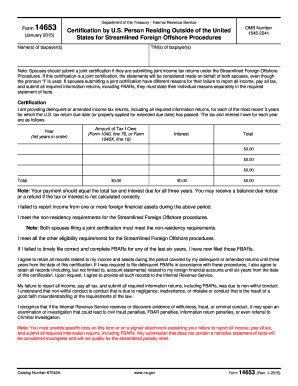

Form 14653

What is the Form 14653

The Form 14653 is a document used by taxpayers to request relief from penalties related to certain tax obligations. This form is particularly relevant for individuals who may have faced challenges in meeting their tax responsibilities due to specific circumstances. It is essential for those seeking to explain their situation to the IRS and request a reconsideration of penalties imposed on their tax filings.

How to use the Form 14653

Using the Form 14653 involves several key steps. First, ensure you have the correct version of the form, which can be obtained from the IRS website. Next, fill out the form accurately, providing all required information, including your personal details and the specific penalties you are contesting. Once completed, submit the form according to the instructions provided, either electronically or via mail, ensuring that you retain copies for your records.

Steps to complete the Form 14653

Completing the Form 14653 requires careful attention to detail. Start by gathering necessary documentation that supports your claim for relief. Fill in your name, address, and taxpayer identification number in the designated fields. Clearly state the reasons for requesting penalty relief, attaching any relevant documents that provide context to your situation. Review the form for accuracy and completeness before submitting it to ensure that all information is correct and that you have included any required signatures.

Legal use of the Form 14653

The legal use of the Form 14653 is governed by IRS guidelines, which stipulate that the form must be used for specific types of penalty relief requests. Taxpayers should ensure that their reasons for seeking relief align with IRS criteria. Submitting the form does not guarantee that penalties will be abated; however, it is a formal request that allows taxpayers to present their case for consideration under the law.

Required Documents

When submitting the Form 14653, it is crucial to include supporting documents that substantiate your claim for penalty relief. This may include copies of previous tax returns, correspondence from the IRS, and any other relevant documentation that explains your circumstances. Having these documents on hand can strengthen your case and provide the IRS with the necessary context to evaluate your request effectively.

Form Submission Methods

The Form 14653 can be submitted through various methods, depending on your preference and the requirements set forth by the IRS. Taxpayers have the option to file the form electronically through the IRS e-filing system or submit a paper version via mail. When choosing to mail the form, it is advisable to send it via certified mail to ensure it is received and to maintain a record of the submission.

Quick guide on how to complete form 14653 215740120

Streamline Form 14653 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely maintain it online. airSlate SignNow provides all the resources you require to design, alter, and electronically sign your documents swiftly without any delays. Manage Form 14653 on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The simplest way to modify and electronically sign Form 14653 with ease

- Locate Form 14653 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important portions of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for such tasks.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or mislaid files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Alter and electronically sign Form 14653 and guarantee excellent communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 14653 215740120

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is email giresunform com, and how does it work with airSlate SignNow?

Email giresunform com is a dedicated email service that allows users to send documents securely through airSlate SignNow. This integration enables seamless document management, allowing users to eSign and send important papers directly from their inbox. By utilizing email giresunform com, businesses can simplify communication and enhance operational efficiency.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to meet different business needs. The plans include options for individual users as well as teams, with features scaling according to the chosen package. For detailed pricing information, including any promotions involving email giresunform com, visit our pricing page.

-

What features does airSlate SignNow provide?

airSlate SignNow boasts a range of features, including electronic signature capabilities, document templates, and secure cloud storage. Users can easily customize documents and track their progress in real-time. Additionally, with the ability to integrate with email giresunform com, users can streamline their workflows.

-

How can email giresunform com benefit my business?

Utilizing email giresunform com as part of your document signing process can signNowly enhance your business communication. It offers a secure and efficient method to send and receive signed documents, ensuring faster deal closures and improved customer satisfaction. This can also reduce the need for physical paperwork, saving time and resources.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow supports integration with various applications, enhancing its functionality. Whether you use CRM software, cloud storage services, or email giresunform com, integration is straightforward and helps unify your workflow. This ensures that all your tools work together seamlessly and efficiently.

-

How secure is the document signing process with airSlate SignNow?

The document signing process with airSlate SignNow is highly secure, utilizing advanced encryption and security protocols. By relying on email giresunform com for document transmission, additional security measures are in place to protect sensitive information. This ensures that all transactions and documents remain confidential and secure.

-

Is there a mobile app for airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows users to manage and sign documents on the go. The app integrates seamlessly with email giresunform com, enabling users to send and receive documents directly from their mobile devices. This functionality enhances convenience and maintains productivity, regardless of location.

Get more for Form 14653

Find out other Form 14653

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation