Form 5452 Instructions

What is the Form 5452 Instructions

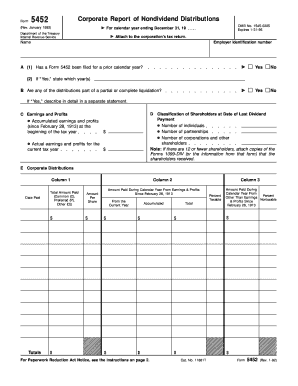

The Form 5452 instructions provide detailed guidance on how to complete the Form 5452, which is used for reporting certain types of information to the IRS. This form is particularly relevant for taxpayers who need to report specific transactions or financial details. Understanding the instructions is crucial for ensuring accurate completion and compliance with IRS regulations.

Steps to complete the Form 5452 Instructions

To successfully complete the Form 5452, follow these steps:

- Obtain the latest version of the Form 5452 and its instructions from a reliable source.

- Gather all necessary documents and information that will be required to fill out the form.

- Carefully read through the instructions to understand the requirements for each section of the form.

- Fill out the form accurately, ensuring that all information is complete and correct.

- Review the completed form against the instructions to confirm that all steps have been followed.

- Submit the form according to the specified submission methods outlined in the instructions.

Legal use of the Form 5452 Instructions

The legal use of the Form 5452 instructions is essential for maintaining compliance with IRS regulations. Properly following these instructions ensures that the information reported is valid and can withstand scrutiny during audits. Utilizing electronic tools for filling out the form can enhance security and ensure that the submission meets legal standards.

Examples of using the Form 5452 Instructions

Examples of using the Form 5452 instructions can include various taxpayer scenarios. For instance, a self-employed individual may need to report specific income details, while a business entity may use the form to disclose certain transactions. Each scenario requires careful adherence to the instructions to ensure that all relevant information is accurately reported.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5452 are critical to avoid penalties. Typically, the form must be submitted by the established due date, which aligns with the taxpayer's filing schedule. It is important to check the IRS guidelines for any updates or changes to these deadlines to ensure timely compliance.

Form Submission Methods (Online / Mail / In-Person)

The Form 5452 can be submitted through various methods, including online submissions, mailing a physical copy, or delivering it in person to the appropriate IRS office. Each method has specific guidelines and requirements, so it is essential to choose the one that aligns with your needs and ensures secure processing of the form.

Quick guide on how to complete form 5452 instructions

Prepare Form 5452 Instructions seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to find the necessary form and safely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and without delays. Manage Form 5452 Instructions on any device with airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The easiest way to alter and eSign Form 5452 Instructions effortlessly

- Find Form 5452 Instructions and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Form 5452 Instructions and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5452 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow related to form 5452 instructions?

airSlate SignNow offers features that simplify the process of eSigning and managing documents, including the ability to easily upload and fill out form 5452 instructions. Users can collaborate in real-time, ensuring that all necessary parties can review and sign documents quickly. The platform also provides templates to streamline the preparation of commonly used forms.

-

How does airSlate SignNow help with completing form 5452 instructions?

With airSlate SignNow, users can fill out form 5452 instructions online, making it easier to ensure all required fields are completed accurately. The platform guides you through each step, reducing errors and helping you understand what information is necessary. This streamlining can save time and reduce frustration associated with paperwork.

-

Is there a free trial available for airSlate SignNow to use with form 5452 instructions?

Yes, airSlate SignNow provides a free trial that allows prospective customers to explore its features and see how it can assist with form 5452 instructions. During this trial, users can experience the ease of eSigning and document management without any commitment. This trial is an excellent way to evaluate if it meets your needs.

-

What are the pricing options for airSlate SignNow when using it for form 5452 instructions?

airSlate SignNow offers various subscription plans that cater to different business sizes and needs, all usable for completing form 5452 instructions. Pricing is designed to be cost-effective, providing value while ensuring all necessary features are included. You can view detailed plans on their website to find the best fit for your organization.

-

Can I integrate airSlate SignNow with other applications while handling form 5452 instructions?

Absolutely! airSlate SignNow offers a wide range of integrations with popular applications, allowing you to streamline processes related to form 5452 instructions. These integrations enhance efficiency by connecting with tools you already use, such as CRM systems or cloud storage solutions, facilitating a seamless workflow.

-

What benefits does airSlate SignNow provide for businesses dealing with form 5452 instructions?

Using airSlate SignNow for form 5452 instructions offers numerous benefits, including improved efficiency, reduced paperwork, and accelerated approval times. The platform ensures documents can be signed from anywhere, at any time, offering flexibility to both businesses and their clients. Additionally, electronic signatures are legally binding, enhancing compliance.

-

Is airSlate SignNow secure when managing sensitive information on form 5452 instructions?

Yes, security is a top priority for airSlate SignNow. The platform uses advanced encryption protocols to protect all data, including when handling sensitive information on form 5452 instructions. With compliance to major security standards, users can trust that their documents and personal information are safe.

Get more for Form 5452 Instructions

- The crusades global ii form

- Hipaa notice of privacy practices liberty dentist form

- Irregular plural nouns exercises pdf form

- Deed of priority template form

- Expense worksheet for non cash contributions form

- Jersey shore council bsa citta scout reservation canoe rental form

- Non poaching agreement template form

- Non solicitation agreement template form

Find out other Form 5452 Instructions

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later