PTAX 340 Senior Citizens Assessment St Clair County Co St Clair Il Form

What is the PTAX 340 Senior Citizens Assessment St Clair County Co St Clair IL

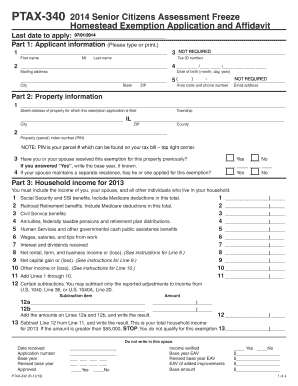

The PTAX 340 Senior Citizens Assessment is a specific form designed for senior citizens residing in St. Clair County, Illinois, to apply for property tax exemptions. This assessment allows eligible seniors to reduce their property tax burden, making homeownership more affordable. It is essential for seniors to understand the criteria and benefits associated with this assessment to take full advantage of the available tax relief.

Eligibility Criteria for the PTAX 340 Senior Citizens Assessment St Clair County Co St Clair IL

To qualify for the PTAX 340 Senior Citizens Assessment, applicants must meet specific eligibility criteria. Generally, applicants must be at least sixty-five years old and must own and occupy the property for which they are applying. Additionally, the total household income must not exceed a certain threshold, which is subject to change annually. It is crucial for applicants to review these criteria carefully to ensure they qualify for the assessment.

Steps to Complete the PTAX 340 Senior Citizens Assessment St Clair County Co St Clair IL

Completing the PTAX 340 Senior Citizens Assessment involves several key steps:

- Gather necessary documentation, including proof of age, property ownership, and income statements.

- Obtain the PTAX 340 form from the St. Clair County Assessor's Office or download it from their official website.

- Fill out the form accurately, ensuring all required fields are completed.

- Submit the completed form along with the required documentation to the appropriate office by the designated deadline.

Form Submission Methods for the PTAX 340 Senior Citizens Assessment St Clair County Co St Clair IL

The PTAX 340 Senior Citizens Assessment can be submitted through various methods to accommodate different preferences:

- Online: If available, applicants may complete and submit the form electronically through the St. Clair County Assessor's website.

- Mail: Completed forms can be mailed to the St. Clair County Assessor's Office. Ensure that the form is sent well before the deadline to allow for processing time.

- In-Person: Applicants may also choose to deliver the form directly to the Assessor's Office during business hours for immediate processing.

Key Elements of the PTAX 340 Senior Citizens Assessment St Clair County Co St Clair IL

Understanding the key elements of the PTAX 340 Senior Citizens Assessment is vital for applicants. The form typically requires personal information, including the applicant's name, address, and date of birth. Additionally, it includes sections to report household income and property details. Accurate completion of these elements is essential to ensure the application is processed without delays.

Legal Use of the PTAX 340 Senior Citizens Assessment St Clair County Co St Clair IL

The PTAX 340 Senior Citizens Assessment is legally recognized as a valid application for property tax relief in St. Clair County. It is important for applicants to understand that submitting this form is a formal request for tax exemption, and any inaccuracies or omissions may lead to denial of the application. Compliance with local regulations and deadlines is crucial for maintaining eligibility.

Quick guide on how to complete ptax 340 senior citizens assessment st clair county co st clair il

Prepare PTAX 340 Senior Citizens Assessment St Clair County Co St clair Il effortlessly on any gadget

Online document handling has become favored by companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, alter, and eSign your documents promptly without delays. Manage PTAX 340 Senior Citizens Assessment St Clair County Co St clair Il on any device with airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The simplest way to alter and eSign PTAX 340 Senior Citizens Assessment St Clair County Co St clair Il with ease

- Locate PTAX 340 Senior Citizens Assessment St Clair County Co St clair Il and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds precisely the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to store your changes.

- Choose how you wish to share your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your preference. Modify and eSign PTAX 340 Senior Citizens Assessment St Clair County Co St clair Il to guarantee effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ptax 340 senior citizens assessment st clair county co st clair il

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PTAX 340 Senior Citizens Assessment in St Clair County, Co St Clair, IL?

The PTAX 340 Senior Citizens Assessment is a property tax exemption designed to provide financial relief to qualifying senior citizens in St Clair County, Co St Clair, IL. This assessment helps reduce the taxable value of a home, thereby lowering the property tax owed. Understanding this assessment can be crucial for seniors looking to manage their expenses effectively.

-

How can I apply for the PTAX 340 Senior Citizens Assessment in St Clair County, Co St Clair, IL?

To apply for the PTAX 340 Senior Citizens Assessment in St Clair County, Co St Clair, IL, seniors must complete the application form and provide any required documentation to the local assessor's office. It's important to meet the eligibility criteria, such as age and income limits, to qualify for the assessment. Make sure to submit your application by the designated deadlines.

-

What are the eligibility requirements for the PTAX 340 Senior Citizens Assessment in St Clair County, Co St Clair, IL?

Eligibility for the PTAX 340 Senior Citizens Assessment in St Clair County, Co St Clair, IL typically includes being at least 65 years old and meeting specific income limits. Homeowners must also occupy the property as their primary residence. Check with the local assessor's office for detailed income thresholds and other requirements that might apply.

-

How much can I save with the PTAX 340 Senior Citizens Assessment in St Clair County, Co St Clair, IL?

The savings from the PTAX 340 Senior Citizens Assessment in St Clair County, Co St Clair, IL, can vary based on individual property value and local tax rates. Generally, the assessment lowers the taxable value of property, which can signNowly reduce annual property taxes. For exact savings, it’s wise to consult your local tax authority or use a property tax calculator.

-

Can I use airSlate SignNow to manage my PTAX 340 Senior Citizens Assessment documents?

Yes, airSlate SignNow is an excellent tool for managing your PTAX 340 Senior Citizens Assessment documents. Our platform allows you to easily send, eSign, and store documents related to your assessment securely and efficiently. Utilizing SignNow’s features can streamline your application process and keep your files organized.

-

What features does airSlate SignNow offer for seniors applying for the PTAX 340 assessment?

airSlate SignNow offers a user-friendly interface, electronic signatures, and efficient document management features that cater specifically to seniors applying for the PTAX 340 Senior Citizens Assessment. You can easily track your documents and receive notifications, ensuring you never miss important deadlines. This helps simplify the application process, making it accessible for seniors.

-

Is there a cost associated with using airSlate SignNow for PTAX 340 document processing?

airSlate SignNow provides a cost-effective solution for managing your PTAX 340 Senior Citizens Assessment documents. Our pricing plans are designed to fit various budgets, and you can start with a free trial to explore our features before committing. Consider SignNow as a budget-friendly option to streamline your document processes.

Get more for PTAX 340 Senior Citizens Assessment St Clair County Co St clair Il

Find out other PTAX 340 Senior Citizens Assessment St Clair County Co St clair Il

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF