Long Term Disability Claim Form Statement of Lincoln Financial

What is the Long Term Disability Claim Form Statement of Lincoln Financial

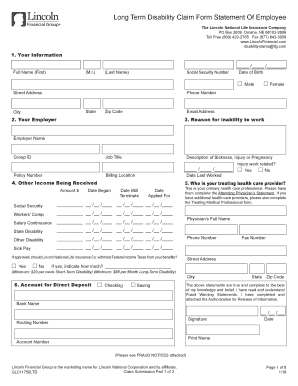

The Long Term Disability Claim Form Statement of Lincoln Financial is a crucial document that individuals use to apply for long-term disability benefits. This form collects essential information about the claimant's medical condition, employment history, and the impact of their disability on their ability to work. It is designed to help Lincoln Financial assess the validity of the claim and determine the appropriate benefits to be awarded. Understanding the purpose of this form is vital for ensuring that all necessary information is accurately provided, which can significantly affect the outcome of the claim.

Steps to Complete the Long Term Disability Claim Form Statement of Lincoln Financial

Completing the Long Term Disability Claim Form requires careful attention to detail. Here are the essential steps to follow:

- Gather necessary documentation, including medical records, employment history, and any previous disability claims.

- Fill out personal information, ensuring accuracy in your name, address, and contact details.

- Provide detailed information about your medical condition, including diagnosis, treatment history, and how it affects your daily life.

- Include information about your employer, job responsibilities, and the circumstances surrounding your disability.

- Review the form for completeness and accuracy before submitting it to avoid delays in processing.

How to Obtain the Long Term Disability Claim Form Statement of Lincoln Financial

To obtain the Long Term Disability Claim Form Statement of Lincoln Financial, you can visit the official Lincoln Financial website or contact their customer service directly. The form is typically available for download in a PDF format, allowing you to print it for completion. If you prefer, you can also request a physical copy to be mailed to you. Ensuring you have the most recent version of the form is important, as updates may occur that could affect the claims process.

Legal Use of the Long Term Disability Claim Form Statement of Lincoln Financial

The Long Term Disability Claim Form is legally binding once it is completed and submitted. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies may lead to legal repercussions or denial of benefits. The form must comply with applicable state and federal regulations regarding disability claims. Understanding the legal implications of submitting this form is crucial for claimants to protect their rights and ensure a fair assessment of their disability status.

Required Documents for the Long Term Disability Claim Form Statement of Lincoln Financial

When submitting the Long Term Disability Claim Form, several supporting documents are typically required to substantiate the claim. These documents may include:

- Medical records detailing your diagnosis and treatment.

- Employer statements or pay stubs to verify employment status.

- Any previous disability claims or decisions.

- Personal identification documents.

Having these documents ready can expedite the claims process and enhance the likelihood of a favorable outcome.

Eligibility Criteria for the Long Term Disability Claim Form Statement of Lincoln Financial

To qualify for benefits through the Long Term Disability Claim Form, claimants must meet specific eligibility criteria set by Lincoln Financial. Typically, these criteria include:

- Proof of a qualifying medical condition that prevents the individual from performing their job duties.

- Documentation of employment history and contributions to the disability insurance plan.

- Compliance with any waiting periods outlined in the insurance policy.

Understanding these criteria is essential for potential claimants to assess their eligibility before submitting the form.

Quick guide on how to complete long term disability claim form statement of lincoln financial

Effortlessly complete Long Term Disability Claim Form Statement Of Lincoln Financial on any device

Digital document management has gained signNow traction among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Long Term Disability Claim Form Statement Of Lincoln Financial on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The simplest way to edit and eSign Long Term Disability Claim Form Statement Of Lincoln Financial with ease

- Find Long Term Disability Claim Form Statement Of Lincoln Financial and click Get Form to begin.

- Use the provided tools to fill out your form.

- Highlight important sections of the documents or obscure sensitive details with the tools offered by airSlate SignNow specifically designed for that purpose.

- Create your signature using the Sign feature, which takes only a few seconds and carries the same legal validity as a traditional ink signature.

- Review all information and click on the Done button to save your updates.

- Choose how you want to send your form, either by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Long Term Disability Claim Form Statement Of Lincoln Financial and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the long term disability claim form statement of lincoln financial

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Lincoln Financial long term disability buyout?

A Lincoln Financial long term disability buyout is a financial settlement offered to individuals with long-term disability policies. This buyout allows policyholders to receive a lump sum payment, freeing them from future obligations and premium payments. The buyout may be advantageous for those looking for immediate funds or who no longer wish to maintain the policy.

-

How does the Lincoln Financial long term disability buyout process work?

The process for a Lincoln Financial long term disability buyout involves submitting a request to Lincoln Financial to evaluate your current disability policy status. The company will assess your policy's value based on various factors including the remaining benefits and your current situation. Once approved, you will receive a lump sum offer from Lincoln Financial.

-

What are the benefits of opting for a Lincoln Financial long term disability buyout?

Choosing a Lincoln Financial long term disability buyout provides immediate funds that can be utilized for various financial needs. It eliminates the need to continue paying premiums and managing a long-term policy. Additionally, a buyout can offer peace of mind by providing you with a financial cushion, alleviating ongoing uncertainty regarding future disability claims.

-

Are there any drawbacks to a Lincoln Financial long term disability buyout?

One potential drawback of a Lincoln Financial long term disability buyout is the loss of long-term coverage which might be beneficial in case of sustained health issues. Additionally, the lump sum received may be less than the total future payouts, meaning you could miss out on potentially larger future benefits. It's essential to carefully consider your personal situation before making this decision.

-

How can I determine if a Lincoln Financial long term disability buyout is right for me?

Determining if a Lincoln Financial long term disability buyout is suitable involves assessing your current financial needs and future expectations. Consulting with a financial advisor is advisable to analyze the implications of foregoing your policy. Factors like your health, financial obligations, and reliance on disability income should all be considered.

-

What is the typical timeline for a Lincoln Financial long term disability buyout?

The timeline for a Lincoln Financial long term disability buyout can vary, but generally, the process takes a few weeks once your request is submitted. After evaluation, it may take additional time to receive and review the buyout offer. Speeding up the process often depends on how quickly all necessary documentation is provided.

-

Can I reinstate my policy after a Lincoln Financial long term disability buyout?

Once a Lincoln Financial long term disability buyout is completed, the original policy cannot typically be reinstated. This means you'll lose access to the benefits associated with that policy. It's crucial to thoroughly assess your long-term financial plans before accepting a buyout.

Get more for Long Term Disability Claim Form Statement Of Lincoln Financial

Find out other Long Term Disability Claim Form Statement Of Lincoln Financial

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe