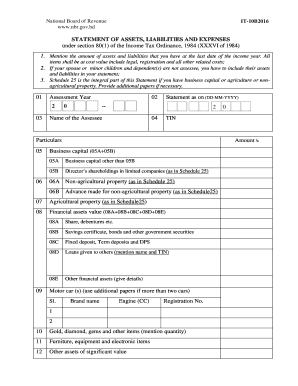

It 10b2016 Form

What is the IT 10B2016?

The IT 10B2016 form is a specific tax document used primarily for reporting certain tax-related information to the Internal Revenue Service (IRS). It is essential for individuals and businesses to accurately complete this form to ensure compliance with federal tax regulations. The form serves as a means to report income, deductions, and other pertinent financial data, which ultimately influences tax obligations.

How to Use the IT 10B2016

Using the IT 10B2016 form involves several key steps. First, gather all necessary financial documents and information that pertain to your income and deductions. Next, fill out the form carefully, ensuring that all entries are accurate and complete. After completing the form, review it for any errors before submission. It is crucial to maintain a copy of the submitted form for your records, as it may be needed for future reference or audits.

Steps to Complete the IT 10B2016

Completing the IT 10B2016 form requires a systematic approach:

- Collect all relevant financial documents, including W-2s, 1099s, and receipts for deductions.

- Begin filling out the form, starting with your personal information and income details.

- Enter any applicable deductions and credits that you qualify for.

- Double-check all figures for accuracy and completeness.

- Sign and date the form before submitting it to the IRS.

Legal Use of the IT 10B2016

The IT 10B2016 form must be used in accordance with IRS guidelines to ensure its legal validity. This includes accurately reporting all required information and adhering to filing deadlines. Failure to comply with these regulations can result in penalties or legal repercussions. It is important to understand the legal implications of submitting this form, as it plays a significant role in your overall tax compliance.

Filing Deadlines / Important Dates

Filing deadlines for the IT 10B2016 form are critical to avoid penalties. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for individuals. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the IRS website or consult a tax professional for specific dates and any changes that may occur.

Who Issues the Form

The IT 10B2016 form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and resources to assist taxpayers in understanding how to complete and submit this form correctly. Staying informed about updates from the IRS can help ensure compliance and avoid potential issues.

Quick guide on how to complete it 10b2016

Effortlessly Prepare It 10b2016 on Any Device

The management of online documents has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can easily locate the desired form and securely preserve it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without delays. Manage It 10b2016 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The Simplest Method to Edit and eSign It 10b2016 Without Effort

- Find It 10b2016 and click Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive details using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and hit the Done button to save your modifications.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign It 10b2016 to ensure clear communication at every phase of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 10b2016

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is it 10b2016 and how does it relate to airSlate SignNow?

It 10b2016 refers to a specific clause essential for businesses managing documents electronically. AirSlate SignNow complies with these regulations, ensuring that your electronic signatures are legally binding and secure.

-

How much does it cost to use airSlate SignNow with it 10b2016 compliance?

Pricing for airSlate SignNow varies based on the plan you choose, but it offers competitive rates to accommodate businesses of all sizes. Each plan ensures compliance with it 10b2016 standards, making it affordable to meet legal requirements.

-

What features does airSlate SignNow offer for it 10b2016 compliance?

AirSlate SignNow provides features such as secure eSigning, document sharing, and template creation that align with it 10b2016 requirements. This ensures your documents are fully compliant and efficient for your business processes.

-

How can airSlate SignNow benefit my business regarding it 10b2016?

By utilizing airSlate SignNow, your business can streamline document workflows while ensuring compliance with it 10b2016. This leads to faster processing times and reduced operational costs, enhancing overall productivity.

-

Does airSlate SignNow integrate with other tools while adhering to it 10b2016?

Yes, airSlate SignNow offers integrations with popular business tools like Salesforce, Google Drive, and Dropbox, all while maintaining compliance with it 10b2016. This allows for seamless operations across platforms, enhancing workflow efficiency.

-

Is airSlate SignNow user-friendly for it 10b2016 compliance?

Absolutely! AirSlate SignNow is designed with a user-friendly interface that makes it easy for anyone to create and manage documents compliant with it 10b2016. You can quickly learn how to use all features without extensive training.

-

What types of documents can I eSign with airSlate SignNow to comply with it 10b2016?

You can eSign a variety of documents, including contracts, agreements, and forms, all compliant with it 10b2016. AirSlate SignNow ensures that any document you sign electronically is secure and legally recognized.

Get more for It 10b2016

Find out other It 10b2016

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template