I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Revenue Wi

What is the I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Revenue Wi

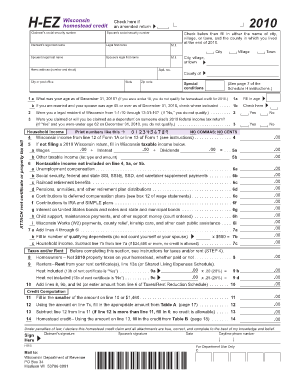

The I 015i Schedule H EZ is a simplified tax form used by residents of Wisconsin to apply for the Homestead Credit. This credit is designed to provide financial relief to low-income homeowners and renters by offsetting property taxes or rent paid. The short form streamlines the application process, making it easier for eligible individuals to claim their benefits without extensive documentation.

How to use the I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Revenue Wi

To use the I 015i Schedule H EZ, you must first determine your eligibility based on income and residency requirements. Once confirmed, you can obtain the form from the Wisconsin Department of Revenue website or local offices. Complete the form by providing necessary personal information, income details, and property information. Ensure that all sections are filled out accurately to avoid delays in processing.

Steps to complete the I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Revenue Wi

Completing the I 015i Schedule H EZ involves several key steps:

- Gather Documentation: Collect necessary documents, including proof of income and property ownership.

- Fill Out the Form: Provide accurate information in each section, ensuring all required fields are completed.

- Review for Accuracy: Double-check all entries for correctness to prevent processing issues.

- Submit the Form: File the completed form with the Wisconsin Department of Revenue by the designated deadline.

Eligibility Criteria

To qualify for the Homestead Credit using the I 015i Schedule H EZ, applicants must meet specific criteria. Generally, applicants must be Wisconsin residents, must own or rent their home, and must have a total household income below a certain threshold. Additionally, the property must be the applicant's primary residence for a minimum period during the tax year.

Required Documents

When completing the I 015i Schedule H EZ, several documents are necessary to support your application. These typically include:

- Proof of income, such as pay stubs or tax returns.

- Documentation of property ownership or rental agreements.

- Identification, such as a driver's license or state ID.

Form Submission Methods

The I 015i Schedule H EZ can be submitted through various methods. Applicants may choose to file online through the Wisconsin Department of Revenue's e-filing system, mail the completed form to the appropriate address, or submit it in person at local revenue offices. Each method has its own advantages, such as convenience or immediate confirmation of receipt.

Quick guide on how to complete i 015i schedule h ez wisconsin homestead credit short form revenue wi

Effortlessly prepare I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Revenue Wi on any device

The management of documents online has gained popularity among organizations and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents quickly and without hassle. Handle I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Revenue Wi on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related task today.

How to edit and electronically sign I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Revenue Wi with ease

- Locate I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Revenue Wi and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive data using the features that airSlate SignNow has specifically designed for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or errors that require the reprinting of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Revenue Wi to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the i 015i schedule h ez wisconsin homestead credit short form revenue wi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Revenue Wi?

The I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Revenue Wi is a simplified tax form designed for Wisconsin residents to apply for homestead credit. This form helps eligible homeowners and renters receive financial assistance based on property taxes and rent paid. Understanding this form is crucial to maximizing your tax benefits.

-

How can airSlate SignNow assist with the I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Revenue Wi?

airSlate SignNow simplifies the process of completing and signing the I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Revenue Wi. With our eSignature capabilities, users can easily fill out the form, securely sign it, and submit it digitally, streamlining tax submissions.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers robust eSigning features that include templates, customizable workflows, and automated reminders. These features enhance the efficiency of completing documents like the I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Revenue Wi. You can also track the signing process in real-time to ensure timely submissions.

-

Is airSlate SignNow easy to integrate with other applications?

Yes, airSlate SignNow provides seamless integration with a variety of popular applications and platforms. This includes CRM systems, document management tools, and more, allowing for easy access to manage the I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Revenue Wi along with other essential tasks. Integration enhances productivity by centralizing your workflow.

-

What pricing options are available for airSlate SignNow users?

airSlate SignNow offers flexible pricing plans tailored to different user needs, ranging from individual to business levels. Each plan provides access to features needed for handling documents like the I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Revenue Wi efficiently. Choose a plan that aligns with your document management requirements.

-

Can I use airSlate SignNow on mobile devices?

Absolutely! airSlate SignNow is optimized for mobile use, allowing you to complete and sign the I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Revenue Wi from anywhere. Our mobile app provides full functionality, ensuring you can manage documents on the go.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like the I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Revenue Wi offers numerous benefits, such as improved accuracy, reduced processing time, and enhanced security. eSignatures are legally binding, making it easier to finalize important documents without delays. Streamlining your tax preparation can save you valuable time and effort.

Get more for I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Revenue Wi

- Attorney lawyer form

- Otc 905 form

- Privacy act consent form 100375428

- Bapplicationb for non immigrant visa the philippine embassy in port bb form

- Student directions build an atom activity answer key form

- Drug use evaluation template form

- Pa form cdl transportation fill out and sign printable

- Ts149 quality control for field placed concrete technical form

Find out other I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Revenue Wi

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free