Application Cum AppraisalSanction Form for Personal Loan 2016-2026

What is the Application cum AppraisalSanction Form For Personal Loan

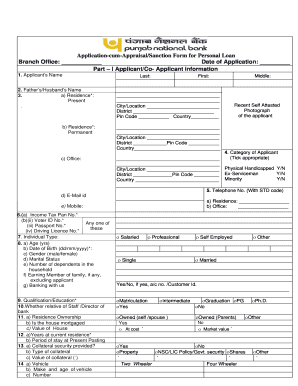

The Application cum AppraisalSanction Form for Personal Loan is a critical document used by individuals seeking financial assistance through personal loans. This form serves as a formal request to lenders, detailing the borrower's financial situation, purpose of the loan, and other relevant information. By providing this information, borrowers enable lenders to assess their creditworthiness and make informed decisions regarding loan approval. The form typically includes sections for personal identification, income details, employment history, and the desired loan amount.

How to use the Application cum AppraisalSanction Form For Personal Loan

Using the Application cum AppraisalSanction Form for Personal Loan involves several straightforward steps. First, gather all necessary documents, such as proof of income, identification, and any other financial statements. Next, fill out the form accurately, ensuring that all information is complete and truthful. After completing the form, review it for any errors or omissions. Finally, submit the form to your chosen lender, either electronically or in person, depending on their submission guidelines.

Steps to complete the Application cum AppraisalSanction Form For Personal Loan

Completing the Application cum AppraisalSanction Form for Personal Loan requires careful attention to detail. Follow these steps for a successful submission:

- Step 1: Read the instructions carefully to understand the requirements.

- Step 2: Provide accurate personal information, including your full name, address, and contact details.

- Step 3: Detail your employment history and income sources, ensuring to include all relevant documentation.

- Step 4: Specify the loan amount you wish to request and the purpose of the loan.

- Step 5: Review the completed form thoroughly for accuracy before submission.

Key elements of the Application cum AppraisalSanction Form For Personal Loan

The Application cum AppraisalSanction Form for Personal Loan comprises several key elements that are essential for the loan approval process. These elements include:

- Personal Information: Name, address, and contact details.

- Employment Details: Current employer, job title, and duration of employment.

- Financial Information: Monthly income, existing debts, and assets.

- Loan Details: Requested loan amount and intended use of funds.

- Signature: Acknowledgment of the information provided and consent to the terms of the loan.

Legal use of the Application cum AppraisalSanction Form For Personal Loan

The legal use of the Application cum AppraisalSanction Form for Personal Loan is governed by various regulations that ensure the protection of both the borrower and the lender. When completed and signed, this form acts as a binding agreement between the parties involved. It is essential that borrowers understand the terms outlined in the form, including any fees, interest rates, and repayment schedules. Compliance with federal and state lending laws is also crucial to ensure that the loan process is conducted fairly and transparently.

Eligibility Criteria

Eligibility for a personal loan using the Application cum AppraisalSanction Form typically depends on several factors. Lenders evaluate the following criteria:

- Credit Score: A higher credit score generally increases the chances of approval.

- Income Level: Proof of stable income is necessary to demonstrate repayment ability.

- Employment Status: A steady job history can positively influence the lender's decision.

- Debt-to-Income Ratio: Lenders assess existing debts in relation to income to determine financial health.

Quick guide on how to complete application cum appraisalsanction form for personal loan

Complete Application cum AppraisalSanction Form For Personal Loan effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without holdups. Handle Application cum AppraisalSanction Form For Personal Loan on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign Application cum AppraisalSanction Form For Personal Loan with ease

- Find Application cum AppraisalSanction Form For Personal Loan and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which requires mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Select how you wish to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Edit and eSign Application cum AppraisalSanction Form For Personal Loan to ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application cum appraisalsanction form for personal loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application cum Appraisal Sanction Form For Personal Loan?

The Application cum Appraisal Sanction Form For Personal Loan is a crucial document required by financial institutions to assess your eligibility for a personal loan. This form typically includes your personal details, financial history, and the purpose of the loan. Filling it out accurately is essential for a smooth loan approval process.

-

How can airSlate SignNow help with the Application cum Appraisal Sanction Form For Personal Loan?

airSlate SignNow simplifies the process of completing and eSigning the Application cum Appraisal Sanction Form For Personal Loan. Our platform provides easy-to-use templates and tools that make it easy to fill out required information, ensuring compliance and accuracy. This streamlines the submission process, so you can focus on what matters most.

-

Is there a cost associated with using airSlate SignNow for the Application cum Appraisal Sanction Form For Personal Loan?

Yes, there may be a subscription fee to use airSlate SignNow, but our pricing plans are cost-effective and tailored to suit both individual and business needs. By using our platform, you can save time and reduce errors in submitting the Application cum Appraisal Sanction Form For Personal Loan, which can be worth the investment.

-

What features does airSlate SignNow offer for the Application cum Appraisal Sanction Form For Personal Loan?

airSlate SignNow offers features such as customizable templates, secure eSignatures, and real-time tracking. These capabilities enhance the efficiency of completing the Application cum Appraisal Sanction Form For Personal Loan and ensure that your documents are protected and easily accessible. Additionally, you can integrate with other tools for a seamless workflow.

-

How secure is my personal information when using the Application cum Appraisal Sanction Form For Personal Loan with airSlate SignNow?

Security is a top priority at airSlate SignNow. When you use our platform for the Application cum Appraisal Sanction Form For Personal Loan, all data is encrypted and stored securely. We comply with industry standards to protect your sensitive information throughout the eSigning process.

-

Can I save and send the Application cum Appraisal Sanction Form For Personal Loan electronically?

Absolutely! With airSlate SignNow, you can easily save and send the Application cum Appraisal Sanction Form For Personal Loan electronically. This not only speeds up the submission process but also helps you keep a digital record of your documents, making it easier to manage your loan application.

-

What integrations does airSlate SignNow support that can help with the Application cum Appraisal Sanction Form For Personal Loan?

airSlate SignNow supports a variety of integrations with popular tools such as Google Drive, Dropbox, and Microsoft Office. These integrations allow you to import, fill out, and manage the Application cum Appraisal Sanction Form For Personal Loan seamlessly alongside your other business processes, enhancing overall productivity.

Get more for Application cum AppraisalSanction Form For Personal Loan

- Sbirt screening form

- Form of application for an arms licence in form ii iii and iv

- Ast 60 form alabama

- Student health and physical exam form

- In the small claims court of alabama form

- Gc 2 application for games of chance license gaming ny gov form

- Department of veterans affairs insurance center p o box 42954 form

- Navy training jacket spot check form

Find out other Application cum AppraisalSanction Form For Personal Loan

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online