Ct Corporate Extension Form

What is the CT Corporate Extension Form?

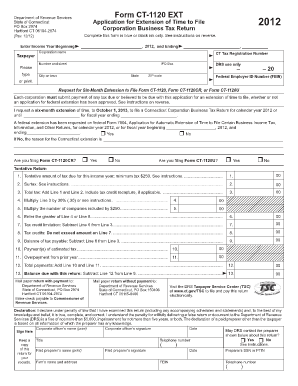

The CT Corporate Extension Form is a tax document that allows corporations operating in Connecticut to request an extension for filing their corporate income tax return. This form is essential for businesses that need additional time to prepare their tax documents accurately. By submitting this form, corporations can avoid late filing penalties while ensuring compliance with state tax regulations.

Steps to Complete the CT Corporate Extension Form

Completing the CT Corporate Extension Form involves several key steps that ensure accurate submission. First, gather all necessary financial information and documentation related to your corporation’s income and expenses. Next, accurately fill out the form, ensuring that all required fields are completed. Pay special attention to the estimated tax liability, as this affects the extension approval. Finally, review the form for accuracy before submitting it to the Connecticut Department of Revenue Services.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the CT Corporate Extension Form is crucial for compliance. Generally, the form must be submitted by the original due date of the corporate income tax return. This date typically falls on the fifteenth day of the fourth month following the close of the corporation's fiscal year. For corporations operating on a calendar year, this means the due date is April 15. Late submissions may result in penalties, so timely filing is essential.

Legal Use of the CT Corporate Extension Form

The CT Corporate Extension Form serves a legal purpose by allowing corporations to extend their filing deadline without incurring penalties. It is crucial to understand that this form does not extend the time to pay any taxes owed. Corporations must still estimate and pay any taxes due by the original filing deadline to avoid interest and penalties. Compliance with state tax laws ensures that corporations maintain good standing and avoid legal complications.

Who Issues the Form?

The CT Corporate Extension Form is issued by the Connecticut Department of Revenue Services. This state agency is responsible for overseeing tax administration and ensuring compliance with tax laws. Corporations must submit the form directly to this agency, which will process the request for an extension. It is important to keep a copy of the submitted form for your records, as it serves as proof of the extension request.

Required Documents

When completing the CT Corporate Extension Form, certain documents may be required to support your request. These typically include financial statements, previous tax returns, and any relevant documentation that substantiates your estimated tax liability. Having these documents on hand will facilitate a smoother completion process and ensure that all information provided is accurate and comprehensive.

Quick guide on how to complete ct corporate extension form

Effortlessly Prepare Ct Corporate Extension Form on Any Gadget

Digital document organization has gained signNow traction among companies and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed papers, allowing you to locate the correct template and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Ct Corporate Extension Form on any gadget with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Ct Corporate Extension Form with ease

- Locate Ct Corporate Extension Form and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced papers, tedious form searching, or errors necessitating new document printouts. airSlate SignNow caters to your document management needs in just a few clicks from any device of your preference. Edit and eSign Ct Corporate Extension Form and ensure smooth communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct corporate extension form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ct Corporate Extension Form?

The Ct Corporate Extension Form is a document that allows businesses in Connecticut to request an extension for filing their corporate tax returns. It is important to understand the requirements and deadlines associated with this form to maintain compliance with state regulations.

-

How can airSlate SignNow help with the Ct Corporate Extension Form?

airSlate SignNow offers an efficient way to eSign and submit the Ct Corporate Extension Form electronically. With our platform, businesses can streamline the process, ensuring documents are signed and submitted on time, reducing the risk of delays and penalties.

-

What are the pricing options for using airSlate SignNow to manage the Ct Corporate Extension Form?

Our pricing plans for airSlate SignNow are flexible, catering to different business needs. Whether you're a small startup or a larger corporation, we provide affordable options that include features specifically designed for handling documents like the Ct Corporate Extension Form.

-

Are there any features that specifically assist with the Ct Corporate Extension Form?

Yes, airSlate SignNow offers customizable templates, cloud storage, and automated reminders that specifically assist with the Ct Corporate Extension Form. These features help ensure that all necessary components are included and that filing deadlines are met seamlessly.

-

What are the benefits of using airSlate SignNow for the Ct Corporate Extension Form?

Using airSlate SignNow for the Ct Corporate Extension Form enhances efficiency through digital workflows, reducing paperwork and manual tasks. This not only saves time but also minimizes errors, allowing businesses to focus on more important aspects of their corporate responsibilities.

-

Can I integrate airSlate SignNow with other software for managing the Ct Corporate Extension Form?

Absolutely! airSlate SignNow offers integrations with various business applications and software, making it easier to manage the Ct Corporate Extension Form alongside your existing systems. This interoperability ensures a smooth workflow and data consistency across platforms.

-

Is my data secure when using airSlate SignNow for the Ct Corporate Extension Form?

Yes, security is a top priority at airSlate SignNow. When using our platform for the Ct Corporate Extension Form, your data is protected with state-of-the-art encryption and security protocols, ensuring that your sensitive corporate information remains safe and confidential.

Get more for Ct Corporate Extension Form

- Ohio provider medical prior authorization request form caresource

- Dd0137 3 pdf form

- Dcs records request form

- Form 5161 multistate loan modification agreement to a fixed rate single family uniform mortgage instruments

- Nppsc 1900 1 388607348 form

- Bdcssb transportation drivers daily time sheet dcss schooldesk form

- Uno school of social work practicum agreement form unomaha

- Verification worksheet for dependent students kean university kean form

Find out other Ct Corporate Extension Form

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now