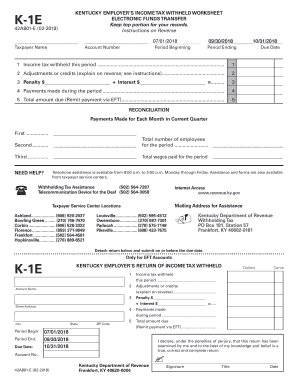

K 1E Kentucky Employer's Income Tax Withheld Worksheet Form

What is the K-1E Kentucky Employer's Income Tax Withheld Worksheet

The K-1E Kentucky Employer's Income Tax Withheld Worksheet is a crucial document used by employers in Kentucky to calculate the amount of state income tax to withhold from employees' wages. This form is essential for ensuring compliance with Kentucky tax regulations and helps employers accurately report and remit withheld taxes to the state. It is designed to assist employers in determining the correct withholding amount based on various factors, including employee earnings and applicable tax rates.

Steps to Complete the K-1E Kentucky Employer's Income Tax Withheld Worksheet

Completing the K-1E form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information about your employees, including their total wages and any exemptions they may claim. Next, follow these steps:

- Review the current Kentucky tax rates applicable to your employees.

- Fill in the employee's personal information, including name and Social Security number.

- Calculate the total wages for the pay period.

- Determine the amount to withhold based on the provided tax tables or formulas.

- Double-check all calculations for accuracy before submission.

Legal Use of the K-1E Kentucky Employer's Income Tax Withheld Worksheet

The K-1E form is legally binding when completed accurately and submitted in accordance with Kentucky tax laws. It is essential for employers to maintain compliance with state regulations to avoid potential penalties. The form must be kept on file for record-keeping purposes and may be subject to review by state tax authorities. Utilizing electronic signature solutions can enhance the legal validity of the form, ensuring that all signatures and submissions meet legal standards.

Who Issues the K-1E Kentucky Employer's Income Tax Withheld Worksheet

The K-1E Kentucky Employer's Income Tax Withheld Worksheet is issued by the Kentucky Department of Revenue. This state agency is responsible for providing tax forms and guidelines to ensure that employers comply with state income tax withholding requirements. Employers can obtain the K-1E form directly from the Kentucky Department of Revenue's official website or through authorized tax preparation software.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines for filing the K-1E form to avoid penalties. The K-1E form is typically submitted along with the employer's quarterly tax filings. Key dates include:

- Quarterly filing deadlines: Generally due on the last day of the month following the end of each quarter.

- Annual reconciliation deadlines: Employers must reconcile their withheld taxes by January 31 of the following year.

Examples of Using the K-1E Kentucky Employer's Income Tax Withheld Worksheet

Employers often encounter various scenarios when using the K-1E form. For instance, a small business owner with multiple employees may need to calculate withholding for each employee based on their individual earnings and exemptions. Additionally, seasonal employers may use the K-1E form to adjust withholding amounts during peak hiring periods. Understanding these examples can help employers navigate the complexities of tax withholding more effectively.

Quick guide on how to complete k 1e kentucky employers income tax withheld worksheet

Prepare K 1E Kentucky Employer's Income Tax Withheld Worksheet effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without interruptions. Handle K 1E Kentucky Employer's Income Tax Withheld Worksheet on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign K 1E Kentucky Employer's Income Tax Withheld Worksheet easily

- Obtain K 1E Kentucky Employer's Income Tax Withheld Worksheet and click on Get Form to begin.

- Make use of the tools provided to complete your form.

- Select pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose how you would like to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or displaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign K 1E Kentucky Employer's Income Tax Withheld Worksheet to ensure remarkable communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the k 1e kentucky employers income tax withheld worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the kentucky k 1e solution offered by airSlate SignNow?

The kentucky k 1e solution from airSlate SignNow is a powerful tool that enables businesses to send and eSign documents seamlessly. It supports various document types, making it an ideal choice for organizations in Kentucky looking to streamline their signing processes.

-

How much does the kentucky k 1e service cost?

Pricing for the kentucky k 1e service varies based on the plan chosen. airSlate SignNow offers flexible pricing tiers designed to fit different business needs, ensuring you get cost-effective options for your document signing requirements.

-

What features does kentucky k 1e include?

The kentucky k 1e features a range of capabilities, including document templates, tracking, and advanced security options. These features help enhance your document management and ensure a smooth eSigning experience for your team.

-

How can kentucky k 1e benefit my business?

Utilizing the kentucky k 1e service can signNowly boost your business's efficiency by reducing the time spent on paperwork. It also enhances collaboration and allows for quicker transactions, ultimately benefiting your bottom line.

-

Is the kentucky k 1e solution easy to integrate with existing software?

Yes, the kentucky k 1e solution is designed for easy integration with various existing software platforms. This ensures that you can incorporate eSigning into your current workflows without signNow disruptions.

-

Are there any mobile capabilities with kentucky k 1e?

Absolutely, the kentucky k 1e solution is mobile-friendly, allowing users to send and sign documents directly from their smartphones or tablets. This flexibility enables users to manage their documents on-the-go, enhancing productivity.

-

What industries can benefit from kentucky k 1e?

The kentucky k 1e service is versatile and can benefit various industries, including real estate, healthcare, and legal sectors. Any business that relies on documentation can find value in utilizing the airSlate SignNow features for efficient document signing.

Get more for K 1E Kentucky Employer's Income Tax Withheld Worksheet

- Aof for jiyo fit program dec 201101cdr yes bank yesbank form

- Direct debit request form westpac online investing

- Eastlake patio homes form

- Form 100s 6112641

- Permission to travel bformb brophy college preparatory brophyprep

- Level 1 appeal form phs

- Red flag reporting form eastern michigan university emich

- Apartment sublease contract template form

Find out other K 1E Kentucky Employer's Income Tax Withheld Worksheet

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document