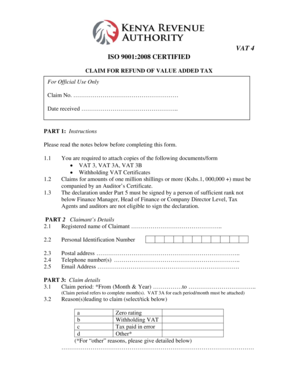

Vat4 Form

What is the VAT4?

The VAT4 form is a critical document used in the United States for reporting specific tax-related information. It is primarily utilized by businesses to declare value-added tax (VAT) obligations. Understanding the VAT4 is essential for compliance with federal and state tax regulations, ensuring that businesses fulfill their legal responsibilities while minimizing the risk of penalties.

How to use the VAT4

Using the VAT4 form requires careful attention to detail to ensure accurate reporting. Businesses should gather all necessary financial data, including sales figures and tax collected. Once the information is compiled, the form can be filled out electronically or on paper. It is crucial to review the completed form for accuracy before submission, as errors can lead to complications with tax authorities.

Steps to complete the VAT4

Completing the VAT4 form involves several key steps:

- Gather all relevant financial documents, including sales records and previous tax filings.

- Access the VAT4 form through the appropriate governmental website or tax office.

- Fill out the form, ensuring all sections are completed accurately.

- Double-check the entries for any discrepancies or errors.

- Submit the form electronically or via mail, following the specific submission guidelines provided.

Legal use of the VAT4

The legal use of the VAT4 form is governed by various tax laws and regulations. To ensure compliance, businesses must adhere to the guidelines set forth by the Internal Revenue Service (IRS) and state tax authorities. Proper use of the VAT4 not only fulfills legal obligations but also protects businesses from potential audits and penalties.

Required Documents

When preparing to complete the VAT4 form, several documents are typically required:

- Sales invoices and receipts

- Previous VAT returns

- Financial statements

- Any correspondence with tax authorities

Having these documents readily available will streamline the process of filling out the VAT4 form and enhance accuracy.

Form Submission Methods

The VAT4 form can be submitted through various methods, depending on the preferences of the business and the requirements of the tax authority. Common submission methods include:

- Online submission through the tax authority's official website

- Mailing a paper copy to the designated tax office

- In-person submission at local tax offices, if applicable

Choosing the right submission method can help ensure timely processing and compliance.

Penalties for Non-Compliance

Failing to file the VAT4 form or submitting inaccurate information can lead to significant penalties. Businesses may face fines, interest on unpaid taxes, and potential legal action from tax authorities. Understanding the consequences of non-compliance emphasizes the importance of timely and accurate reporting.

Quick guide on how to complete vat4

Complete Vat4 seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without any delays. Manage Vat4 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Vat4 effortlessly

- Obtain Vat4 and then click Get Form to begin.

- Make use of the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tiresome form searches, or errors requiring the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign Vat4 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is VAT4 and how does it relate to airSlate SignNow?

VAT4 is a crucial component for businesses dealing with value-added tax compliance. airSlate SignNow allows users to electronically sign VAT4 documents, simplifying the process and ensuring legal compliance without the hassle of paper documentation.

-

How can airSlate SignNow help with VAT4 document management?

With airSlate SignNow, users can efficiently manage VAT4 documents through secure electronic signatures and cloud storage. The platform streamlines the approval process, enabling teams to collaborate on VAT4 forms seamlessly and effectively.

-

What are the pricing plans for using airSlate SignNow for VAT4 processes?

airSlate SignNow offers various pricing tiers to accommodate different business needs, making it affordable for all sizes. Each plan includes features that support VAT4 document management, ensuring you have the right tools for efficient VAT compliance.

-

Are there any integrations available to enhance VAT4 processes with airSlate SignNow?

Yes, airSlate SignNow integrates with popular platforms like Google Workspace and Salesforce, enhancing your VAT4 document workflows. These integrations allow for smoother data flow and improved productivity when handling VAT4 forms.

-

What features does airSlate SignNow offer to support VAT4 eSigning?

airSlate SignNow provides a range of features specifically designed for VAT4 eSigning, including audit trails, customizable templates, and mobile accessibility. These features ensure that your VAT4 documents are signed quickly and securely, helping you stay compliant.

-

Can airSlate SignNow assist in tracking VAT4 document statuses?

Absolutely! airSlate SignNow provides real-time tracking of VAT4 document statuses, allowing users to monitor who has signed and who hasn't. This transparency helps ensure that your VAT4 processes remain on schedule and compliant.

-

Is airSlate SignNow compliant with international VAT4 regulations?

Yes, airSlate SignNow is designed to comply with various international regulations, including those related to VAT4. This compliance ensures that businesses can use the platform confidently for their VAT documentation needs.

Get more for Vat4

- Nmls form 22e firpta certification

- Blue cross request of aba form

- Propane system check form

- Name date esl kids world past simple verbs n a h a k d form

- Mc 040 notice of change of address judicial council forms courtinfo ca

- Signed mortgage deed example nationwide form

- Instructions for requesting a copy of a form

- Georgia open records request form

Find out other Vat4

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online