MONTHLY REPORT of RESTAURANT TAX SHELBYKY TOURISM &amp Form

What is the Monthly Report of Restaurant Tax ShelbyKY Tourism?

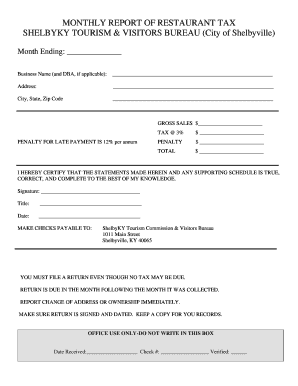

The Monthly Report of Restaurant Tax ShelbyKY Tourism is a specific document required for restaurants operating in Shelby County, Kentucky. This report is essential for tracking the sales tax collected from customers and ensuring compliance with local tax regulations. It typically includes details such as total sales, tax collected, and any applicable deductions or exemptions. Accurate completion of this report is crucial for maintaining good standing with local tax authorities.

Steps to Complete the Monthly Report of Restaurant Tax ShelbyKY Tourism

Completing the Monthly Report of Restaurant Tax ShelbyKY Tourism involves several key steps:

- Gather Sales Data: Collect all sales records for the month, including receipts and invoices.

- Calculate Total Sales: Sum the total sales amounts, ensuring to include all taxable sales.

- Determine Tax Collected: Calculate the total amount of sales tax collected based on the applicable tax rate.

- Complete the Report: Fill out the report form with the gathered data, ensuring accuracy.

- Submit the Report: File the report by the designated deadline, either online or via mail.

Legal Use of the Monthly Report of Restaurant Tax ShelbyKY Tourism

The Monthly Report of Restaurant Tax ShelbyKY Tourism serves a legal purpose in documenting sales tax collections. For the report to be legally binding, it must be completed accurately and submitted on time. Compliance with local tax laws is essential to avoid penalties. Utilizing a reliable electronic signature tool can help ensure the report is signed and submitted securely, meeting legal requirements.

Filing Deadlines / Important Dates

Timely submission of the Monthly Report of Restaurant Tax ShelbyKY Tourism is critical. Typically, the report is due by the 15th of the month following the reporting period. For example, the report for January sales is due by February 15. Missing deadlines can result in penalties and interest charges, so it is important to stay informed about filing dates.

Form Submission Methods

The Monthly Report of Restaurant Tax ShelbyKY Tourism can be submitted through various methods:

- Online Submission: Many jurisdictions offer an online portal for easy submission.

- Mail: The completed report can be sent via postal service to the appropriate tax authority.

- In-Person: Businesses may also have the option to submit the report in person at designated tax offices.

Key Elements of the Monthly Report of Restaurant Tax ShelbyKY Tourism

When completing the Monthly Report of Restaurant Tax ShelbyKY Tourism, it is important to include the following key elements:

- Business Information: Name, address, and tax identification number of the restaurant.

- Total Sales: The gross sales amount for the reporting period.

- Tax Collected: The total sales tax collected from customers.

- Deductions: Any applicable deductions or exemptions that reduce taxable sales.

- Signature: An authorized signature certifying the accuracy of the report.

Quick guide on how to complete monthly report of restaurant tax shelbyky tourism ampamp

Accomplish MONTHLY REPORT OF RESTAURANT TAX SHELBYKY TOURISM & effortlessly on any device

Digital document management has become widely embraced by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your files swiftly without delays. Manage MONTHLY REPORT OF RESTAURANT TAX SHELBYKY TOURISM & across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

Steps to edit and eSign MONTHLY REPORT OF RESTAURANT TAX SHELBYKY TOURISM & with ease

- Locate MONTHLY REPORT OF RESTAURANT TAX SHELBYKY TOURISM & and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign MONTHLY REPORT OF RESTAURANT TAX SHELBYKY TOURISM & and ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the monthly report of restaurant tax shelbyky tourism ampamp

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MONTHLY REPORT OF RESTAURANT TAX SHELBYKY TOURISM &?

The MONTHLY REPORT OF RESTAURANT TAX SHELBYKY TOURISM & is a document that summarizes the tax obligations of restaurants in Shelby, Kentucky related to tourism. It assists restaurant owners in understanding their tax contributions to local tourism initiatives. Keeping this report updated ensures compliance with state regulations and supports the local economy.

-

How can airSlate SignNow help with the MONTHLY REPORT OF RESTAURANT TAX SHELBYKY TOURISM &?

airSlate SignNow simplifies the process of creating and managing the MONTHLY REPORT OF RESTAURANT TAX SHELBYKY TOURISM &. Our easy-to-use platform allows you to eSign documents securely and keep a digital record for your financial records. This streamlining can save you time and reduce the risk of errors in your reporting.

-

What features does airSlate SignNow offer for tax reporting?

airSlate SignNow includes features like eSignature capabilities, document templates, and automated workflows specifically designed for financial reporting, including the MONTHLY REPORT OF RESTAURANT TAX SHELBYKY TOURISM &. These features ensure that your documents are professional and compliant.

-

Is there a cost associated with using airSlate SignNow for tax reports?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. The pricing is competitive and provides access to all the essential features required for preparing documents like the MONTHLY REPORT OF RESTAURANT TAX SHELBYKY TOURISM &. You can choose a plan based on your usage and business size.

-

How secure is my data when using airSlate SignNow?

Data security is our top priority at airSlate SignNow. Our platform employs advanced encryption techniques to protect all information, including the MONTHLY REPORT OF RESTAURANT TAX SHELBYKY TOURISM &. You can trust that your sensitive data is safe while using our services.

-

Can airSlate SignNow integrate with my existing accounting software?

Absolutely! airSlate SignNow seamlessly integrates with many popular accounting software solutions. This feature allows you to easily generate and manage the MONTHLY REPORT OF RESTAURANT TAX SHELBYKY TOURISM & directly within your existing workflow, enhancing convenience and efficiency.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation like the MONTHLY REPORT OF RESTAURANT TAX SHELBYKY TOURISM & provides numerous benefits, including time savings, improved accuracy, and easy access to documents anytime, anywhere. Our platform enhances collaboration among team members, making tax reporting a hassle-free process.

Get more for MONTHLY REPORT OF RESTAURANT TAX SHELBYKY TOURISM &amp

- Louisianas small succession affidavitlegacy estate ampamp elder law of form

- Month to month lease form

- Type names of children to receive homestead form

- This article is for you to leave all the rest and remainder of your property except form

- Free utah revocable living trust form pdfwordeformsfree

- Fernandina beach news leader uf digital collections university form

- Your homestead and any special items you listed in article three form

- Type the names of your children amp dates of birth form

Find out other MONTHLY REPORT OF RESTAURANT TAX SHELBYKY TOURISM &amp

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document