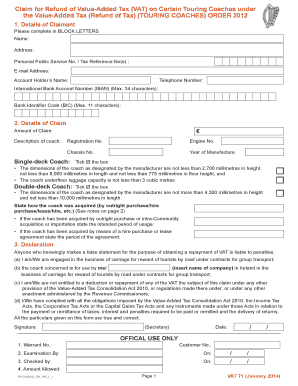

Vat 71 Form

What is the VAT 71?

The VAT 71 form is a crucial document used in the context of Value Added Tax (VAT) in the United States. It serves as a declaration for businesses to report their VAT liabilities and entitlements. This form is essential for ensuring compliance with tax regulations and helps businesses manage their tax obligations effectively. Understanding the VAT 71 is vital for businesses that engage in taxable activities, as it provides a structured way to communicate VAT-related information to the tax authorities.

How to Use the VAT 71

Using the VAT 71 form involves several steps to ensure accurate reporting of VAT obligations. First, gather all necessary financial records related to sales and purchases that are subject to VAT. Next, fill out the form with precise details, including the VAT amounts collected and paid. It's important to double-check all entries for accuracy to avoid errors that could lead to penalties. After completing the form, submit it to the appropriate tax authority, either online or by mail, depending on your jurisdiction's requirements.

Steps to Complete the VAT 71

Completing the VAT 71 form requires careful attention to detail. Follow these steps for a successful submission:

- Collect financial records: Gather invoices, receipts, and other documents that reflect your VAT transactions.

- Fill out the form: Enter your business information, including name, address, and VAT registration number.

- Report VAT amounts: Accurately report the VAT collected from sales and the VAT paid on purchases.

- Review for accuracy: Check all entries for correctness to minimize the risk of errors.

- Submit the form: Send the completed VAT 71 to the relevant tax authority, following their submission guidelines.

Legal Use of the VAT 71

The VAT 71 form must be used in compliance with applicable tax laws and regulations. It is legally binding when filled out correctly and submitted on time. Failure to comply with the legal requirements associated with the VAT 71 can result in penalties, including fines or additional scrutiny from tax authorities. Businesses should ensure they understand the legal implications of their VAT reporting and maintain accurate records to support their submissions.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the use of the VAT 71 form. These guidelines outline the necessary steps for proper completion, submission deadlines, and the consequences of non-compliance. It is essential for businesses to familiarize themselves with these guidelines to ensure they meet all regulatory requirements and avoid potential penalties. Keeping abreast of any updates or changes to IRS guidelines related to VAT will also help maintain compliance.

Filing Deadlines / Important Dates

Filing deadlines for the VAT 71 form are critical for maintaining compliance with tax regulations. Businesses must be aware of the specific dates by which the form must be submitted to avoid late fees or penalties. Typically, these deadlines align with the end of the tax period, whether quarterly or annually. Keeping a calendar of important dates related to VAT filings can help businesses stay organized and ensure timely submissions.

Quick guide on how to complete vat 71

Complete Vat 71 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Manage Vat 71 on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest method to edit and eSign Vat 71 effortlessly

- Obtain Vat 71 and then click Get Form to begin.

- Utilize our provided tools to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all details and then click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Edit and eSign Vat 71 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat 71

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is vat 71 and how does it relate to airSlate SignNow?

VAT 71 refers to specific VAT-related documentation required for businesses in certain jurisdictions. airSlate SignNow helps streamline the process of generating and signing such documents efficiently, ensuring compliance and accuracy.

-

How can I use airSlate SignNow to manage my vat 71 documents?

You can easily upload and send vat 71 documents for eSignature using airSlate SignNow's intuitive platform. The solution enables tracking and storage, making it simple to manage all your VAT-related paperwork in one place.

-

What are the pricing plans for airSlate SignNow for handling vat 71?

airSlate SignNow offers various pricing plans tailored for businesses of all sizes, making it cost-effective for managing vat 71 documents. Each plan includes essential features to ensure your VAT processes are efficient and compliant without breaking the bank.

-

What features does airSlate SignNow include for handling vat 71 documentation?

airSlate SignNow provides features like eSignature capabilities, document templates tailored for vat 71, and automated workflows. These features help simplify the VAT documentation process, saving you time and reducing errors.

-

Is airSlate SignNow compliant with VAT regulations for vat 71?

Yes, airSlate SignNow is designed to meet compliance standards for managing vat 71 documents. By utilizing our platform, you ensure that your documentation follows relevant VAT laws and regulations, mitigating legal risks.

-

Can I integrate airSlate SignNow with other tools to manage vat 71?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting and business management software, allowing you to manage vat 71 documents alongside your existing tools. This enhances efficiency and keeps all your data organized.

-

What are the benefits of using airSlate SignNow for vat 71 documentation?

Using airSlate SignNow for vat 71 documentation provides several benefits, including improved efficiency, reduced paperwork, and enhanced collaboration. It allows you to focus on your core business while ensuring that your VAT processes are handled promptly and accurately.

Get more for Vat 71

- Nuisance complaint aiken sc form

- Form w 9 rev october dekalb county georgia co dekalb ga

- Mathcounts state solutions form

- In on under above behind in front of between next to form

- F243 001 000 form

- Bc 4761 authorization to use or disclose protected health information english

- Risk factors clinical presentations and predictors of stroke form

- Muscle amp nerve laboratory protocolprocedure for sending form

Find out other Vat 71

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast