Nevada Sales and Tax Return Forms 2006-2026

What is the Nevada Sales and Use Tax Form?

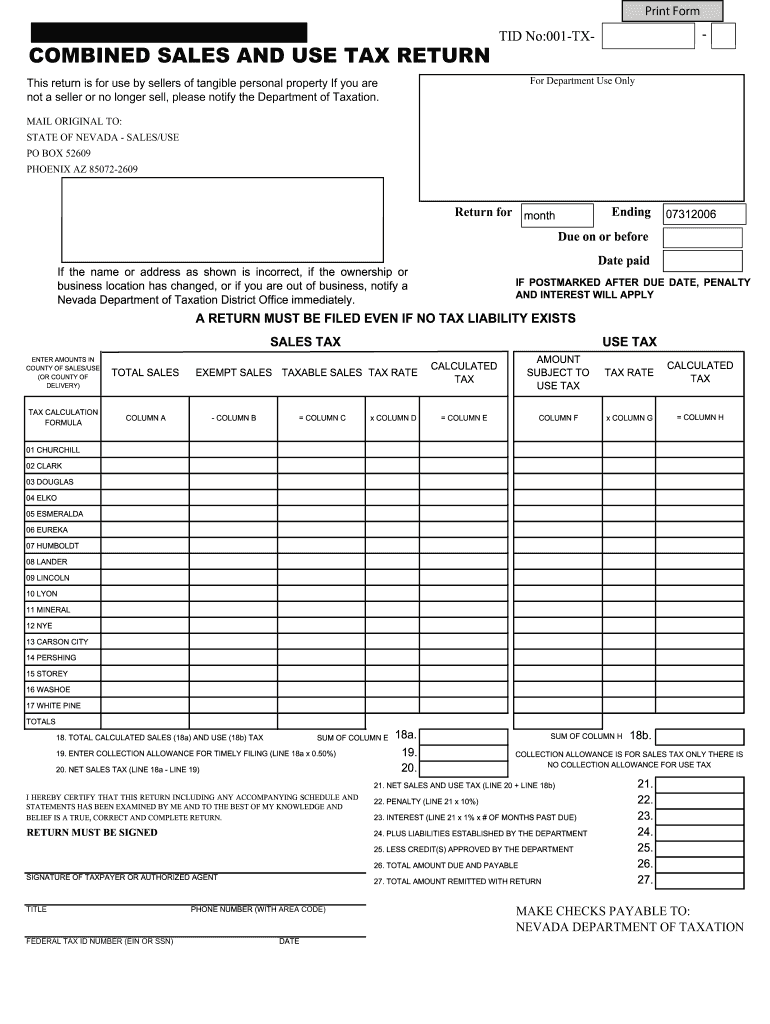

The Nevada Sales and Use Tax Form is a crucial document that businesses in Nevada must complete to report and remit sales and use taxes. This form is designed to capture the details of taxable sales made within the state and any applicable use taxes on items purchased for use in Nevada. Understanding this form is essential for compliance with state tax regulations and for avoiding potential penalties.

Steps to Complete the Nevada Sales and Use Tax Form

Completing the Nevada Sales and Use Tax Form involves several key steps:

- Gather all necessary sales records, including receipts and invoices.

- Determine the total sales amount and any exempt sales.

- Calculate the total sales tax collected based on the applicable Nevada sales tax rate.

- Include any use tax owed on items purchased without paying Nevada sales tax.

- Fill out the form accurately, ensuring all figures are correct.

- Review the completed form for accuracy before submission.

How to Obtain the Nevada Sales and Use Tax Form

The Nevada Sales and Use Tax Form can be obtained through the Nevada Department of Taxation's official website. The form is available in a downloadable PDF format, allowing businesses to print it for manual completion. Additionally, businesses may access the form via authorized tax preparation software that complies with Nevada tax regulations.

Form Submission Methods

Businesses have several options for submitting the Nevada Sales and Use Tax Form:

- Online Submission: Many businesses choose to file electronically through the Nevada Department of Taxation's online portal, which offers a streamlined process.

- Mail: Completed forms can be mailed to the appropriate address provided on the form. It is advisable to send forms via certified mail to ensure delivery confirmation.

- In-Person: Taxpayers can also submit the form in person at designated Nevada Department of Taxation offices.

Legal Use of the Nevada Sales and Use Tax Form

The Nevada Sales and Use Tax Form is legally binding and must be completed in accordance with state laws. Accurate reporting is essential to avoid legal repercussions, including fines or audits. Businesses should ensure they are familiar with the legal requirements surrounding sales and use tax in Nevada, including any exemptions that may apply to specific transactions.

Filing Deadlines / Important Dates

Timely filing of the Nevada Sales and Use Tax Form is critical to remain compliant with state regulations. The filing deadlines typically align with the reporting period, which can be monthly, quarterly, or annually, depending on the volume of sales. It is important for businesses to keep track of these deadlines to avoid penalties for late submissions.

Key Elements of the Nevada Sales and Use Tax Form

Key elements of the Nevada Sales and Use Tax Form include:

- Business Information: Name, address, and tax identification number of the business.

- Sales Information: Total sales amount, exempt sales, and total sales tax collected.

- Use Tax Information: Details of any use tax owed on items purchased for use in Nevada.

- Signature: The form must be signed by an authorized representative of the business, affirming the accuracy of the information provided.

Quick guide on how to complete nevada combined sales and use tax form

Your assistance manual on how to prepare your Nevada Sales And Tax Return Forms

If you’re curious about how to develop and transmit your Nevada Sales And Tax Return Forms, here are some quick guidelines to simplify tax submission.

