Affidavit of Exemption from City of Colorado Springs Sales Tax Form

What is the Affidavit Of Exemption From City Of Colorado Springs Sales Tax

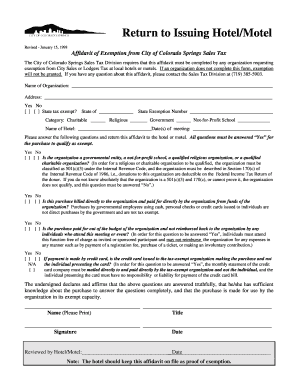

The Affidavit of Exemption From City of Colorado Springs Sales Tax is a legal document that allows eligible entities to claim an exemption from sales tax imposed by the city. This form is typically used by organizations or individuals who qualify under specific criteria defined by local tax regulations. The affidavit serves as a formal declaration, confirming that the signer meets the requirements for exemption, thus ensuring compliance with city tax laws.

How to use the Affidavit Of Exemption From City Of Colorado Springs Sales Tax

Steps to complete the Affidavit Of Exemption From City Of Colorado Springs Sales Tax

Completing the Affidavit of Exemption From City of Colorado Springs Sales Tax involves several key steps:

- Obtain the affidavit form from the City of Colorado Springs website or designated office.

- Fill out the form with accurate information, including your name, address, and the reason for the exemption.

- Sign and date the affidavit to validate your claim.

- Submit the completed form to the appropriate city department, either online or in person.

Key elements of the Affidavit Of Exemption From City Of Colorado Springs Sales Tax

The key elements of the Affidavit of Exemption From City of Colorado Springs Sales Tax include:

- Entity Information: Name and address of the individual or organization claiming the exemption.

- Exemption Reason: A clear statement outlining the basis for the exemption.

- Signature: The authorized representative must sign the affidavit to confirm its validity.

- Date: The date when the affidavit is completed and signed.

Eligibility Criteria

To qualify for the Affidavit of Exemption From City of Colorado Springs Sales Tax, entities must meet specific eligibility criteria set forth by local regulations. Generally, exemptions are available for non-profit organizations, government entities, and other specific categories defined by the city. It is essential to review these criteria to ensure compliance and avoid potential issues during the exemption process.

Form Submission Methods

The Affidavit of Exemption From City of Colorado Springs Sales Tax can be submitted through various methods, including:

- Online Submission: Many municipalities offer an online portal for submitting forms electronically.

- Mail: Completed affidavits can be mailed to the designated city department.

- In-Person: Individuals may also deliver the form directly to the city office for processing.

Quick guide on how to complete affidavit of exemption from city of colorado springs sales tax

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained popularity among companies and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can obtain the necessary forms and securely keep them online. airSlate SignNow equips you with all the resources required to create, alter, and eSign your files rapidly without delays. Handle [SKS] on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The Easiest Way to Alter and eSign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searching, or mistakes requiring new document prints. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Alter and eSign [SKS] and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Affidavit Of Exemption From City Of Colorado Springs Sales Tax

Create this form in 5 minutes!

How to create an eSignature for the affidavit of exemption from city of colorado springs sales tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Affidavit Of Exemption From City Of Colorado Springs Sales Tax?

An Affidavit Of Exemption From City Of Colorado Springs Sales Tax is a legal document used by businesses to claim exemption from sales tax on certain purchases. This affidavit helps ensure compliance with local taxation laws while allowing businesses to save on costs associated with sales tax. By using this affidavit, organizations can streamline their tax processes and avoid unnecessary expenses.

-

Why should I use airSlate SignNow for my Affidavit Of Exemption From City Of Colorado Springs Sales Tax?

airSlate SignNow provides a user-friendly platform to easily create, send, and eSign your Affidavit Of Exemption From City Of Colorado Springs Sales Tax. The service simplifies the documentation process, ensuring that your affidavit is both secure and legally binding. With airSlate SignNow, you can manage your documents efficiently, saving time and reducing errors.

-

What features does airSlate SignNow offer for managing the Affidavit Of Exemption From City Of Colorado Springs Sales Tax?

airSlate SignNow offers a variety of features specifically tailored for managing the Affidavit Of Exemption From City Of Colorado Springs Sales Tax, including templates, customizable fields, and automated reminders. Users can track the status of their documents in real-time, ensuring timely completion. Additionally, integration with other software enhances workflow efficiency.

-

Is airSlate SignNow affordable for small businesses needing an Affidavit Of Exemption From City Of Colorado Springs Sales Tax?

Yes, airSlate SignNow offers flexible pricing plans that cater to small businesses looking to manage their Affidavit Of Exemption From City Of Colorado Springs Sales Tax economically. The cost-effective solution allows users to utilize powerful eSignature features without a hefty financial commitment. By choosing airSlate SignNow, small businesses can optimize their documentation processes while staying within budget.

-

How secure is my Affidavit Of Exemption From City Of Colorado Springs Sales Tax with airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including the Affidavit Of Exemption From City Of Colorado Springs Sales Tax. The platform employs advanced encryption technologies to safeguard your data and ensure confidentiality. With airSlate SignNow, users can trust that their documents are handled securely throughout the signing process.

-

Can I integrate airSlate SignNow with other applications for my Affidavit Of Exemption From City Of Colorado Springs Sales Tax?

Absolutely! airSlate SignNow offers seamless integrations with a variety of applications, enabling users to manage their Affidavit Of Exemption From City Of Colorado Springs Sales Tax more effectively. Integration with popular software services can streamline workflows and enhance productivity. This compatibility makes it easier to incorporate eSignatures into existing business processes.

-

How do I get started with airSlate SignNow for my Affidavit Of Exemption From City Of Colorado Springs Sales Tax?

Getting started with airSlate SignNow is simple! Sign up for an account, choose the appropriate pricing plan, and you can begin creating and managing your Affidavit Of Exemption From City Of Colorado Springs Sales Tax right away. The user-friendly interface and helpful resources make the onboarding process quick and easy.

Get more for Affidavit Of Exemption From City Of Colorado Springs Sales Tax

- Payroll reimbursement journal voucher approved by form

- Decommissioning checklist template excel 207817387 form

- Rental montana agreement template form

- Rental month to month agreement template form

- Rental one page agreement template form

- Rental netherlands agreement template form

- Rental payment agreement template form

- Rental payment plan agreement template form

Find out other Affidavit Of Exemption From City Of Colorado Springs Sales Tax

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word