Statutory DeclarationTransfer of Interest in Property to SpouseOffice of State Revenue Qld Transfers of Property that Are Wholly Form

What is the Statutory Declaration Transfer Of Interest In Property To Spouse

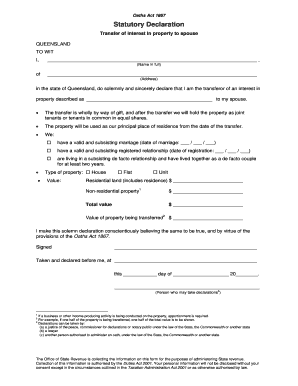

The Statutory Declaration Transfer Of Interest In Property To Spouse is a legal document used to transfer ownership of property between spouses. This transfer is often executed as a gift, meaning no monetary exchange occurs. After the transfer, the property will be held jointly by both spouses, either as joint tenants or tenants in common. This declaration serves to formalize the transfer, ensuring both parties acknowledge the change in ownership and the terms under which the property is held.

Steps to Complete the Statutory Declaration Transfer Of Interest In Property To Spouse

Completing the Statutory Declaration Transfer Of Interest In Property To Spouse involves several key steps:

- Gather necessary information about the property, including its legal description and current ownership details.

- Ensure both spouses are in agreement regarding the transfer and its implications.

- Fill out the statutory declaration form accurately, including all required details about both parties and the property.

- Sign the document in the presence of a notary public or authorized witness to validate the transfer.

- Submit the completed form to the appropriate state office or authority to officially record the transfer.

Legal Use of the Statutory Declaration Transfer Of Interest In Property To Spouse

This statutory declaration is legally binding, provided it meets specific requirements set forth by state laws. It is crucial for the document to be signed and witnessed correctly to ensure its enforceability. The declaration can be used in various legal contexts, such as estate planning, divorce settlements, or simply to clarify ownership interests between spouses.

Key Elements of the Statutory Declaration Transfer Of Interest In Property To Spouse

Several key elements must be included in the statutory declaration to ensure its validity:

- The full names and addresses of both spouses involved in the transfer.

- A clear description of the property being transferred, including its address and legal description.

- A statement indicating that the transfer is a gift and not a sale.

- The date of the transfer and the signatures of both parties.

- Details of any witnesses or notaries involved in the signing process.

How to Obtain the Statutory Declaration Transfer Of Interest In Property To Spouse

The statutory declaration form can typically be obtained from local government offices, such as the county clerk or recorder's office. Many jurisdictions also provide downloadable forms online. It is important to ensure that you are using the most current version of the form to comply with state regulations.

Form Submission Methods

Once the statutory declaration is completed, it can be submitted in several ways:

- In-person submission at the local county clerk or recorder’s office.

- Mailing the completed form to the appropriate office, ensuring it is sent via a traceable method.

- Some jurisdictions may allow electronic submission through their official websites.

Quick guide on how to complete statutory declarationtransfer of interest in property to spouseoffice of state revenue qld transfers of property that are

Complete Statutory DeclarationTransfer Of Interest In Property To SpouseOffice Of State Revenue Qld Transfers Of Property That Are Wholly seamlessly on any device

Web-based document management has become favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and without interruptions. Manage Statutory DeclarationTransfer Of Interest In Property To SpouseOffice Of State Revenue Qld Transfers Of Property That Are Wholly on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to revise and electronically sign Statutory DeclarationTransfer Of Interest In Property To SpouseOffice Of State Revenue Qld Transfers Of Property That Are Wholly effortlessly

- Obtain Statutory DeclarationTransfer Of Interest In Property To SpouseOffice Of State Revenue Qld Transfers Of Property That Are Wholly and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with features that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Statutory DeclarationTransfer Of Interest In Property To SpouseOffice Of State Revenue Qld Transfers Of Property That Are Wholly and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the statutory declarationtransfer of interest in property to spouseoffice of state revenue qld transfers of property that are

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Statutory Declaration in the context of property transfers?

A Statutory Declaration is a legal document that serves as a written statement, declared as true in the presence of an authorized witness. When transferring property to a spouse, this declaration ensures compliance with the Office of State Revenue Qld regulations for Transfers Of Property That Are Wholly By Way Of Gift. It is crucial for establishing joint ownership as either Joint Tenants or Tenants In, depending on your preference.

-

How does airSlate SignNow facilitate the Statutory Declaration process?

airSlate SignNow streamlines the process of creating and signing Statutory Declarations for the Transfer Of Interest In Property To Spouse. It offers easy-to-use templates, secure eSigning capabilities, and compliance with the Office of State Revenue Qld requirements, all designed to simplify property transactions.

-

What are the fees associated with using airSlate SignNow for my property transfers?

airSlate SignNow provides competitive pricing for businesses, making it a cost-effective solution for managing Statutory Declarations and property transfers. Various plans are available to cater to different needs, ensuring you can select a package that suits your requirements without overspending.

-

Can I integrate airSlate SignNow with other business tools?

Yes, airSlate SignNow boasts robust integrations with popular business applications such as Google Drive, Dropbox, and CRM systems. This flexibility allows you to streamline all your document management processes, including Statutory Declarations and Transfers Of Property That Are Wholly By Way Of Gift, within your existing workflows.

-

What security measures are in place for documents signed via airSlate SignNow?

Safety is a priority at airSlate SignNow. Our platform uses bank-level encryption and secure cloud storage to protect your documents, including Statutory Declarations for property transfers. This means your information is safeguarded against unauthorized access and ensures compliance with legal standards.

-

How long does it take to complete the Statutory Declaration process with airSlate SignNow?

The Statutory Declaration process can be completed quickly using airSlate SignNow, often within minutes. With pre-built templates and simple eSigning capabilities, you can efficiently execute the Transfer Of Interest In Property To Spouse and ensure compliance with Office of State Revenue Qld regulations.

-

What happens if I make a mistake in my Statutory Declaration?

If you notice an error in your Statutory Declaration after signing, airSlate SignNow allows you to retract or void the document easily. Simply create a new declaration to correct the details related to the Transfer Of Interest In Property To Spouse and keep your transaction compliant with the Office of State Revenue Qld policies.

Get more for Statutory DeclarationTransfer Of Interest In Property To SpouseOffice Of State Revenue Qld Transfers Of Property That Are Wholly

Find out other Statutory DeclarationTransfer Of Interest In Property To SpouseOffice Of State Revenue Qld Transfers Of Property That Are Wholly

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer