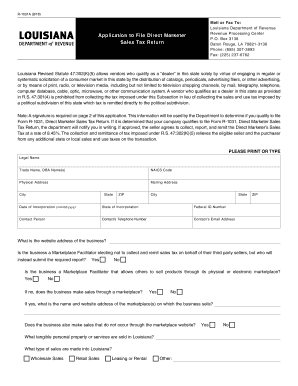

Louisiana Dept of Revenue Form

What is the Louisiana Department of Revenue?

The Louisiana Department of Revenue (LDR) is the state agency responsible for administering and enforcing the state's tax laws. This includes the collection of various taxes, such as income, sales, and property taxes. The LDR also oversees tax compliance and provides resources for taxpayers to understand their obligations. By ensuring that tax regulations are followed, the department plays a crucial role in maintaining the financial health of the state.

How to Use the Louisiana Department of Revenue

Utilizing the Louisiana Department of Revenue involves accessing its resources for filing taxes, understanding tax obligations, and seeking assistance. The department's website offers forms, guides, and FAQs that help taxpayers navigate their responsibilities. Users can also find information on tax credits and deductions available in Louisiana, making it easier to optimize their tax filings.

Steps to Complete the Louisiana Department of Revenue Forms

Completing forms for the Louisiana Department of Revenue requires a systematic approach. First, identify the specific form needed based on your tax situation. Gather necessary documentation, such as income statements and previous tax returns. Fill out the form accurately, ensuring all required fields are completed. Once the form is filled, review it for accuracy before submitting it online, by mail, or in person. Keeping a copy of the completed form for your records is also advisable.

Legal Use of the Louisiana Department of Revenue Forms

Forms issued by the Louisiana Department of Revenue are legally binding documents when completed and submitted in accordance with state regulations. To ensure legal validity, it is essential to comply with the requirements set forth by the department. This includes providing accurate information and using the appropriate form for your specific tax situation. Electronic submissions are accepted, provided they adhere to the guidelines established by the LDR.

Required Documents for Louisiana Department of Revenue Forms

When filing forms with the Louisiana Department of Revenue, certain documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for additional income

- Receipts for deductible expenses

- Previous year’s tax return

- Proof of residency, if applicable

Having these documents ready can streamline the process and help ensure accurate reporting.

Form Submission Methods

The Louisiana Department of Revenue offers multiple methods for submitting forms. Taxpayers can choose to file online through the LDR's website, which often provides instant confirmation of receipt. Alternatively, forms can be mailed to the appropriate address specified on the form or submitted in person at designated locations. Each method has its own processing times, so it is important to choose one that aligns with your needs.

Quick guide on how to complete louisiana dept of revenue

Complete Louisiana Dept Of Revenue seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly substitute to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any hold-ups. Manage Louisiana Dept Of Revenue on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to adjust and eSign Louisiana Dept Of Revenue without any hassle

- Obtain Louisiana Dept Of Revenue and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight essential sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign Louisiana Dept Of Revenue and ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the louisiana dept of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of the Louisiana Department of Revenue in tax compliance?

The Louisiana Department of Revenue is responsible for collecting state taxes and ensuring compliance with tax laws. By using solutions like airSlate SignNow, businesses can easily sign and submit documents required by the department, streamlining their tax compliance process.

-

How can airSlate SignNow help with submitting documents to the Louisiana Department of Revenue?

airSlate SignNow provides a simple platform to eSign and send essential documents directly to the Louisiana Department of Revenue. This eliminates the need for physical signatures and enhances the speed and efficiency of your submissions.

-

What features does airSlate SignNow offer for businesses dealing with the Louisiana Department of Revenue?

airSlate SignNow offers various features such as secure eSigning, customizable templates, and document tracking that are particularly beneficial for businesses interacting with the Louisiana Department of Revenue. These features ensure compliance and timely submissions.

-

Is airSlate SignNow cost-effective for small businesses managing their taxes with the Louisiana Department of Revenue?

Yes, airSlate SignNow is designed to be budget-friendly, making it a great choice for small businesses that need to manage their tax documents with the Louisiana Department of Revenue. Its pricing structure is scalable, allowing businesses to choose a plan that fits their needs without breaking the bank.

-

Can airSlate SignNow integrate with other platforms for managing Louisiana tax documents?

Absolutely! airSlate SignNow integrates seamlessly with various platforms, enhancing your ability to manage documents related to the Louisiana Department of Revenue. This means you can work within your preferred tools while ensuring compliance and efficiency.

-

What benefits does airSlate SignNow provide for dealing with the Louisiana Department of Revenue?

By using airSlate SignNow, businesses benefit from increased efficiency, reduced paperwork, and enhanced security when signing documents for the Louisiana Department of Revenue. This leads to quicker processing times and minimizes the risk of errors.

-

How does airSlate SignNow ensure the security of documents submitted to the Louisiana Department of Revenue?

airSlate SignNow prioritizes the security of your documents with encryption and secure signing mechanisms. This level of security is crucial when submitting sensitive documents to the Louisiana Department of Revenue, ensuring that your information is protected.

Get more for Louisiana Dept Of Revenue

- Viking cruises gift order form

- Save the children donation form

- Bureau of building inspection hvac permit application apps pittsburghpa form

- Interesesinternal revenue service form

- Release of confidential information agencyindividual newhaven

- Va form 26 8261a

- Road maintenance agreement template form

- Rolling tenancy agreement template form

Find out other Louisiana Dept Of Revenue

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free