Rut 7 Form

What is the Rut 7

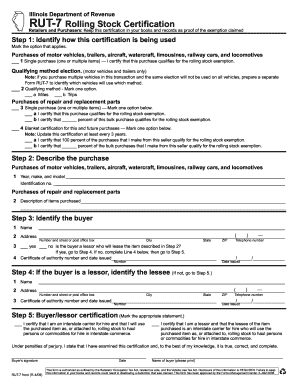

The Rut 7 form is a tax document used in Illinois, specifically for vehicle tax reporting. This form is essential for individuals and businesses that own vehicles subject to the state’s vehicle use tax. The Rut 7 form provides the necessary information to calculate the tax owed based on the vehicle's purchase price and other relevant factors. Understanding the Rut 7 is crucial for compliance with state tax laws and avoiding potential penalties.

Steps to complete the Rut 7

Completing the Rut 7 form involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant information about the vehicle, including the purchase price, vehicle identification number (VIN), and the date of purchase. Next, fill out the form by entering the required details in the designated fields. It is important to double-check all entries for accuracy. After completing the form, sign and date it to validate your submission. Finally, submit the Rut 7 form according to the specified submission methods, whether online or via mail.

Legal use of the Rut 7

The Rut 7 form must be used in accordance with Illinois state tax regulations. Legally, the information provided on this form must be accurate and complete to avoid issues with tax compliance. The form serves as a declaration of the vehicle's use tax liability, and any discrepancies may lead to penalties. Utilizing a reliable electronic signature platform, like signNow, can enhance the legal standing of your submission by ensuring that all signatures are verified and compliant with eSignature laws.

How to obtain the Rut 7

Obtaining the Rut 7 form is straightforward. The form can be accessed online through the Illinois Department of Revenue website or other official state resources. Additionally, physical copies may be available at local tax offices or government buildings. It is essential to ensure that you are using the most current version of the Rut 7 form, as updates may occur periodically.

Filing Deadlines / Important Dates

Filing deadlines for the Rut 7 form are crucial for compliance. Generally, the form must be submitted within a specific timeframe following the vehicle purchase. It is advisable to check the Illinois Department of Revenue's official guidelines for the exact deadlines to avoid late fees or penalties. Marking these dates on your calendar can help ensure timely submission.

Required Documents

When completing the Rut 7 form, certain documents are typically required to support your submission. These may include proof of vehicle purchase, such as a bill of sale or purchase agreement, as well as any previous tax documents related to the vehicle. Having these documents ready can facilitate a smoother completion process and ensure compliance with state requirements.

Quick guide on how to complete rut 7

Effortlessly Prepare Rut 7 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Rut 7 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign Rut 7 with Ease

- Locate Rut 7 and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Rut 7 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rut 7

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rut7 and how can it help my business?

Rut7 is a powerful tool within airSlate SignNow that streamlines the process of sending and eSigning documents. It allows businesses to enhance their workflow efficiency by securely managing and automating document transactions. With rut7, you can ensure faster approvals and reduce the turnaround time signNowly.

-

What are the pricing options for using rut7?

AirSlate SignNow offers several pricing tiers that include access to rut7, catering to different business needs. Depending on your organization’s size and requirements, you can choose a plan that provides the features of rut7 at a cost-effective rate. It's essential to evaluate the pricing structure to find the best fit for your budget.

-

What features does rut7 offer that stand out from competitors?

Rut7 offers unique features such as custom workflows, real-time tracking, and advanced security measures for document handling. These features make airSlate SignNow a reliable choice for businesses looking to manage their documents digitally. Additionally, rut7 simplifies collaboration by enabling multiple users to eSign simultaneously.

-

Can rut7 integrate with other software applications?

Yes, rut7 integrates seamlessly with various popular software applications, such as CRM systems, cloud storage solutions, and project management tools. This capability allows businesses to create a more cohesive workflow by connecting all their necessary tools. With these integrations, rut7 enhances productivity and streamlines document management.

-

How can rut7 benefit remote teams?

Rut7 supports remote teams by facilitating easy document signing and collaboration from any location. It enables team members to eSign documents digitally without the need for physical presence. This feature is essential for businesses with remote employees, ensuring efficient document handling and process management.

-

Is rut7 secure and compliant with regulations?

Absolutely! Rut7 prioritizes security by implementing advanced encryption and compliance with industry-standard regulations such as GDPR and eIDAS. These measures ensure that your documents are protected during the signing process while maintaining legal validity. You can trust rut7 for secure digital transactions.

-

How does rut7 improve document turnaround time?

Rut7 signNowly improves document turnaround time by automating various steps in the signing process. With features like bulk sending and automated reminders, you can ensure that documents are processed swiftly. This efficiency leads to faster approvals, allowing your business operations to run smoothly.

Get more for Rut 7

Find out other Rut 7

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer