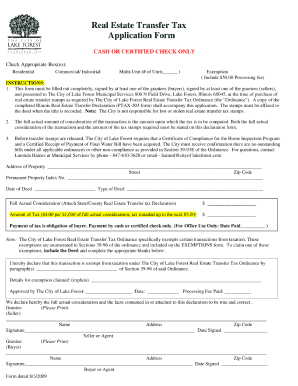

Lake Forest Transfer Tax Form

What is the Lake Forest Transfer Tax

The Lake Forest Transfer Tax is a municipal tax imposed on the transfer of real estate within the city limits of Lake Forest, Illinois. This tax is typically calculated based on the sale price of the property being transferred. It serves as a source of revenue for local government services and infrastructure. Understanding this tax is crucial for both buyers and sellers involved in real estate transactions, as it can impact the overall cost of the transaction.

How to use the Lake Forest Transfer Tax

Using the Lake Forest Transfer Tax involves calculating the amount due based on the sale price of the property. The tax rate is generally a specific percentage of the sale price, and it must be paid at the time of closing. Buyers and sellers should ensure that this tax is factored into their financial planning when negotiating real estate transactions. Proper documentation must accompany the payment to ensure compliance with local regulations.

Steps to complete the Lake Forest Transfer Tax

Completing the Lake Forest Transfer Tax involves several key steps:

- Determine the Sale Price: Identify the agreed-upon sale price of the property.

- Calculate the Tax: Apply the local tax rate to the sale price to determine the total transfer tax owed.

- Prepare Documentation: Gather necessary documents, including the sales contract and any other required forms.

- Submit Payment: Pay the calculated tax amount to the appropriate local authority, typically at the time of closing.

- Keep Records: Retain copies of all documents and payment receipts for future reference.

Legal use of the Lake Forest Transfer Tax

The legal use of the Lake Forest Transfer Tax is governed by local ordinances and state laws. It is essential for property owners and real estate professionals to comply with these regulations to avoid penalties. The tax must be paid in full to ensure that the property transfer is legally recognized. Non-compliance can lead to complications in property ownership and potential legal disputes.

Required Documents

To complete the Lake Forest Transfer Tax process, several documents are typically required:

- Sales Contract: A signed agreement between the buyer and seller outlining the terms of the sale.

- Transfer Tax Form: A specific form designated for reporting the transfer tax, which may need to be filled out and submitted.

- Payment Receipt: Proof of payment for the transfer tax, which is essential for record-keeping and legal compliance.

Penalties for Non-Compliance

Failure to comply with the Lake Forest Transfer Tax regulations can result in penalties for both buyers and sellers. These penalties may include fines, interest on unpaid taxes, and potential legal action to enforce payment. It is crucial to adhere to the deadlines and requirements set forth by local authorities to avoid these consequences.

Quick guide on how to complete lake forest transfer tax

Complete Lake Forest Transfer Tax seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides all the resources you need to draft, modify, and eSign your files swiftly without complications. Manage Lake Forest Transfer Tax on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Lake Forest Transfer Tax with ease

- Find Lake Forest Transfer Tax and click Get Form to begin.

- Utilize the features we provide to complete your document.

- Highlight important sections of the documents or obscure confidential information with tools designed specifically for that function by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to finalize your changes.

- Choose how you prefer to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Lake Forest Transfer Tax and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lake forest transfer tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are lake forest transfer stamps?

Lake forest transfer stamps are official certifications that facilitate the transfer of property ownership within Lake Forest. These stamps are often required for real estate transactions to ensure compliance with local regulations. Understanding how these stamps work is essential for both buyers and sellers in the area.

-

How do I obtain lake forest transfer stamps?

To obtain lake forest transfer stamps, you typically need to fill out the appropriate application through your local government office or real estate authority. This process may require the submission of certain documents related to the property transaction. It's advisable to consult with a real estate agent to streamline the process.

-

What is the cost associated with lake forest transfer stamps?

The cost of lake forest transfer stamps can vary depending on the property value and local regulations. Generally, these stamps are calculated as a percentage of the sale price. For accurate pricing, it's best to check with the local tax assessor's office.

-

Are lake forest transfer stamps required for all property transactions?

Yes, lake forest transfer stamps are typically required for most property transactions in Lake Forest to ensure proper documentation of ownership transfer. However, certain exemptions may apply, so it’s important to verify the specifics with your local authorities. Ensuring proper compliance can help avoid potential legal issues.

-

How can airSlate SignNow help with lake forest transfer stamps?

AirSlate SignNow can simplify the process of obtaining lake forest transfer stamps by allowing users to eSign documents securely and efficiently. Its user-friendly interface makes it easy to manage the paperwork required for your property transactions. This ensures a smooth process while complying with local regulations.

-

What other features does airSlate SignNow offer for real estate transactions?

In addition to eSigning documents, airSlate SignNow offers features like document templates, automated workflows, and secure cloud storage specifically designed for real estate transactions. These tools can enhance efficiency and organization when dealing with lake forest transfer stamps and other paperwork. Staying organized helps streamline the entire buying or selling process.

-

Can airSlate SignNow integrate with other real estate tools?

Yes, airSlate SignNow integrates seamlessly with many real estate tools, facilitating easy management of transactions, including those involving lake forest transfer stamps. Whether you use CRM systems or accounting software, these integrations enhance your workflow and keep everything organized. This interoperability is vital for effective transaction management.

Get more for Lake Forest Transfer Tax

Find out other Lake Forest Transfer Tax

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later