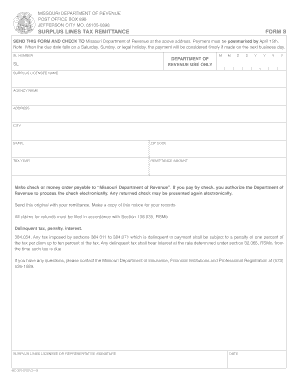

Surplus Lines Tax Remittance Missouri Department of Insurance Insurance Mo Form

What is the Missouri Surplus Lines Tax Remittance?

The Missouri Surplus Lines Tax Remittance is a specific requirement for insurance companies that operate in the surplus lines market within the state. Surplus lines insurance refers to coverage that is not available from licensed insurers in Missouri. The tax remittance process ensures that these companies comply with state regulations and contribute to the state's revenue. This tax is typically calculated based on the premiums collected from policyholders and must be remitted to the Missouri Department of Insurance.

Steps to Complete the Missouri Surplus Lines Tax Remittance

Completing the Missouri Surplus Lines Tax Remittance involves several important steps to ensure compliance with state regulations. The process typically includes:

- Gather necessary documentation, including premium records and previous tax filings.

- Calculate the total surplus lines premiums collected during the reporting period.

- Determine the applicable tax rate as specified by the Missouri Department of Insurance.

- Complete the required tax remittance form accurately, ensuring all figures are correct.

- Submit the completed form and payment to the appropriate state office, either online or via mail.

Legal Use of the Missouri Surplus Lines Tax Remittance

The legal framework surrounding the Missouri Surplus Lines Tax Remittance is governed by state laws that outline the obligations of surplus lines insurers. To ensure that the remittance is legally valid, it must adhere to the requirements set forth by the Missouri Department of Insurance. This includes proper documentation, timely submission, and compliance with all relevant tax regulations. Utilizing a reliable digital filing service can enhance the legality and efficiency of the remittance process.

Filing Deadlines and Important Dates

Timely filing of the Missouri Surplus Lines Tax Remittance is crucial to avoid penalties. The typical deadline for remittance is quarterly, with specific due dates established by the Missouri Department of Insurance. It is essential for insurers to keep track of these dates to ensure compliance. Missing a deadline may result in fines or additional scrutiny from regulatory authorities.

Required Documents for the Missouri Surplus Lines Tax Remittance

To successfully complete the Missouri Surplus Lines Tax Remittance, certain documents are required. These typically include:

- Records of premiums collected from surplus lines policies.

- Previous tax remittance forms, if applicable.

- Any correspondence from the Missouri Department of Insurance regarding tax obligations.

- Proof of payment for any previous tax remittances.

Penalties for Non-Compliance

Failure to comply with the Missouri Surplus Lines Tax Remittance requirements can lead to significant penalties. These may include financial fines, interest on unpaid taxes, and potential legal action. Insurers should be aware of the consequences of non-compliance and take proactive measures to ensure that all tax obligations are met promptly.

Quick guide on how to complete surplus lines tax remittance missouri department of insurance insurance mo

Complete Surplus Lines Tax Remittance Missouri Department Of Insurance Insurance Mo effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the correct format and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents quickly without delays. Handle Surplus Lines Tax Remittance Missouri Department Of Insurance Insurance Mo on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to edit and eSign Surplus Lines Tax Remittance Missouri Department Of Insurance Insurance Mo with ease

- Locate Surplus Lines Tax Remittance Missouri Department Of Insurance Insurance Mo and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you'd like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Surplus Lines Tax Remittance Missouri Department Of Insurance Insurance Mo and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the surplus lines tax remittance missouri department of insurance insurance mo

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Missouri surplus lines tax filing service offered by airSlate SignNow?

The Missouri surplus lines tax filing service by airSlate SignNow provides businesses with a streamlined solution to efficiently file surplus lines taxes. This service simplifies the filing process, ensures compliance with Missouri's regulations, and saves valuable time for businesses focused on other priorities.

-

How does airSlate SignNow ensure compliance with Missouri surplus lines tax regulations?

airSlate SignNow's Missouri surplus lines tax filing service is designed to stay updated with the latest tax regulations and requirements. We continuously monitor state guidelines, enabling our users to file accurately and avoid potential penalties due to non-compliance.

-

What are the pricing options for the Missouri surplus lines tax filing service?

Our pricing for the Missouri surplus lines tax filing service is competitive and designed to accommodate businesses of all sizes. We offer flexible subscription plans, ensuring you get the best value for your investment while leveraging our easy-to-use platform for tax filings.

-

Can I integrate the Missouri surplus lines tax filing service with other software?

Yes, airSlate SignNow supports seamless integrations with various accounting and ERP systems, allowing you to enhance the efficiency of your Missouri surplus lines tax filing service. These integrations simplify the data transfer process, reducing errors and saving you time.

-

What are the key features of the Missouri surplus lines tax filing service?

The Missouri surplus lines tax filing service offers features like automated tax calculations, secure document storage, and electronic filing capabilities. These features help ensure accuracy, enhance security, and streamline the overall tax filing process for your business.

-

How can the Missouri surplus lines tax filing service benefit my business?

By using airSlate SignNow's Missouri surplus lines tax filing service, your business can signNowly reduce the time and effort spent on tax filings. This service allows you to maintain compliance effortlessly, thus freeing up resources to focus on core activities and growth.

-

Is there customer support available for the Missouri surplus lines tax filing service?

Yes, our dedicated customer support team is available to assist users of the Missouri surplus lines tax filing service. Whether you have questions about the process or need technical assistance, our experts are here to provide timely support to ensure a smooth experience.

Get more for Surplus Lines Tax Remittance Missouri Department Of Insurance Insurance Mo

- Domestic relations initiation packet fulton county superior court form

- Additional vocabulary support answers form

- Beftb enrollment bformb alameda alliance for health alamedaalliance

- Usps form 4052

- Jv438 childs namecase numbertwelvemonth perman form

- Fashion design non disclosure agreement template form

- Fast advisor agreement template form

- Featured artist agreement template form

Find out other Surplus Lines Tax Remittance Missouri Department Of Insurance Insurance Mo

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile