Liste Der Rechnungen Zu 3 Tva Form

What is the Liste Der Rechnungen Zu 3 Tva

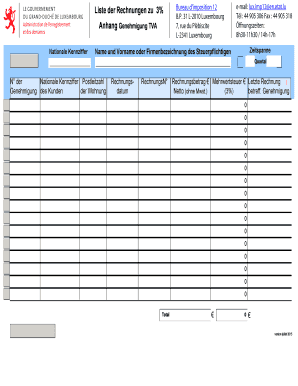

The Liste der Rechnungen zu 3 TVA is a specific document used in the context of value-added tax (VAT) compliance. It serves as a record of invoices that are subject to the three percent VAT rate. This form is crucial for businesses to accurately report their VAT obligations to tax authorities. By maintaining a comprehensive list of these invoices, companies can ensure they meet legal requirements and avoid penalties associated with non-compliance.

How to Use the Liste Der Rechnungen Zu 3 Tva

Using the Liste der Rechnungen zu 3 TVA involves accurately documenting all relevant invoices that fall under the three percent VAT category. Businesses should gather all invoices and input the necessary details, such as the invoice number, date, amount, and the VAT applied. This information is essential for tax reporting and helps in maintaining clear financial records. Regular updates to this list are recommended to ensure compliance and facilitate easier audits.

Steps to Complete the Liste Der Rechnungen Zu 3 Tva

Completing the Liste der Rechnungen zu 3 TVA requires careful attention to detail. Here are the steps to follow:

- Gather all invoices that apply to the three percent VAT rate.

- Record each invoice's number, date, and total amount.

- Calculate the VAT for each invoice based on the three percent rate.

- Ensure all entries are accurate and complete.

- Review the list for any discrepancies before submission.

Legal Use of the Liste Der Rechnungen Zu 3 Tva

The Liste der Rechnungen zu 3 TVA is legally binding when completed correctly. It must comply with local tax regulations, including proper documentation and record-keeping practices. Businesses are required to retain this list for a specified period, as it may be subject to review by tax authorities. Adhering to the legal requirements ensures that the document serves its purpose in tax compliance and can protect businesses from potential legal issues.

Key Elements of the Liste Der Rechnungen Zu 3 Tva

Several key elements must be included in the Liste der Rechnungen zu 3 TVA to ensure it is comprehensive and compliant:

- Invoice number: A unique identifier for each invoice.

- Date of issue: The date when the invoice was created.

- Invoice amount: The total amount billed, including VAT.

- VAT amount: The specific VAT charged at the three percent rate.

- Supplier information: Details about the entity issuing the invoice.

Examples of Using the Liste Der Rechnungen Zu 3 Tva

Examples of using the Liste der Rechnungen zu 3 TVA include scenarios where businesses need to track their VAT obligations. For instance, a small business providing services may issue multiple invoices to clients, each subject to the three percent VAT. By maintaining this list, the business can easily calculate its total VAT liability at the end of the reporting period. Another example is during an audit, where having this list readily available can streamline the process and demonstrate compliance with tax regulations.

Quick guide on how to complete liste der rechnungen zu 3 tva

Complete Liste Der Rechnungen Zu 3 Tva effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as it allows you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Liste Der Rechnungen Zu 3 Tva on any device with the airSlate SignNow apps for Android or iOS and enhance any document-centered operation today.

How to edit and eSign Liste Der Rechnungen Zu 3 Tva with ease

- Locate Liste Der Rechnungen Zu 3 Tva and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to missing or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Liste Der Rechnungen Zu 3 Tva and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the liste der rechnungen zu 3 tva

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'liste der rechnungen zu 3 tva' feature in airSlate SignNow?

The 'liste der rechnungen zu 3 tva' feature in airSlate SignNow allows users to effectively manage and track invoices with a 3% VAT rate. This feature ensures that you can easily categorize and access your documents, making financial tracking straightforward for your business. With this option, you can streamline your accounting processes and maintain better financial records.

-

How does airSlate SignNow assist with managing invoices?

airSlate SignNow offers a comprehensive solution that helps businesses organize and manage their invoices, including the 'liste der rechnungen zu 3 tva.' Users can upload, sign, and send invoices seamlessly, improving efficiency. The platform allows for easy tracking and visibility of all transactions, making your invoicing process smoother.

-

What pricing plans does airSlate SignNow offer for its services?

airSlate SignNow provides various pricing plans tailored to different business needs, which include access to advanced features like the 'liste der rechnungen zu 3 tva.' These plans range from basic to more comprehensive options, ensuring businesses of all sizes can find a suitable solution at an affordable price. Each plan offers distinct features to maximize your document management experience.

-

Can airSlate SignNow integrate with my existing accounting software?

Yes, airSlate SignNow can integrate with a range of accounting software to optimize your invoicing processes, including managing the 'liste der rechnungen zu 3 tva.' This integration allows for seamless data transfer and helps streamline your overall financial workflow, ensuring that your invoices and accounting records are always in sync.

-

What are the benefits of using airSlate SignNow for invoice management?

Using airSlate SignNow for invoice management, particularly for the 'liste der rechnungen zu 3 tva,' offers numerous benefits such as enhanced efficiency, reduced processing time, and improved accuracy. The platform’s user-friendly interface enables quick access to documents, making it easier for teams to collaborate and maintain financial compliance. These factors contribute to overall cost savings and better resource allocation.

-

Is it secure to use airSlate SignNow for my documents?

Absolutely, airSlate SignNow is designed with robust security protocols to protect your sensitive documents, including those related to the 'liste der rechnungen zu 3 tva.' The platform employs encryption and strict access controls, ensuring that your invoices and other important files remain confidential and safe from unauthorized access. You can trust airSlate SignNow for secure document management.

-

How can I get started with airSlate SignNow?

Getting started with airSlate SignNow is simple and involves signing up for a plan that suits your needs. Once registered, you can access all features, including managing your 'liste der rechnungen zu 3 tva.' The platform offers various resources and support to help you familiarize yourself with the tools available, ensuring a smooth onboarding process.

Get more for Liste Der Rechnungen Zu 3 Tva

- Interested provider information form magellan provideramp39s home

- Sub tuum praesidium low setting in g major form

- Law society property information form ta6 4th edition pdf download

- Lyft inspection form pdf

- Ccl200x climate change levy tax credit claim use this form to claim for payment of overpaid climate change levy hmrc gov

- Va form 29 357

- Dmv 34 tr form

- Client confidentiality agreement template form

Find out other Liste Der Rechnungen Zu 3 Tva

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself