Vat 29 Form

What is the Vat 29 Form

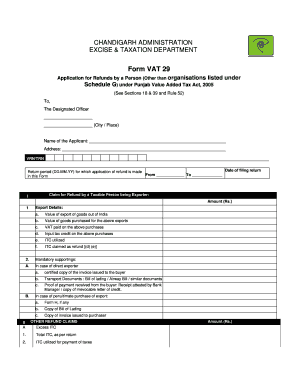

The Vat 29 form is a tax-related document used primarily in the United States. It serves as a request for a refund of excess value-added tax (VAT) paid on purchases made by businesses. This form is essential for businesses that seek to recover VAT they have overpaid, ensuring they maintain accurate financial records and comply with tax regulations. Understanding the purpose and function of the Vat 29 form is crucial for businesses aiming to optimize their tax processes.

How to use the Vat 29 Form

Using the Vat 29 form involves a systematic approach to ensure accurate completion and submission. First, gather all necessary documentation that supports your claim for a VAT refund. This may include invoices, receipts, and proof of payment. Next, fill out the Vat 29 form with precise information regarding your business and the VAT amounts being claimed. Once completed, review the form for accuracy before submitting it to the appropriate tax authority. This careful process helps prevent delays and ensures compliance with tax regulations.

Steps to complete the Vat 29 Form

Completing the Vat 29 form requires attention to detail. Follow these steps for effective completion:

- Gather supporting documents, including invoices and payment proofs.

- Provide accurate business information, including your tax identification number.

- Detail the VAT amounts you are claiming for refund.

- Double-check all entries for accuracy and completeness.

- Submit the form to the relevant tax authority, either online or by mail.

By adhering to these steps, businesses can enhance their chances of a successful VAT refund claim.

Legal use of the Vat 29 Form

The legal use of the Vat 29 form is governed by specific tax laws and regulations. To be considered valid, the form must be completed accurately and submitted within the designated timeframes set by tax authorities. Additionally, businesses must ensure that all claims for VAT refunds are substantiated with proper documentation. Failure to comply with these legal requirements may result in delays or rejection of the refund request, underscoring the importance of understanding the legal framework surrounding the Vat 29 form.

Required Documents

When filing the Vat 29 form, certain documents are required to support your claim. These typically include:

- Invoices showing VAT charged on purchases.

- Receipts confirming payment for the goods or services.

- Any relevant correspondence with tax authorities.

Having these documents ready not only facilitates the completion of the form but also strengthens your case for a refund.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial when submitting the Vat 29 form. Each tax year may have specific deadlines for submitting refund claims, and these can vary based on the jurisdiction. Typically, businesses should check the latest guidelines from the relevant tax authority to ensure timely submission. Missing these deadlines could result in the forfeiture of potential refunds, making it essential to stay informed about important dates.

Quick guide on how to complete vat 29 form

Prepare Vat 29 Form effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without delays. Work with Vat 29 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-based process today.

The easiest way to modify and eSign Vat 29 Form without hassle

- Locate Vat 29 Form and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to preserve your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the concern of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Modify and eSign Vat 29 Form and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat 29 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is vat29 and how does airSlate SignNow facilitate its use?

VAT29 refers to the VAT declaration form in some jurisdictions. With airSlate SignNow, businesses can easily eSign and send their VAT29 forms securely online, streamlining their compliance processes while ensuring that important documents are handled efficiently.

-

What are the pricing options for airSlate SignNow when managing VAT29 forms?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you're a small startup or a large corporation, you can choose a plan that fits your budget while effectively managing your VAT29 and other document workflows.

-

What features does airSlate SignNow offer for completing VAT29 forms?

airSlate SignNow provides an array of features designed to simplify the completion of VAT29 forms. Users can utilize customizable templates, automated workflows, and secure electronic signatures, making the process fast and reliable.

-

How does eSigning for VAT29 forms benefit businesses using airSlate SignNow?

ESigning VAT29 forms with airSlate SignNow enhances efficiency by eliminating the need for paper-based documents. This not only saves time but also reduces costs and ensures that all signed documents are stored securely and can be accessed anytime.

-

Can airSlate SignNow integrate with other tools for managing VAT29?

Yes, airSlate SignNow offers integration capabilities with various third-party applications, allowing for seamless management of VAT29 forms alongside your preferred tools. This integration enhances productivity by providing a comprehensive solution for document handling.

-

Is airSlate SignNow suitable for businesses of all sizes when handling VAT29 forms?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, from freelancers to large enterprises. Its user-friendly interface and scalable features make it an ideal choice for anyone looking to manage their VAT29 forms efficiently.

-

What security measures does airSlate SignNow implement for VAT29 forms?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards to protect your VAT29 forms. This ensures that all sensitive information remains confidential and secure during the signing process.

Get more for Vat 29 Form

- Email add to send creditcard application to bank of commerce form

- Affidavit of parentage 66411086 form

- Foresters life insurance surrender form

- Form p tem a see rule 73i vi application for jharkhand gov

- Career history form

- Sample codicil form

- Employe separation agreement template form

- Emission reduction purchase agreement template form

Find out other Vat 29 Form

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online