Form 275 021 04 CONTRACTOR CERTIFICATION of EEOAA POLICY 2004-2026

Understanding the Form 275 021 04 Contractor Certification of EEOAA Policy

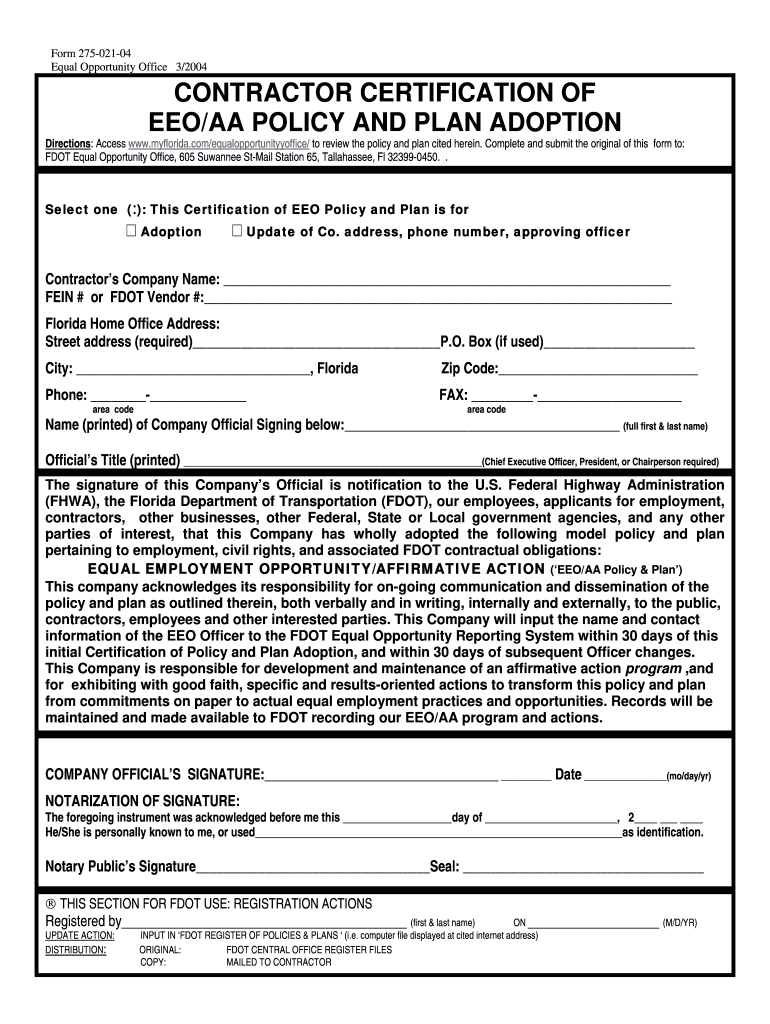

The Form 275 021 04, also known as the Contractor Certification of EEOAA Policy, is a critical document used by contractors to affirm their commitment to equal employment opportunity and affirmative action. This form is essential for compliance with federal regulations that promote fair employment practices. By completing this certification, contractors demonstrate their adherence to the principles outlined in the Equal Employment Opportunity Act (EEOAA), which aims to prevent discrimination in the workplace.

Steps to Complete the Form 275 021 04 Contractor Certification of EEOAA Policy

Completing the Form 275 021 04 involves several key steps to ensure accuracy and compliance. Start by gathering all necessary information, including your business details and any relevant policies related to equal employment opportunity. Follow these steps:

- Provide your business name, address, and contact information.

- Detail your EEOAA policy, highlighting your commitment to diversity and inclusion.

- Include any specific programs or initiatives aimed at promoting equal opportunity within your organization.

- Sign and date the form to certify that the information provided is accurate and complete.

It is advisable to review the form carefully before submission to avoid any errors that could lead to compliance issues.

Legal Use of the Form 275 021 04 Contractor Certification of EEOAA Policy

The legal use of the Form 275 021 04 is governed by federal regulations that mandate equal employment opportunity practices. This form serves as a formal declaration of a contractor's commitment to uphold these standards. Failure to comply with the requirements outlined in the EEOAA can result in penalties, including disqualification from federal contracts. Therefore, it is crucial for contractors to understand their legal obligations and ensure that the information submitted is truthful and reflective of their practices.

Key Elements of the Form 275 021 04 Contractor Certification of EEOAA Policy

Several key elements must be included in the Form 275 021 04 to ensure it meets the necessary legal standards. These elements include:

- Business Information: Accurate details about the contracting entity.

- EEOAA Policy Statement: A clear articulation of the contractor's policy regarding equal employment opportunities.

- Commitment to Affirmative Action: Description of initiatives aimed at promoting diversity and preventing discrimination.

- Signature and Date: An authorized signature confirming the accuracy of the information provided.

Including these elements is vital for the form's validity and for demonstrating compliance with federal regulations.

How to Obtain the Form 275 021 04 Contractor Certification of EEOAA Policy

The Form 275 021 04 can typically be obtained through official government websites or directly from contracting agencies that require its submission. It is important to ensure that you are using the most current version of the form, as outdated forms may not be accepted. Additionally, some organizations may provide the form in a fillable PDF format, which can facilitate easier completion and submission.

