Kenton County Annual Reconciliation Form

What is the Kenton County Annual Reconciliation

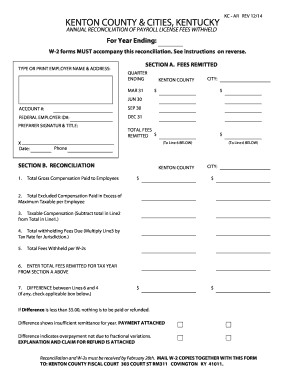

The Kenton County Annual Reconciliation is a financial document used by businesses and organizations in Kenton County to ensure that their financial records align with the county's requirements. This form is essential for maintaining accurate financial reporting and compliance with local regulations. It typically includes details about revenue, expenses, and other financial transactions that occurred over the year, providing a comprehensive overview of the entity's financial health.

How to use the Kenton County Annual Reconciliation

Using the Kenton County Annual Reconciliation involves several steps to ensure accuracy and compliance. First, gather all relevant financial records, including income statements and expense reports. Next, fill out the form with the required financial data, ensuring that all figures are accurate and reflect the true financial state of the organization. Once completed, review the form for any discrepancies before submission. This process helps maintain transparency and accountability in financial reporting.

Steps to complete the Kenton County Annual Reconciliation

Completing the Kenton County Annual Reconciliation requires careful attention to detail. Follow these steps for a smooth process:

- Collect all financial documents, including bank statements and invoices.

- Fill out the form with accurate figures, ensuring all income and expenses are accounted for.

- Double-check calculations to avoid errors.

- Obtain necessary signatures from authorized personnel.

- Submit the completed form by the designated deadline.

Legal use of the Kenton County Annual Reconciliation

The Kenton County Annual Reconciliation must be completed in accordance with local laws and regulations. It serves as a legal document that can be used in audits or financial reviews. Compliance with these legal standards ensures that the information provided is valid and can withstand scrutiny from regulatory bodies. Organizations should be aware of the specific requirements set forth by Kenton County to avoid potential penalties.

Key elements of the Kenton County Annual Reconciliation

Key elements of the Kenton County Annual Reconciliation include:

- Financial summary of revenues and expenses.

- Detailed breakdown of specific financial transactions.

- Signatures from authorized representatives.

- Compliance statements confirming adherence to local regulations.

Form Submission Methods

The Kenton County Annual Reconciliation can be submitted through various methods, including online submission, mailing a hard copy, or delivering it in person to the appropriate county office. Each method has its own set of requirements and deadlines, so it is essential to choose the one that best suits your organization’s needs.

Quick guide on how to complete kenton county annual reconciliation

Effortlessly Prepare Kenton County Annual Reconciliation on Any Device

Web-based document management has become increasingly popular among businesses and individuals. It offers a great eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and safely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Kenton County Annual Reconciliation on any platform using the airSlate SignNow apps available for Android and iOS, and streamline any document-related task today.

How to Edit and eSign Kenton County Annual Reconciliation with Ease

- Find Kenton County Annual Reconciliation and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal significance as a traditional handwritten signature.

- Review all details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you choose. Edit and eSign Kenton County Annual Reconciliation and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kenton county annual reconciliation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Kenton County annual reconciliation process?

The Kenton County annual reconciliation process is a financial review that ensures all accounts match effectively over a year. This process involves reconciling transactions to avoid discrepancies and improve financial accuracy, which can be streamlined using airSlate SignNow's electronic signature platform.

-

How can airSlate SignNow help with Kenton County annual reconciliation?

airSlate SignNow simplifies the Kenton County annual reconciliation by enabling easy document management and secure eSigning. Our platform allows for the quick sharing and signing of required documents, ensuring that all financial records are accurate and easily accessible.

-

What features does airSlate SignNow offer for the annual reconciliation needs in Kenton County?

airSlate SignNow offers features such as template creation, bulk sending, and real-time tracking, all essential for the Kenton County annual reconciliation. These tools help businesses automate the document workflow, enhancing efficiency and minimizing errors during the reconciliation process.

-

Is airSlate SignNow a cost-effective solution for the Kenton County annual reconciliation?

Yes, airSlate SignNow is an extremely cost-effective solution for the Kenton County annual reconciliation. With flexible pricing plans designed to cater to businesses of all sizes, you can choose the plan that best suits your needs without overspending.

-

What are the benefits of using airSlate SignNow for Kenton County annual reconciliation?

Using airSlate SignNow for the Kenton County annual reconciliation offers numerous benefits, including time savings, improved accuracy, and enhanced security. The platform ensures that all documents are securely signed, reducing the time spent on manual processes and increasing overall productivity.

-

Does airSlate SignNow integrate with other software for Kenton County annual reconciliation?

Yes, airSlate SignNow provides integrations with various accounting and financial software, making it easier to manage the Kenton County annual reconciliation. This seamless integration means you can import/export documents and maintain data consistency across different platforms.

-

How secure is the airSlate SignNow platform for the Kenton County annual reconciliation?

The airSlate SignNow platform is highly secure and compliant with various industry standards, ensuring that your documents during the Kenton County annual reconciliation are protected. With features like encryption and secure cloud storage, you can trust that your sensitive financial information remains safe.

Get more for Kenton County Annual Reconciliation

- Neptune beach permit search form

- Lpkp 2 pin spad gov form

- Mybonusbonds form

- 1310 fm dcnr0018 form

- Boletn oficial de la rioja ayudas e incentivos para empresas form

- Convocatoria pblica para la contratacin temporal en form

- E x p o n e ayuntamiento de las palmas de gran canaria form

- El gobierno de la rioja abre una bolsa de empleo temporal form

Find out other Kenton County Annual Reconciliation

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe