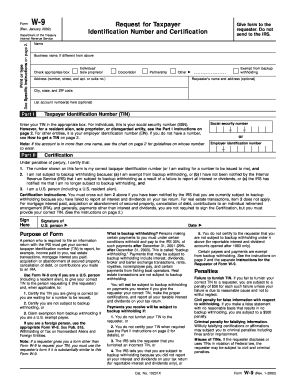

Form W 9

What is the Form W-9

The Form W-9 is a tax form used in the United States by individuals and businesses to provide their taxpayer identification information to entities that are required to report certain payments to the Internal Revenue Service (IRS). This form is essential for freelancers, contractors, and other self-employed individuals who receive income but are not classified as employees. By completing the W-9, taxpayers certify their name, business name (if applicable), address, and taxpayer identification number (TIN), which can be either a Social Security number (SSN) or an Employer Identification Number (EIN).

Steps to Complete the Form W-9

Completing the Form W-9 involves several straightforward steps. First, download the form from the IRS website or obtain it from the requesting entity. Next, fill in your name as it appears on your tax return. If you have a business name, include it in the designated field. Then, provide your address, ensuring it matches the address on your tax documents. In the following section, enter your taxpayer identification number, which is crucial for accurate reporting. Finally, sign and date the form to certify that the information provided is correct. It is important to review the completed form for accuracy before submission.

How to Obtain the Form W-9

The Form W-9 can be easily obtained through various channels. The most reliable source is the official IRS website, where you can download the form in PDF format. Alternatively, many businesses and organizations may provide their own copies of the form for convenience. Ensure that you are using the most current version of the form, as the IRS occasionally updates its forms and instructions. If you need assistance, tax professionals can also provide guidance on obtaining and completing the W-9.

Legal Use of the Form W-9

The legal use of the Form W-9 is primarily to ensure compliance with IRS regulations regarding tax reporting. When a business pays an independent contractor or freelancer, it must report these payments to the IRS using Form 1099. The W-9 provides the necessary information for accurate reporting. It is important to note that providing false information on the W-9 can lead to penalties and legal repercussions. Therefore, individuals should ensure that all information is accurate and up to date when submitting the form.

Key Elements of the Form W-9

The Form W-9 contains several key elements that are essential for its proper completion. These include:

- Name: The legal name of the individual or business.

- Business Name: If applicable, the name under which the business operates.

- Address: The current mailing address.

- Taxpayer Identification Number (TIN): This can be either an SSN or an EIN.

- Certification: A signature and date to confirm the accuracy of the information provided.

Examples of Using the Form W-9

There are various scenarios in which the Form W-9 is used. For instance, a freelance graphic designer may be asked to complete a W-9 by a client who intends to pay them for services rendered. Similarly, a landlord may request a W-9 from a tenant who is receiving rental assistance payments. These examples illustrate the form's role in facilitating accurate tax reporting for both the payer and payee, ensuring compliance with IRS regulations.

Quick guide on how to complete form w 9

Streamline Form W 9 effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to draft, modify, and electronically sign your documents rapidly without delays. Manage Form W 9 on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and electronically sign Form W 9 effortlessly

- Acquire Form W 9 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes requiring the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign Form W 9 and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 9

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Form W 9 and how is it used?

A Form W 9 is a tax form used in the United States by individuals and entities to provide their taxpayer identification number (TIN) to businesses for income reporting. It helps companies accurately report payments made to contractors and freelancers. Understanding and correctly filling out a Form W 9 is essential for compliance and tax reporting.

-

How does airSlate SignNow assist with Form W 9?

airSlate SignNow simplifies the process of requesting and managing Form W 9 from contractors and clients. With our eSignature features, you can quickly send, sign, and store Form W 9 documents securely. This streamlines the workflow and ensures you have reliable, compliant documentation on hand.

-

Is airSlate SignNow suitable for small businesses needing Form W 9 processing?

Absolutely! airSlate SignNow offers a cost-effective and user-friendly solution ideal for small businesses handling Form W 9 requests. Our platform enhances efficiency by reducing paperwork and enabling quick electronic signatures without compromising on security.

-

What are the key features of airSlate SignNow related to Form W 9?

Key features of airSlate SignNow include customizable templates for Form W 9, easy sharing options, real-time tracking of document status, and secure cloud storage. These features help ensure that businesses can manage Form W 9 efficiently while maintaining compliance with IRS regulations.

-

Can I integrate airSlate SignNow with my existing software for Form W 9 management?

Yes, airSlate SignNow easily integrates with various software solutions, such as CRM and accounting platforms, to streamline Form W 9 management. This integration allows you to automate the collection and storing of Form W 9 data, saving you time and reducing errors in your workflow.

-

What is the pricing structure for using airSlate SignNow for Form W 9 documents?

airSlate SignNow offers flexible pricing plans tailored to different business needs, including options for handling Form W 9 efficiently. You can choose a plan that suits your volume of document management without overpaying. Visit our website for detailed pricing information.

-

How secure is the data when using airSlate SignNow for Form W 9?

When using airSlate SignNow, your data security is our top priority. We implement advanced encryption methods and adhere to compliance standards to protect sensitive information in Form W 9. You can trust that your documents are safe and confidential.

Get more for Form W 9

Find out other Form W 9

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later