Examples of Using the Form 275 021 04 Contractor Certification of EEOAA Policy

Contractors may use the Form 275 021 04 in various scenarios, particularly when bidding for federal contracts or when required to demonstrate compliance with EEOAA regulations. Examples include:

- Submitting the form as part of a proposal for a government contract.

- Providing the certification during compliance reviews or audits.

- Utilizing the form to enhance workplace diversity initiatives and promote a culture of inclusion.

These examples highlight the form's role in supporting fair employment practices and ensuring contractors meet their legal obligations.

Quick guide on how to complete form 275 021 04 contractor certification of eeoaa policy

Manage Form 275 021 04 CONTRACTOR CERTIFICATION OF EEOAA POLICY from any location, at any moment

Your everyday business operations may necessitate additional attention when handling state-specific business documents. Reclaim your work hours and reduce the costs associated with paper-based processes using airSlate SignNow. airSlate SignNow provides you with a variety of ready-made business documents, including Form 275 021 04 CONTRACTOR CERTIFICATION OF EEOAA POLICY, which you can utilize and distribute to your business associates. Manage your Form 275 021 04 CONTRACTOR CERTIFICATION OF EEOAA POLICY easily with powerful editing and eSignature features and send it directly to your recipients.

How to obtain Form 275 021 04 CONTRACTOR CERTIFICATION OF EEOAA POLICY in just a few clicks:

- Select a form that pertains to your state.

- Click Learn More to access the document and ensure its accuracy.

- Choose Get Form to begin using it.

- Form 275 021 04 CONTRACTOR CERTIFICATION OF EEOAA POLICY will open automatically in the editor. No additional steps are needed.

- Utilize airSlate SignNow’s advanced editing tools to complete or modify the form.

- Click on the Sign tool to create your personalized signature and eSign your document.

- When finished, click Done, save changes, and access your document.

- Share the form via email or text, or use a link-to-fill option with your partners or allow them to download the document.

airSlate SignNow signNowly conserves your time managing Form 275 021 04 CONTRACTOR CERTIFICATION OF EEOAA POLICY and enables you to locate important documents in one centralized location. An extensive collection of forms is organized and crafted to address essential business processes vital for your organization. The advanced editor minimizes the risk of errors, allowing you to quickly correct mistakes and review your documents on any device before sending them out. Start your free trial today to discover all the advantages of airSlate SignNow for your daily business workflows.

Create this form in 5 minutes or less

FAQs

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the form 275 021 04 contractor certification of eeoaa policy

How to create an electronic signature for your Form 275 021 04 Contractor Certification Of Eeoaa Policy in the online mode

How to make an electronic signature for your Form 275 021 04 Contractor Certification Of Eeoaa Policy in Chrome

How to create an eSignature for signing the Form 275 021 04 Contractor Certification Of Eeoaa Policy in Gmail

How to make an electronic signature for the Form 275 021 04 Contractor Certification Of Eeoaa Policy from your smart phone

How to make an eSignature for the Form 275 021 04 Contractor Certification Of Eeoaa Policy on iOS

How to make an electronic signature for the Form 275 021 04 Contractor Certification Of Eeoaa Policy on Android OS

People also ask

-

What is EEOAA and how does it relate to airSlate SignNow?

EEOAA stands for 'Equal Employment Opportunity and Affirmative Action' which is a critical compliance requirement for many businesses. airSlate SignNow offers solutions that facilitate the eSigning of documents related to EEOAA, ensuring a streamlined process for compliance.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides flexible pricing plans tailored to different business needs. The pricing is designed to be cost-effective, especially for companies focused on managing EEOAA-related documentation efficiently.

-

What features does airSlate SignNow offer for EEOAA compliance?

airSlate SignNow includes features such as customizable templates, secure eSignatures, and document tracking, all of which support EEOAA compliance. These features ensure that your documents are signed securely and efficiently, minimizing the risk of non-compliance.

-

How can airSlate SignNow benefit my business's EEOAA initiatives?

By using airSlate SignNow, businesses can enhance their EEOAA initiatives through quick document turnaround and improved compliance tracking. This allows organizations to focus more on hiring and training diverse talent without getting bogged down in paperwork.

-

Does airSlate SignNow integrate with other software for EEOAA reporting?

Yes, airSlate SignNow seamlessly integrates with various HR and document management software, making it easier to manage EEOAA reporting. This integration ensures that all relevant documents are accessible and compliant with your reporting requirements.

-

Is airSlate SignNow secure for handling sensitive EEOAA documents?

Absolutely! airSlate SignNow prioritizes security, employing encryption and robust data protection measures to ensure that all EEOAA documents are handled securely. Your sensitive information is safe from unauthorized access.

-

How does the eSigning process work with airSlate SignNow?

The eSigning process with airSlate SignNow is straightforward and user-friendly. Users simply upload their EEOAA documents, add signatures, and send them out for approval, making it an efficient solution for busy HR departments.

Get more for Form 275 021 04 CONTRACTOR CERTIFICATION OF EEOAA POLICY

- First tuesday california real estate forms

- Dch contrast material extravasation form dearborn county hospital

- Applicant support form carms

- Lock in permission slip template form

- K 1e kentucky employers income tax withheld worksheet form

- Zero income questionnaire 25508307 form

- Equipment transfer request the university of texas health science uthscsa form

- Student identification certificate form

Find out other Form 275 021 04 CONTRACTOR CERTIFICATION OF EEOAA POLICY

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document