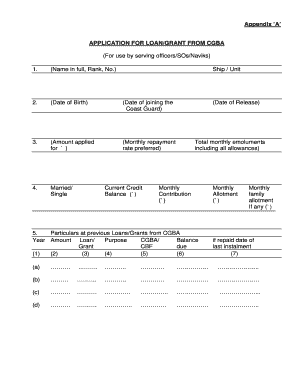

Cgba Loan Form

What is the CGBA Loan

The CGBA loan, or Community Growth Business Assistance loan, is designed to support small businesses in the United States. This financial product aims to provide essential funding for various business needs, including expansion, equipment purchases, and operational costs. The CGBA loan is typically offered through local and state government programs, making it accessible to a diverse range of entrepreneurs. Understanding the purpose and benefits of the CGBA loan can help business owners make informed decisions about their financing options.

How to Obtain the CGBA Loan

Obtaining a CGBA loan involves several steps that ensure eligibility and compliance with the program's requirements. Business owners should start by researching local and state programs that offer CGBA loans. This may include visiting government websites or contacting local economic development offices. Once the appropriate program is identified, applicants need to prepare necessary documentation, which may include business plans, financial statements, and personal identification. After submitting the application, businesses will typically undergo a review process, which may involve interviews or additional documentation requests.

Steps to Complete the CGBA Loan

Completing the CGBA loan application process requires careful attention to detail. Here are the key steps:

- Research available CGBA loan programs in your state or locality.

- Gather required documentation, including business plans and financial records.

- Fill out the application form accurately, ensuring all information is complete.

- Submit the application by the specified deadline, either online or by mail.

- Prepare for potential follow-up questions or requests for additional information from the loan committee.

Legal Use of the CGBA Loan

The legal use of the CGBA loan is crucial for compliance with funding regulations. Businesses must utilize the loan funds for the purposes outlined in their application, such as purchasing equipment, hiring staff, or expanding operations. Misuse of funds can lead to penalties, including the requirement to repay the loan or legal action. It is essential for borrowers to keep detailed records of how the funds are spent to ensure compliance with the terms of the loan agreement.

Eligibility Criteria

Eligibility for the CGBA loan varies by program but generally includes criteria such as business size, location, and purpose of the loan. Most programs require that the business be a small business as defined by the Small Business Administration (SBA). Other common eligibility factors may include:

- Demonstration of financial need.

- A solid business plan outlining how the funds will be used.

- Proof of operational history or potential for growth.

Required Documents

When applying for a CGBA loan, applicants must prepare a set of documents that demonstrate their business viability and need for funding. Commonly required documents include:

- Business plan detailing objectives and strategies.

- Financial statements, including profit and loss statements.

- Tax returns from the past few years.

- Personal identification and business registration documents.

Quick guide on how to complete cgba loan

Effortlessly Prepare Cgba Loan on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and without delays. Manage Cgba Loan on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

Edit and eSign Cgba Loan with Ease

- Locate Cgba Loan and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections or obscure sensitive information with features that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to finalize your changes.

- Choose your preferred method of sending your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and eSign Cgba Loan and ensure seamless communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cgba loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CGBA loan and how can airSlate SignNow help with it?

A CGBA loan refers to a financial product designed to assist businesses in leveraging government-backed funding. With airSlate SignNow, you can streamline the documentation process associated with CGBA loans, ensuring that all necessary forms are completed and signed quickly and securely.

-

How much does airSlate SignNow cost for CGBA loan processing?

AirSlate SignNow offers various pricing plans that cater to different business sizes and needs. The cost-effectiveness of using airSlate SignNow can signNowly reduce the expenses associated with handling CGBA loan paperwork, ultimately facilitating a smoother application process.

-

What features does airSlate SignNow offer for CGBA loan documentation?

AirSlate SignNow provides essential features such as document templates, customizable workflows, and audit trails that are particularly beneficial for managing CGBA loan applications. These tools help ensure compliance and streamline communication between stakeholders.

-

Can airSlate SignNow integrate with my existing CGBA loan management system?

Yes, airSlate SignNow is designed to seamlessly integrate with various loan management systems, enabling a smooth flow of information. This integration ensures that all documents related to the CGBA loan process are easily accessible, enhancing efficiency and reducing errors.

-

What are the benefits of using airSlate SignNow for CGBA loan documents?

Using airSlate SignNow for CGBA loan documents offers several benefits, such as faster turnaround times, improved accuracy, and enhanced security. The platform also allows for electronic signatures, which simplifies the signing process for all parties involved.

-

Is airSlate SignNow secure for handling CGBA loan paperwork?

Absolutely, airSlate SignNow prioritizes security for all documents, including those related to CGBA loans. Advanced encryption, multi-factor authentication, and compliance with industry standards ensure that your sensitive information remains protected throughout the process.

-

How can airSlate SignNow improve the customer experience for CGBA loan applicants?

AirSlate SignNow enhances the customer experience by providing a user-friendly interface and simplifying the document signing process for CGBA loan applicants. Quick access to documents and real-time status updates foster transparency, leading to higher customer satisfaction.

Get more for Cgba Loan

- Genetics 4 dominant and recessive alleles flashcardsquizlet form

- Travel forms forms travel office texas state university

- Preliminary technology assessment report volume ii c form

- Mail code l453 form

- 2020 hunter form

- The essentials of doctoral education for advanced nursing form

- School counselor information form

- Authorization for request or release of medical csu chico form

Find out other Cgba Loan

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease