Form Ic3

What is the Form Ic3

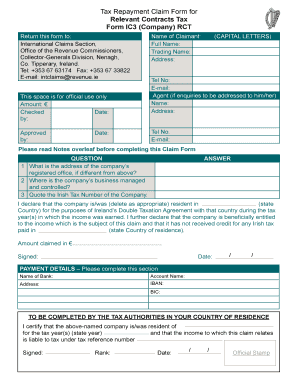

The Form Ic3 is a relevant contracts tax form used in the United States for reporting specific financial transactions. It is essential for individuals and businesses to accurately complete this form to ensure compliance with tax regulations. The form serves as a declaration of income and is crucial for proper tax assessment.

How to use the Form Ic3

Using the Form Ic3 involves several key steps. First, gather all necessary financial documents that pertain to the income being reported. Next, fill out the form with accurate information, including your personal details and the specifics of the transactions. Once completed, review the form for accuracy before submission to ensure all data is correct.

Steps to complete the Form Ic3

Completing the Form Ic3 requires careful attention to detail. Follow these steps:

- Gather your financial records related to the income.

- Enter your personal information accurately.

- Detail the transactions that need to be reported.

- Review the completed form for any errors.

- Submit the form according to the specified guidelines.

Legal use of the Form Ic3

The legal use of the Form Ic3 is governed by U.S. tax laws. To be considered valid, the form must be filled out completely and accurately. It is crucial to understand that any discrepancies or inaccuracies may lead to penalties or legal issues. Therefore, it is advisable to consult a tax professional if there are uncertainties regarding the form.

Required Documents

When preparing to fill out the Form Ic3, certain documents are required to ensure accurate reporting. These may include:

- Previous tax returns for reference.

- Records of income received during the reporting period.

- Any relevant financial statements or receipts.

Form Submission Methods

The Form Ic3 can be submitted through various methods, allowing for flexibility based on user preference. Common submission methods include:

- Online submission through the designated tax portal.

- Mailing a physical copy to the appropriate tax office.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete form ic3

Complete Form Ic3 effortlessly on any device

Web-based document management has become widespread among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any delays. Manage Form Ic3 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to adjust and eSign Form Ic3 with ease

- Find Form Ic3 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

No more worry about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form Ic3 and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ic3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IC3 form and why is it important?

The IC3 form is a crucial document designed for reporting internet crime, and it helps individuals and businesses report suspicious online activities. Completing the IC3 form allows users to notify law enforcement agencies about incidents like fraud or identity theft. Understanding the significance of the IC3 form can enhance your overall cybersecurity strategy.

-

How can airSlate SignNow assist with the IC3 form?

airSlate SignNow simplifies the process of filling out the IC3 form by providing easy-to-use templates and eSignature functionalities. With our platform, users can create, sign, and send IC3 forms securely and efficiently. This streamlines compliance with reporting requirements while maintaining the integrity of your documents.

-

What features does airSlate SignNow offer for IC3 form processing?

With airSlate SignNow, users benefit from features like customizable templates, secure cloud storage, and integration with various applications for seamless document management. These features are designed to enhance the efficiency of completing the IC3 form. Our platform ensures that all your documents are properly managed and easily accessible whenever needed.

-

Is airSlate SignNow affordable for businesses needing to submit IC3 forms?

Yes, airSlate SignNow provides a cost-effective solution for businesses looking to submit IC3 forms and other documents. Our pricing plans are designed to fit various budgets, allowing small and large businesses alike to utilize our eSignature capabilities without breaking the bank. Explore our plans to find the best fit for your needs.

-

Can I integrate airSlate SignNow with other tools for IC3 form management?

Absolutely! airSlate SignNow offers integrations with many popular tools and platforms, enhancing your workflow when managing the IC3 form. Whether you use CRM systems, cloud storage solutions, or communication tools, our platform can seamlessly connect, helping streamline your document processes.

-

What are the benefits of using eSignature for the IC3 form?

Using an eSignature for the IC3 form provides increased security and faster processing times. airSlate SignNow ensures the authenticity of signatures while maintaining compliance with legal standards. This means submitting your IC3 form is not only efficient but also trustable and recognized by regulatory bodies.

-

How does airSlate SignNow ensure the security of my IC3 form submissions?

We prioritize security at airSlate SignNow by employing advanced encryption protocols and secure servers to protect your IC3 form submissions. Our platform adheres to strict compliance regulations, meaning your data is safely stored and shared. Trust that your sensitive information remains confidential when using our services.

Get more for Form Ic3

- Documentation of abstinence example form

- Bscheduleb torontomlsnet form

- Childcare centre enrolment form

- Tc 95 608 doc transportation ky form

- Offer to purchase real estate form 100115594

- Transcript request catholic memorial high school form

- Prison commissary list form

- Httpsassets publishing service gov ukmedia64f form

Find out other Form Ic3

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge

- How Do I Sign North Dakota Notice to Stop Credit Charge

- How To Sign Oklahoma Notice of Rescission

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo