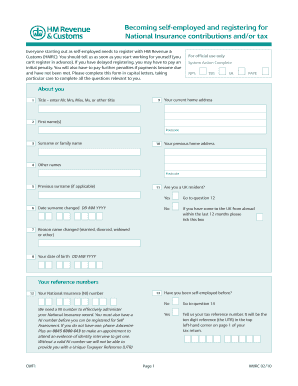

Cwf1 Form

What is the Cwf1?

The Cwf1 form is a crucial document used primarily for tax purposes in the United States. It serves as a means for individuals and businesses to report specific financial information to the Internal Revenue Service (IRS). Understanding the Cwf1 form is essential for ensuring compliance with tax regulations and for accurately reporting income or deductions. This form may be required for various situations, including self-employment, business income, or other financial disclosures.

How to Obtain the Cwf1

Obtaining the Cwf1 form is a straightforward process. Individuals can typically download the Cwf1 form PDF directly from the official IRS website or through authorized tax preparation software. It is important to ensure that the most current version of the form is used to avoid any compliance issues. Additionally, some tax professionals may provide the form as part of their services, ensuring that it is filled out correctly and submitted on time.

Steps to Complete the Cwf1

Completing the Cwf1 form requires attention to detail to ensure accuracy. Here are the general steps to follow:

- Gather all necessary financial documents, including income statements and receipts for deductions.

- Download the Cwf1 form PDF and open it using a compatible PDF reader.

- Carefully fill out each section of the form, ensuring that all information is accurate and complete.

- Review the completed form for any errors or omissions.

- Sign and date the form where required.

- Submit the form according to the specified submission methods, whether online, by mail, or in person.

Legal Use of the Cwf1

The Cwf1 form is legally binding when completed and submitted according to IRS regulations. To ensure its legal validity, it is essential to follow all guidelines provided by the IRS, including accurate reporting of income and deductions. Additionally, using a reliable platform for electronic signatures can enhance the form's legal standing, as it provides a digital certificate that verifies the signer's identity and intent.

Key Elements of the Cwf1

Several key elements must be included in the Cwf1 form to ensure it is complete and compliant. These elements typically include:

- Personal identification information, such as name and Social Security number.

- Details regarding income sources and amounts.

- Any applicable deductions or credits.

- Signature and date fields to validate the submission.

Form Submission Methods

There are various methods for submitting the Cwf1 form, which can include:

- Online submission through the IRS e-file system, which is often the fastest method.

- Mailing the completed form to the appropriate IRS address, based on the taxpayer's location.

- In-person submission at designated IRS offices or authorized tax preparation sites.

Quick guide on how to complete cwf1

Complete Cwf1 effortlessly on any device

Digital document management has become prevalent among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to easily find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Handle Cwf1 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to alter and eSign Cwf1 with ease

- Find Cwf1 and click Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to share your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Cwf1 to ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cwf1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a cwf1 form pdf?

The cwf1 form pdf is a specific document used in various business processes, often related to compliance and data verification. With airSlate SignNow, you can easily create, fill, and sign the cwf1 form pdf digitally, streamlining your workflows and ensuring that you meet all necessary regulations.

-

How can I fill out a cwf1 form pdf electronically?

To fill out a cwf1 form pdf electronically, simply upload the document to airSlate SignNow's platform. You can then use the intuitive editing tools to input the required information and even add electronic signatures, making it a hassle-free process.

-

Are there any costs associated with using the cwf1 form pdf feature?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including the ability to work with cwf1 form pdfs. You can choose a plan that fits your budget, ensuring you have access to essential features without overspending.

-

What are the benefits of using airSlate SignNow for cwf1 form pdfs?

Using airSlate SignNow for your cwf1 form pdfs offers numerous benefits including easy document management, secure electronic signatures, and enhanced collaboration. This platform accelerates your workflow, helping you save time and improve accuracy in handling important documents.

-

Can I integrate airSlate SignNow with other apps to manage cwf1 form pdfs?

Yes, airSlate SignNow seamlessly integrates with various applications like Google Drive, Salesforce, and Dropbox, allowing you to manage your cwf1 form pdfs efficiently. These integrations help you streamline processes and keep your documents organized in one convenient location.

-

Is it safe to sign cwf1 form pdfs with airSlate SignNow?

Absolutely! airSlate SignNow employs advanced security protocols to protect your cwf1 form pdfs and personal information. With encryption and secure data storage, you can be confident that your documents are safe during the signing process.

-

What devices can I use to access cwf1 form pdfs on airSlate SignNow?

You can access your cwf1 form pdfs on airSlate SignNow from any device, including desktop computers, tablets, and smartphones. This flexibility ensures you can manage, fill out, and sign your documents anytime and anywhere, enhancing your productivity.

Get more for Cwf1

Find out other Cwf1

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast