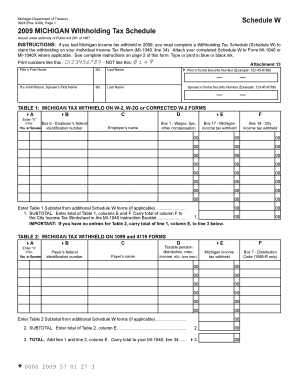

Michigan Withholding Tax Schedule W Form

What is the Michigan Withholding Tax Schedule W Form

The Michigan Withholding Tax Schedule W Form is a document used by employers in Michigan to report and remit state income tax withheld from employees' wages. This form is essential for ensuring compliance with Michigan's tax regulations. It provides a structured way for employers to calculate the amount of tax to withhold based on the employee's earnings and applicable tax rates.

The form is typically part of the employer's tax filing process and is submitted to the Michigan Department of Treasury. It is crucial for maintaining accurate records of withholding amounts and ensuring that employees receive proper credit for state taxes paid.

How to use the Michigan Withholding Tax Schedule W Form

To effectively use the Michigan Withholding Tax Schedule W Form, employers must first gather the necessary information about their employees, including their total wages and applicable withholding allowances. The form includes sections for reporting these details accurately.

Employers should fill out the form based on the employee's earnings for the pay period and the appropriate withholding tax rates. After completing the form, it should be submitted along with the payment of withheld taxes to the Michigan Department of Treasury. Keeping a copy of the completed form for record-keeping purposes is also advisable.

Steps to complete the Michigan Withholding Tax Schedule W Form

Completing the Michigan Withholding Tax Schedule W Form involves several key steps:

- Gather employee information, including names, Social Security numbers, and total wages for the reporting period.

- Determine the appropriate tax withholding rates based on the employee's earnings and filing status.

- Fill out the form by entering the required information in the designated fields, ensuring accuracy.

- Review the completed form for any errors or omissions before submission.

- Submit the form along with the tax payment to the Michigan Department of Treasury by the specified deadline.

Legal use of the Michigan Withholding Tax Schedule W Form

The legal use of the Michigan Withholding Tax Schedule W Form is governed by state tax laws. Employers are required to use this form to report withholding accurately to comply with Michigan's tax regulations. Failure to use the form correctly can result in penalties or fines imposed by the state.

Additionally, the form must be completed and submitted within the designated time frames to ensure that employees receive proper credit for the taxes withheld. Employers should also retain copies of submitted forms for their records, as they may be requested during audits or reviews by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Michigan Withholding Tax Schedule W Form are crucial for compliance. Employers must submit the form along with the withheld taxes by the due dates specified by the Michigan Department of Treasury. Typically, these deadlines align with the employer's payroll schedule, whether it is weekly, bi-weekly, or monthly.

It is important for employers to stay informed about any changes to these deadlines, as late submissions can result in penalties. Keeping a calendar of important dates related to tax filings can help ensure timely compliance.

Form Submission Methods (Online / Mail / In-Person)

The Michigan Withholding Tax Schedule W Form can be submitted through various methods, providing flexibility for employers. The primary submission methods include:

- Online: Employers can submit the form electronically through the Michigan Department of Treasury's online portal, which allows for quick processing.

- Mail: The form can be printed and mailed to the Michigan Department of Treasury. Employers should ensure that it is sent well before the deadline to allow for processing time.

- In-Person: Employers may also choose to deliver the form in person to designated offices of the Michigan Department of Treasury.

Quick guide on how to complete michigan withholding tax schedule w form

Effortlessly prepare Michigan Withholding Tax Schedule W Form on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Michigan Withholding Tax Schedule W Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to adjust and eSign Michigan Withholding Tax Schedule W Form with ease

- Obtain Michigan Withholding Tax Schedule W Form and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, exhaustive form searches, or errors that necessitate reprinting documents. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign Michigan Withholding Tax Schedule W Form to ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan withholding tax schedule w form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Michigan Withholding Tax Schedule W Form?

The Michigan Withholding Tax Schedule W Form is a document used by employers in Michigan to report and remit the state income tax withheld from employees' wages. It is essential for compliance with Michigan tax regulations. Properly submitting this form ensures that businesses avoid penalties and keeps their tax obligations in order.

-

How can airSlate SignNow help with the Michigan Withholding Tax Schedule W Form?

AirSlate SignNow streamlines the process of filling out and eSigning the Michigan Withholding Tax Schedule W Form, making it easy to send and receive documents securely. Our platform is designed for efficiency, allowing you to complete your tax forms without hassle. This ensures timely submissions and reduces the risk of errors in your filings.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers a range of pricing plans that cater to businesses of all sizes. These plans include advanced features for managing documents, including the Michigan Withholding Tax Schedule W Form. The cost is competitive, providing a cost-effective solution for your business’s eSigning needs.

-

What features does airSlate SignNow offer for managing tax forms?

AirSlate SignNow includes features like customizable templates, cloud storage, real-time tracking, and secure sharing options, all of which enhance the management of your Michigan Withholding Tax Schedule W Form. With these tools, you can ensure that your tax documents are handled efficiently and securely. Additionally, electronic signatures add a layer of convenience and compliance.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! AirSlate SignNow offers integration with various accounting and payroll software, allowing for seamless management of your Michigan Withholding Tax Schedule W Form. These integrations enhance workflow efficiency by enabling automatic data transfer, reducing manual entry, and ensuring that all relevant tax information is easily accessible.

-

How does airSlate SignNow ensure the security of my tax documents?

Security is a top priority for airSlate SignNow. Our platform employs robust encryption protocols and secure servers to protect your sensitive information, including the Michigan Withholding Tax Schedule W Form. Additionally, we provide audit trails and user authentication to prevent unauthorized access, ensuring that your documents remain confidential and safe.

-

Can I track the status of my Michigan Withholding Tax Schedule W Form with airSlate SignNow?

Yes, airSlate SignNow includes real-time tracking features that allow you to monitor the status of your Michigan Withholding Tax Schedule W Form. You can see when the document has been viewed, signed, or completed, which helps you stay organized and ensures that submissions are made on time. This transparency reduces the stress of document management.

Get more for Michigan Withholding Tax Schedule W Form

- Form cra m 1 hse

- Hoa bylaws template 361759174 form

- Youth ministry waiver parental consent form emergency fbcpineville

- Oha 3871 covid 19 vaccine religious exception request form

- Form d 1040r city of detroit detroitmi 30446267

- Sp 248 concealed handgun permit application rev 10 1 17 edits 1 form

- Home care application guidance letterhead oklahoma gov form

- Firearms and explosives office form no 1 revisionoctober

Find out other Michigan Withholding Tax Schedule W Form

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form