Borrower Certification Form

What is the Borrower Certification

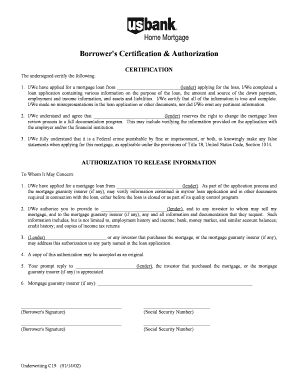

The borrower certification is a formal document that verifies the identity and financial status of an individual seeking a loan or mortgage. This certification serves as a declaration of the borrower's financial information, including income, debts, and assets. It is crucial for lenders to assess the borrower's creditworthiness and ability to repay the loan. The borrower certification typically includes personal details, employment information, and financial statements, ensuring that all provided information is accurate and up-to-date.

Key Elements of the Borrower Certification

A borrower certification generally includes several key components that are essential for its validity. These elements include:

- Personal Information: Full name, address, Social Security number, and contact details.

- Financial Disclosure: Detailed information about income sources, employment history, and existing debts.

- Asset Declaration: A list of assets, such as bank accounts, real estate, and investments.

- Signature: The borrower's signature, which confirms the accuracy of the information provided.

Each of these components plays a vital role in ensuring that the certification is both comprehensive and legally binding.

Steps to Complete the Borrower Certification

Completing the borrower certification involves several straightforward steps. Following these steps can help ensure that the document is filled out correctly:

- Gather Necessary Documents: Collect all required financial documents, including pay stubs, tax returns, and bank statements.

- Fill Out Personal Information: Enter your full name, address, and contact details accurately.

- Disclose Financial Information: Provide a detailed account of your income, debts, and assets.

- Review for Accuracy: Double-check all entries to ensure that the information is correct and complete.

- Sign the Document: Sign the borrower certification to affirm that all provided information is truthful.

Following these steps will help facilitate a smooth loan application process.

Legal Use of the Borrower Certification

The borrower certification is legally binding when it meets specific requirements set forth by federal and state laws. To ensure its legal standing, the document must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws validate electronic signatures and electronic records in transactions. Additionally, the borrower must provide accurate and truthful information, as any discrepancies can lead to legal consequences, including loan denial or fraud charges.

How to Obtain the Borrower Certification

Obtaining a borrower certification can typically be done through your lender or financial institution. Most lenders provide a standardized form that borrowers can fill out. In some cases, you may also find templates available online. It is essential to ensure that any form you use complies with the legal standards required in your state. Additionally, consulting with a financial advisor or legal professional can help ensure that you complete the certification correctly and meet all necessary requirements.

Examples of Using the Borrower Certification

The borrower certification is commonly used in various lending scenarios. Examples include:

- Mortgage Applications: Required when applying for a home loan to verify the borrower's financial status.

- Personal Loans: Used by lenders to assess the risk of lending to an individual.

- Auto Loans: Necessary for financing the purchase of a vehicle, ensuring the borrower can meet payment obligations.

In each of these cases, the borrower certification helps lenders make informed decisions regarding loan approvals.

Quick guide on how to complete borrower certification

Effortlessly prepare Borrower Certification on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Borrower Certification on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Borrower Certification with ease

- Locate Borrower Certification and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow supplies specifically for this purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, exhaustive form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow satisfies your document management needs in just a few clicks from any device you choose. Alter and electronically sign Borrower Certification to ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the borrower certification

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a borrower's authorization in the context of e-signatures?

A borrower's authorization is a document that allows a lender to access certain information related to a borrower's loan application. With airSlate SignNow, you can easily create, send, and eSign this document electronically, ensuring a smooth and secure process for both parties involved.

-

How does airSlate SignNow simplify the borrower's authorization process?

airSlate SignNow simplifies the borrower's authorization process by providing a user-friendly platform where borrowers can quickly review and electronically sign documents. The platform eliminates the need for paper documents, allowing for faster processing and reduced turnaround times.

-

Is airSlate SignNow cost-effective for handling borrower's authorizations?

Yes, airSlate SignNow is a cost-effective solution for managing borrower's authorizations. With flexible pricing plans, businesses can choose an option that best fits their needs, ensuring that they get the most value while streamlining their document processes.

-

Can I integrate airSlate SignNow with other applications for managing borrower's authorizations?

Absolutely! airSlate SignNow offers integrations with various applications like CRM and document management systems. This allows you to seamlessly manage borrower's authorization documents alongside other essential business workflows.

-

What security measures does airSlate SignNow have in place for borrower's authorizations?

airSlate SignNow prioritizes the security of your documents, including borrower's authorizations. The platform employs advanced encryption, secure authentication, and compliance with industry standards to protect sensitive information during the e-signing process.

-

How can I track the status of a borrower's authorization in airSlate SignNow?

You can easily track the status of a borrower's authorization using the tracking features within airSlate SignNow. The platform provides real-time updates on document status, notifying you when a borrower has viewed and signed the authorization.

-

What features does airSlate SignNow offer for managing multiple borrower's authorizations?

airSlate SignNow offers features such as bulk sending, document templates, and customizable workflows to manage multiple borrower's authorizations efficiently. This allows your team to handle large volumes of authorizations with ease, saving time and effort.

Get more for Borrower Certification

- Form r expression of interest r licence accreditation nsw dpi nsw gov

- Fillable eu ewr tschechisch pdf form

- Louisiana child support calculator worksheet b form

- High school activity sheet form

- Laser amp skin care consultation form

- Jackson state university application fee waiver form

- Vollmacht power of attorney form

- Dd form 1172 2 march

Find out other Borrower Certification

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document