Form B1040 2015-2026

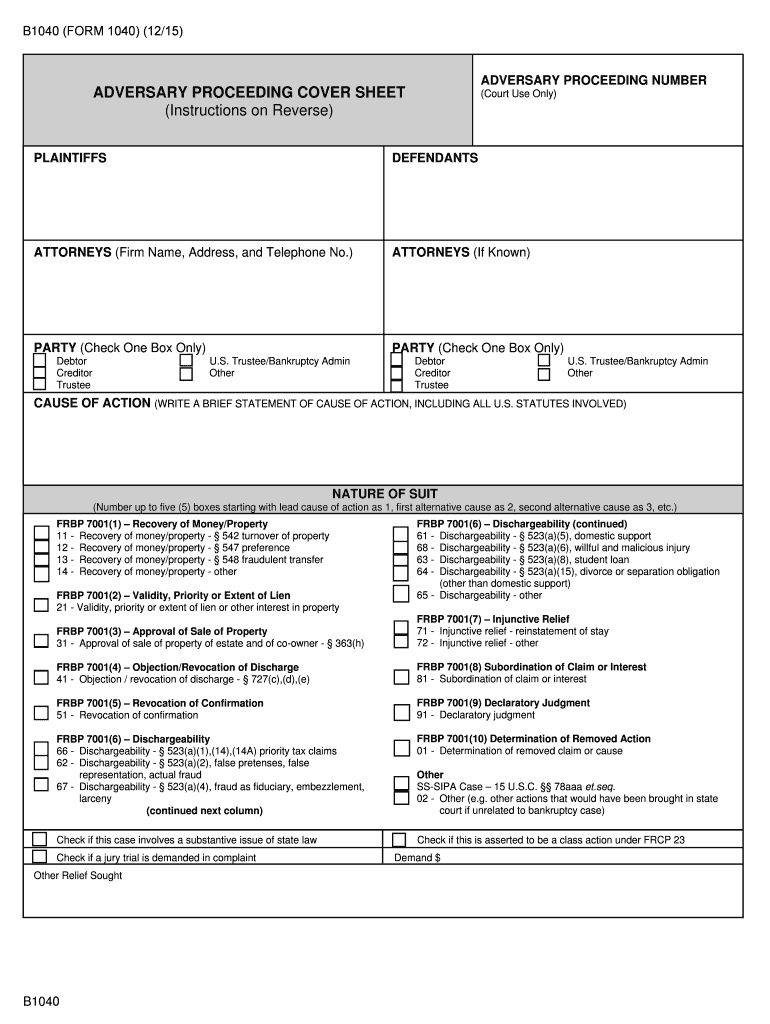

What is the Form B1040

The Form B1040 is a tax document utilized primarily for filing individual income taxes in the United States. It is part of the U.S. tax system and is designed to report income, calculate taxes owed, and determine eligibility for various tax credits and deductions. The B1040 form is typically used by individuals who have straightforward tax situations, allowing for a simplified filing process compared to more complex forms.

How to use the Form B1040

Using the Form B1040 involves several steps to ensure accurate reporting of your income and tax obligations. Begin by gathering all necessary financial documents, such as W-2s, 1099s, and any other income statements. Next, fill out the form by entering your personal information, including your name, address, and Social Security number. Report your income in the designated sections, and apply any deductions or credits for which you qualify. Finally, calculate your total tax liability and sign the form before submitting it to the IRS.

Steps to complete the Form B1040

Completing the Form B1040 requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents.

- Fill in your personal information accurately.

- Report all sources of income, including wages and investments.

- Claim deductions and credits applicable to your situation.

- Calculate your total tax due or refund amount.

- Review the completed form for accuracy.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form B1040. Typically, the deadline for submitting your tax return is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers may request an extension, allowing for an additional six months to file, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Legal use of the Form B1040

The Form B1040 must be used in compliance with IRS regulations. It is essential to ensure that all information provided is accurate and truthful, as any discrepancies can lead to legal repercussions, including fines or audits. The form is legally binding once signed, confirming that the information is correct to the best of the taxpayer's knowledge. Understanding the legal implications of filing this form is vital for all taxpayers.

Required Documents

To complete the Form B1040, several documents are necessary. These include:

- W-2 forms from employers.

- 1099 forms for additional income sources.

- Records of any deductible expenses, such as medical bills or charitable contributions.

- Statements for any tax credits you wish to claim.

Having these documents ready will streamline the filing process and help ensure accuracy.

Quick guide on how to complete b 1040 us bankruptcy court casb uscourts

The optimal approach to locate and sign Form B1040

On the scale of an entire organization, ineffective procedures concerning paper approvals can take up considerable working hours. Completing documents like Form B1040 is a routine aspect of operations in any enterprise, which is why the smoothness of each agreement’s lifecycle signNowly impacts the overall effectiveness of the company. With airSlate SignNow, signing your Form B1040 is as straightforward and rapid as possible. This platform provides you with the latest version of nearly any form. Even better, you can sign it instantly without needing to install additional software on your computer or printing anything as physical copies.

How to obtain and sign your Form B1040

- Explore our library by category or utilize the search bar to locate the form you require.

- View the form preview by clicking on Learn more to confirm it is the correct one.

- Select Get form to begin editing immediately.

- Fill out your form and input any necessary details using the toolbar.

- Once finished, click the Sign tool to endorse your Form B1040.

- Choose the signature method that is most suitable for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finalize editing and move on to document-sharing options as required.

With airSlate SignNow, you possess everything you need to handle your documents effectively. You can find, complete, modify, and even send your Form B1040 within a single tab without any complications. Enhance your procedures by utilizing a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I fill out Form B under the Insolvency and Bankruptcy code? Does the affidavit require a stamp paper?

Affidavit is always on stamp paper

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

I’m being sued and I’m representing myself in court. How do I fill out the form called “answer to complaint”?

You can represent yourself. Each form is different per state or county but generally an answer is simply a written document which presents a synopsis of your story to the court. The answer is not your defense, just written notice to the court that you intend to contest the suit. The blank forms are available at the court clerk’s office and are pretty much self explanatoryThere will be a space calling for the signature of an attorney. You should sign your name on the space and write the words “Pro se” after your signature. This lets the court know you are acting as your own attorney.

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

If a couple is applying for a US B-1 visa, do they need to fill out a form for individuals or groups?

Go for group.

Create this form in 5 minutes!

How to create an eSignature for the b 1040 us bankruptcy court casb uscourts

How to generate an electronic signature for your B 1040 Us Bankruptcy Court Casb Uscourts online

How to generate an eSignature for the B 1040 Us Bankruptcy Court Casb Uscourts in Chrome

How to create an electronic signature for signing the B 1040 Us Bankruptcy Court Casb Uscourts in Gmail

How to create an eSignature for the B 1040 Us Bankruptcy Court Casb Uscourts right from your smart phone

How to make an eSignature for the B 1040 Us Bankruptcy Court Casb Uscourts on iOS

How to make an eSignature for the B 1040 Us Bankruptcy Court Casb Uscourts on Android OS

People also ask

-

What is the form B1040 and why do I need it?

The form B1040 is a crucial document for individuals filing their annual income tax return in the United States. Understanding how to complete and submit the form B1040 can help ensure compliance with IRS regulations and maximize your potential tax refunds.

-

How can airSlate SignNow assist with the eSignature of form B1040?

airSlate SignNow provides a seamless solution for electronically signing form B1040, allowing you to complete the document securely and conveniently. By using airSlate SignNow, you can eliminate the need for printing, scanning, and mailing, making the process much quicker.

-

Is airSlate SignNow affordable for small businesses needing form B1040 solutions?

Yes, airSlate SignNow offers competitive pricing tailored for small businesses that require efficient handling of documents like form B1040. With subscription plans designed to fit different budgets, you can choose an option that best meets your organization’s needs.

-

What features does airSlate SignNow offer for managing form B1040?

airSlate SignNow includes features such as customizable templates for form B1040, real-time tracking, and automated reminders. These tools streamline the document handling process, ensuring that your form B1040 is completed and submitted on time.

-

Can I integrate airSlate SignNow with other software for processing form B1040?

Absolutely! airSlate SignNow easily integrates with various accounting and CRM software, allowing you to enhance your workflow when processing form B1040. This integration ensures that your documents are seamlessly shared, reducing manual data entry.

-

What are the advantages of using airSlate SignNow for form B1040?

Using airSlate SignNow for form B1040 provides numerous advantages, such as increased efficiency, enhanced security, and reduced turnaround times. By using our platform, you can focus more on your business and less on the administrative details of document management.

-

Is it secure to send form B1040 through airSlate SignNow?

Yes, sending form B1040 through airSlate SignNow is highly secure. Our platform complies with industry standards for data protection, ensuring that all documents and personal information remain confidential and safe from unauthorized access.

Get more for Form B1040

Find out other Form B1040

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online