To commence, simply register your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is a highly intuitive and robust document solution that enables you to edit, generate, and complete your tax forms effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and revisit to modify answers as necessary. Optimize your tax oversight with advanced PDF editing, eSigning, and user-friendly sharing.

Complete the steps below to finalize your Nevada Sales And Tax Return Forms in minutes:

- Establish your account and begin working on PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Select Get form to access your Nevada Sales And Tax Return Forms in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to affix your legally-recognized eSignature (if required).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to submit your taxes electronically with airSlate SignNow. Be aware that submitting in writing can lead to an increase in return errors and delay refunds. Undoubtedly, before electronically filing your taxes, consult the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

FAQs

-

Can I print a notice of intent form to homeschool in Nevada, fill it out, and turn it in?

It's best to ask homeschoolers in your state. Every state has different laws. What works in one may not work in another.This looks like the information you need: Notice of Intent (NOI)

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

What tax forms do I need to fill out for reporting bitcoin gains and loses?

IRS1040 and 1099 forms.“For instance, there is no long-term capital gains tax to pay if you are in the lower two tax brackets (less than $36,900 single income or less than $73,800 married income). The capital gains rate is only 15% for other tax brackets (less than $405,100 single income) with 20% for the final bracket.”Reference: Filing Bitcoin Taxes Capital Gains Losses 1040 Schedule DOther References:IRS Virtual Currency Guidance : Virtual Currency Is Treated as Property for U.S. Federal Tax Purposes; General Rules for Property Transactions ApplyHow do I report taxes?Filing Bitcoin Taxes Capital Gains Losses 1040 Schedule Dhttps://www.irs.gov/pub/irs-drop...

-

If I publish on Smashwords and tick on the option to take a 30 percent tax, do I still need to fill out the tax form?

If you want to get any of that tax money back in your pocket, you will have to fill out the forms.Are you a US citizen? If not, you will need to obtain an ITIN using IRS form W-7. This will allow you to file the appropriate US tax return forms and claim a refund. Depending on your country of residence, the refund could be up to 100% of the tax collected. With an ITIN, you will usually be exempt from the 30% withholding and will not be required to fill out any US tax returns at the end of the year (unless you actually reside in the US, but that is a far more complicated situation). The ITIN application process can be a royal pain in the behind, especially if you wait until after the taxes have been withheld.If your book only makes a few dollars, the hassle is not worth it. But if you hit the self-publishing lottery, you will definitely want to apply for that refund.

Create this form in 5 minutes!

How to create an eSignature for the nevada combined sales and use tax form

How to generate an eSignature for the Nevada Combined Sales And Use Tax Form in the online mode

How to make an electronic signature for the Nevada Combined Sales And Use Tax Form in Chrome

How to create an eSignature for putting it on the Nevada Combined Sales And Use Tax Form in Gmail

How to make an electronic signature for the Nevada Combined Sales And Use Tax Form from your smartphone

How to create an eSignature for the Nevada Combined Sales And Use Tax Form on iOS

How to make an electronic signature for the Nevada Combined Sales And Use Tax Form on Android OS

People also ask

-

What are Nevada Sales And Tax Return Forms?

Nevada Sales And Tax Return Forms are official documents required by the state of Nevada for reporting sales and use tax collected by businesses. These forms ensure compliance with state tax regulations and help businesses accurately report their sales activity. It's crucial for businesses operating in Nevada to understand how to correctly fill out these forms to avoid penalties.

-

How can airSlate SignNow help with Nevada Sales And Tax Return Forms?

airSlate SignNow offers a seamless solution for managing Nevada Sales And Tax Return Forms by allowing businesses to electronically sign and send these documents easily. With its user-friendly interface, users can quickly complete and submit their tax forms while ensuring compliance with state requirements. This streamlines the tax filing process and saves valuable time.

-

Are there any costs associated with using airSlate SignNow for Nevada Sales And Tax Return Forms?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs, including options for users who need to manage Nevada Sales And Tax Return Forms. The pricing is competitive and designed to provide a cost-effective solution for businesses looking to streamline their document management. You can choose a plan that best fits your frequency of use and number of users.

-

Is airSlate SignNow compliant with Nevada tax regulations?

Absolutely! airSlate SignNow is designed to comply with all state regulations, including those governing Nevada Sales And Tax Return Forms. This means you can trust that your documents are handled securely and in accordance with Nevada's legal requirements, providing peace of mind for your business.

-

Can I integrate airSlate SignNow with other accounting software for filing Nevada Sales And Tax Return Forms?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software, making it easier to manage your Nevada Sales And Tax Return Forms. By connecting your preferred software, you can automate data input, reduce manual errors, and improve your overall workflow efficiency. This integration ensures that you have all necessary data at your fingertips.

-

What features does airSlate SignNow offer for managing Nevada Sales And Tax Return Forms?

airSlate SignNow provides features like electronic signatures, document templates, and secure cloud storage specifically tailored for handling Nevada Sales And Tax Return Forms. These tools help you streamline the process of preparing and submitting tax documents while ensuring they are securely signed and stored. Enhanced collaboration features also allow multiple team members to work on the forms together.

-

How secure is airSlate SignNow for handling Nevada Sales And Tax Return Forms?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like Nevada Sales And Tax Return Forms. The platform employs advanced encryption and security protocols to protect your data at all times. This ensures that your forms remain confidential and compliant with regulations.

Get more for Nevada Sales And Tax Return Forms

- Doh 166 form

- Application for admission fishburne military school fishburne form

- B 1040 us bankruptcy court casb uscourts form

- Residential sample bill duquesne light form

- Patient specific direction psd for university hospitals of form

- Write no objection letter from parents form

- Pretrial catalogue florida sample form

- State of connecticut form must be accompanied by department

Find out other Nevada Sales And Tax Return Forms

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple