Irs Form 8283

What is the IRS Form 8283

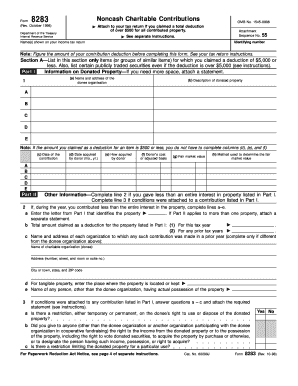

The IRS Form 8283 is a tax form used by individuals and businesses to report noncash charitable contributions. This form is essential for taxpayers who donate property, such as clothing, vehicles, or real estate, valued at more than five hundred dollars. It provides the IRS with detailed information about the donated items, including descriptions, fair market values, and the intended charitable organization. Proper completion of this form is crucial for claiming a tax deduction for these contributions.

Steps to complete the IRS Form 8283

Completing the IRS Form 8283 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the noncash contributions, including appraisals if required. Next, fill out the form by providing details such as the donor's information, a description of the donated property, and the date of the contribution. If the total value exceeds five thousand dollars, an independent appraisal is necessary, and Form 8283 must be signed by the appraiser. Finally, ensure that the form is signed and dated before submission, along with the tax return.

Legal use of the IRS Form 8283

The legal use of the IRS Form 8283 is governed by IRS regulations that dictate how noncash charitable contributions should be reported. To be legally valid, the form must be accurately completed and submitted alongside the taxpayer's annual return. Additionally, the donor must retain copies of all supporting documentation, including receipts from the charitable organization and any appraisals. Failure to comply with these regulations may result in penalties or disallowance of the claimed deductions.

Key elements of the IRS Form 8283

Key elements of the IRS Form 8283 include sections for donor information, descriptions of the donated property, and the fair market value of each item. The form also includes a section for the charitable organization’s details and a signature line for the appraiser if the total value of the donation exceeds five thousand dollars. Each of these elements is crucial for ensuring that the form meets IRS requirements and that the taxpayer can substantiate their deductions.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 8283 align with the annual tax return deadlines. Typically, the form must be submitted by April fifteenth of the year following the tax year in which the donation was made. If a taxpayer files for an extension, the deadline for submitting Form 8283 also extends accordingly. It is important for taxpayers to be aware of these dates to avoid late filing penalties and ensure that their charitable contributions are properly documented.

Examples of using the IRS Form 8283

Examples of using the IRS Form 8283 include situations where an individual donates a vehicle valued at three thousand dollars to a nonprofit organization or a business donates office furniture valued at seven thousand dollars. In both cases, the donors must complete the form to report these noncash contributions accurately. These examples illustrate the importance of the form in capturing the details of charitable donations and ensuring that taxpayers can claim the appropriate deductions on their tax returns.

How to obtain the IRS Form 8283

The IRS Form 8283 can be obtained directly from the IRS website or through tax preparation software that includes IRS forms. Additionally, taxpayers can request a physical copy by contacting the IRS or visiting a local IRS office. It is advisable to ensure that the most current version of the form is used, as tax forms may be updated annually to reflect changes in tax law.

Quick guide on how to complete irs form 8283

Effortlessly Complete Irs Form 8283 on Any Device

Digital document management has gained traction among companies and individuals. It offers an optimal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your paperwork quickly without delays. Manage Irs Form 8283 on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

Streamlined Modifications and eSigning of Irs Form 8283 with Ease

- Obtain Irs Form 8283 and then click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Highlight key sections of the documents or redact sensitive data with tools provided specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to finalize your changes.

- Choose your preferred delivery method for your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Irs Form 8283 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 8283

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2019 IRS Form 8283?

The 2019 IRS Form 8283 is a tax form used to report noncash charitable contributions. This form is essential for taxpayers who donate items like clothes, vehicles, or artwork, as it provides the IRS with crucial information about the donations. Accurately filling out the 2019 IRS Form 8283 can help ensure compliance and potentially maximize your tax deductions.

-

Why do I need to complete the 2019 IRS Form 8283?

Completing the 2019 IRS Form 8283 is important for taxpayers who wish to receive tax deductions for their noncash charitable contributions. This form helps to validate the value of donated items and ensures that the IRS has the details needed for tax compliance. Failure to complete the 2019 IRS Form 8283 may result in disallowed deductions and penalties.

-

How can airSlate SignNow simplify the process of filling out the 2019 IRS Form 8283?

airSlate SignNow offers an intuitive platform that allows users to easily input and eSign the 2019 IRS Form 8283. With our electronic signature capabilities, you can ensure that your forms are completed quickly and securely, without the hassle of printing and faxing. Simplifying this process helps you focus more on your charitable contributions rather than paperwork.

-

Is there a cost associated with using airSlate SignNow for the 2019 IRS Form 8283?

airSlate SignNow provides a cost-effective solution for managing your document signing needs, including the 2019 IRS Form 8283. Various pricing plans are available that cater to different business sizes and needs, ensuring that you can find a solution that fits your budget. Explore our plans to see how affordable eSigning can be for your needs.

-

Can I integrate airSlate SignNow with other software solutions when working on the 2019 IRS Form 8283?

Yes, airSlate SignNow seamlessly integrates with popular software solutions, allowing you to manage your documentation effortlessly while working on the 2019 IRS Form 8283. Whether you use CRM platforms or document management systems, our integrations enhance your workflow. This interoperability saves you time and increases operational efficiency.

-

What features does airSlate SignNow offer to help with the 2019 IRS Form 8283?

airSlate SignNow includes features that streamline the completion and signing of the 2019 IRS Form 8283, such as templates, auto-fill options, and secure electronic signatures. These tools allow for accuracy and expedite the submission process. With user-friendly features, you'll find it easier than ever to handle important tax documentation.

-

How secure is airSlate SignNow when submitting the 2019 IRS Form 8283?

The security of your data is a top priority at airSlate SignNow. We utilize advanced encryption and compliance protocols to protect sensitive information while completing the 2019 IRS Form 8283 and other documents. Rest assured that your data is secure with our robust security measures.

Get more for Irs Form 8283

Find out other Irs Form 8283

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form