhanced security, ease of use, and faster turnaround times. The platform ensures that your documents are securely stored and transmitted, reducing the risk of data bsignNowes. Additionally, the user-friendly interface allows for quick completion and submission of the form.

-

How does airSlate SignNow ensure the security of the SC Form 1041?

airSlate SignNow prioritizes security by employing advanced encryption and compliance measures to protect the SC Form 1041 and other sensitive documents. This includes secure storage and transmission protocols that safeguard your information from unauthorized access. Users can confidently manage their documents knowing that their data is protected.

Get more for Estates And Trusts With An Adjusted Gross Income O

- Substance abuse minnesota department of human services form

- Tb suspect request for hospital discharge form

- File a claim california state compensation insurance fund form

- Pre employment consent and release form for drug and

- Congressional ballpark louisiana department of health form

- Use this form to notify optumhealth care solutions of your

- Docusign envelope id 0fd78c66 e0b5 42cf 86b4 a5ceae3abf7a form

- Fillable online order form kitchen cabinetry bathroom

Find out other Estates And Trusts With An Adjusted Gross Income O

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter