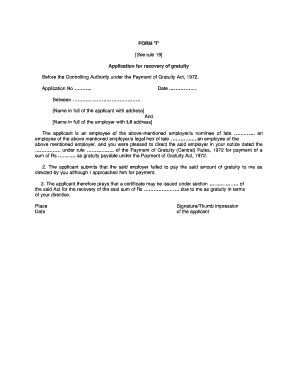

Form T for Gratuity

What is the Form T For Gratuity

The Form T for gratuity is a document used in the United States to report and manage gratuity payments made to employees. This form is essential for businesses that provide tips or gratuities as part of their employees' compensation. It helps ensure that these payments are accurately recorded for tax purposes and comply with federal and state regulations. The form typically includes details about the employee receiving the gratuity, the amount, and the date of the payment.

How to Use the Form T For Gratuity

To use the Form T for gratuity, businesses must first gather all necessary information regarding gratuity payments made to employees. This includes the employee's name, the total amount of gratuity, and the date of payment. Once this information is collected, it can be entered into the form accurately. After completing the form, it should be submitted to the appropriate tax authority, ensuring that all details are correct to avoid any compliance issues.

Steps to Complete the Form T For Gratuity

Completing the Form T for gratuity involves several straightforward steps:

- Gather employee information, including names and payment details.

- Fill out the form with the total gratuity amount and the date of payment.

- Review the information for accuracy and completeness.

- Submit the completed form to the relevant tax authority.

Following these steps helps ensure that gratuity payments are reported correctly, maintaining compliance with tax regulations.

Legal Use of the Form T For Gratuity

The legal use of the Form T for gratuity is crucial for businesses to avoid penalties. This form must be filled out in accordance with IRS guidelines and state laws regarding gratuity payments. Proper documentation helps protect both the employer and employee by ensuring that gratuity payments are reported accurately for tax purposes. Failure to comply with these regulations can lead to legal repercussions and financial penalties.

Key Elements of the Form T For Gratuity

Key elements of the Form T for gratuity include:

- Employee Information: Name and identification details of the employee receiving gratuity.

- Gratuity Amount: The total dollar amount of gratuity paid.

- Date of Payment: The specific date when the gratuity was given.

- Employer Information: Name and contact details of the employer providing the gratuity.

These elements are essential for ensuring accurate reporting and compliance with tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form T for gratuity are crucial for compliance. Typically, the form must be submitted by specific dates set by the IRS and state tax authorities. It is essential for businesses to be aware of these deadlines to avoid late fees and penalties. Keeping track of important dates ensures that gratuity payments are reported on time and helps maintain good standing with tax authorities.

Quick guide on how to complete form t for gratuity

Effortlessly Prepare Form T For Gratuity on Any Device

Digital document management has become increasingly favored by both organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Handle Form T For Gratuity on any device using the airSlate SignNow apps for Android or iOS and enhance any document-driven workflow today.

The simplest method to modify and electronically sign Form T For Gratuity without hassle

- Obtain Form T For Gratuity and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or an invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Modify and electronically sign Form T For Gratuity and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form t for gratuity

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form t for gratuity?

The form t for gratuity is a tax form that businesses use to report gratuity income for their employees. It details the amount of tips received and helps ensure compliance with tax regulations. Understanding how to properly fill out the form t for gratuity can be essential for accurate reporting and avoiding potential penalties.

-

How does airSlate SignNow help with the form t for gratuity?

airSlate SignNow streamlines the process of preparing and signing important documents like the form t for gratuity. Our platform provides templates that ensure all necessary details are included, making it simple to generate, send, and receive signed forms. This efficiency reduces time spent on administrative tasks typically associated with tax documentation.

-

Is there a cost associated with using airSlate SignNow for the form t for gratuity?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Regardless of the plan chosen, you gain access to features that simplify document management, including the form t for gratuity. Investing in our solution can save your business both time and money in the long term.

-

What features does airSlate SignNow offer for eSigning the form t for gratuity?

airSlate SignNow provides an intuitive interface for eSigning documents like the form t for gratuity. Features such as template creation, collaboration tools, and secure cloud storage make it easy for businesses to manage their gratuity documents efficiently. Additionally, our platform ensures all signatures are legally binding and compliant.

-

Can I integrate airSlate SignNow with other applications for managing the form t for gratuity?

Absolutely! airSlate SignNow integrates seamlessly with a variety of business applications, enhancing your workflow around the form t for gratuity. Whether you use accounting software or project management tools, our integrations help synchronize data and improve overall efficiency in handling gratuity-related documents.

-

What are the benefits of using airSlate SignNow for the form t for gratuity?

Using airSlate SignNow for the form t for gratuity offers numerous benefits, including time savings, reduced paper usage, and enhanced security. Our platform allows you to manage all your signNow documents in one place, increasing productivity and ensuring compliance with tax regulations. Additionally, the platform's user-friendly features make it accessible for all team members.

-

How can I ensure compliance when using the form t for gratuity with airSlate SignNow?

To ensure compliance when using the form t for gratuity with airSlate SignNow, make use of our templates designed specifically for this tax form. Always double-check your entries and follow IRS guidelines on gratuity reporting. Our platform keeps track of all document revisions, providing you with an audit trail that further supports compliance.

Get more for Form T For Gratuity

- Knights of columbus form 100

- Service hours time sheet chicagoland habitat for humanity chicagolandhabitat form

- Bbir formb 1901 etis 1 only

- As we change order form

- Eclipse micropen patient consent form 080315

- Tf350 18 2 r e unit pre execution checklist army stewart army form

- Mlse reciprocal program 2017 form

- Dar application ogsconference form

Find out other Form T For Gratuity

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now