K Ben 3119 Form

What is the K Ben 3119 Form

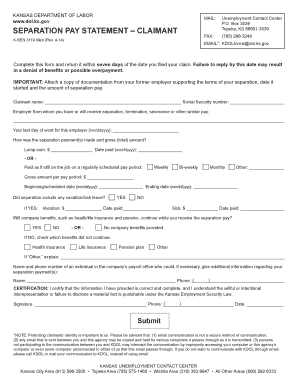

The K Ben 3119 Form is a specific document used in the United States for reporting certain financial information to tax authorities. It is often required for individuals or entities involved in particular financial transactions or activities. Understanding the purpose of this form is crucial for compliance and accurate reporting, as it helps ensure that all necessary information is disclosed to the relevant authorities.

How to use the K Ben 3119 Form

Using the K Ben 3119 Form involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents and data pertinent to the transactions or activities being reported. Next, carefully fill out each section of the form, ensuring that all information is complete and accurate. Once the form is filled out, review it for any errors before submitting it to the appropriate tax authority. Proper use of this form can help avoid penalties and ensure compliance with tax regulations.

Steps to complete the K Ben 3119 Form

Completing the K Ben 3119 Form requires a systematic approach. Follow these steps for successful completion:

- Gather all relevant financial documents.

- Read the instructions carefully to understand the requirements.

- Fill out the form, ensuring accuracy in all entries.

- Double-check all information for completeness.

- Sign and date the form as required.

- Submit the form by the designated deadline.

Legal use of the K Ben 3119 Form

The K Ben 3119 Form serves a legal purpose in the context of financial reporting. It is essential for individuals and businesses to understand the legal implications of submitting this form. Compliance with tax laws and regulations is critical, as failure to properly report can result in penalties or legal issues. The form must be completed accurately and submitted on time to maintain legal standing and avoid complications with tax authorities.

Who Issues the Form

The K Ben 3119 Form is typically issued by the Internal Revenue Service (IRS) or relevant state tax authorities. These agencies provide the necessary guidelines and requirements for filling out the form, ensuring that it meets legal standards for financial reporting. It is important for users to refer to the official resources provided by these authorities to obtain the most current version of the form and any associated instructions.

Filing Deadlines / Important Dates

Filing deadlines for the K Ben 3119 Form can vary based on the type of report being submitted and the specific circumstances of the filer. Generally, it is crucial to be aware of the deadlines set by the IRS or state tax authorities to avoid late penalties. Keeping a calendar of important dates related to tax filings can help ensure that the form is submitted on time and in compliance with all regulations.

Quick guide on how to complete k ben 3119 form

Complete K Ben 3119 Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow provides all the necessary tools for you to create, edit, and electronically sign your documents swiftly without any hassle. Manage K Ben 3119 Form on any device using airSlate SignNow’s Android or iOS applications and enhance any document-oriented workflow today.

How to edit and electronically sign K Ben 3119 Form with ease

- Locate K Ben 3119 Form and click on Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Emphasize important sections of the documents or conceal sensitive details using tools specifically offered by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign K Ben 3119 Form and ensure excellent communication at any step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the k ben 3119 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the K Ben 3119 Form?

The K Ben 3119 Form is a document used for specific business transactions and filings. It is essential for companies needing clarity on tax reporting and compliance. Understanding this form is crucial for ensuring accurate submission and avoiding potential pitfalls.

-

How can airSlate SignNow help me with the K Ben 3119 Form?

airSlate SignNow simplifies the process of completing and submitting the K Ben 3119 Form. With our intuitive platform, you can easily fill out, eSign, and share the form online, ensuring smooth transactions. This eliminates the hassle of handling paper documents while maintaining compliance.

-

Is there a cost for using airSlate SignNow for the K Ben 3119 Form?

Yes, while airSlate SignNow provides a cost-effective solution for eSigning and managing documents like the K Ben 3119 Form, pricing may vary based on your subscription plan. We offer various plans to suit businesses of all sizes, providing flexibility for your needs.

-

Can I integrate airSlate SignNow with other applications for the K Ben 3119 Form?

Absolutely! airSlate SignNow offers seamless integrations with various applications to streamline your workflow when handling the K Ben 3119 Form. Whether you use CRM systems, cloud storage, or project management tools, our integrations enhance efficiency and productivity.

-

What are the benefits of using airSlate SignNow for the K Ben 3119 Form?

Using airSlate SignNow for the K Ben 3119 Form offers several benefits, including quick eSigning, easy document sharing, and enhanced security. This platform ensures that your documents are signed and processed efficiently, saving you time and reducing administrative burdens.

-

Is it easy to fill out the K Ben 3119 Form using airSlate SignNow?

Yes, airSlate SignNow provides an easy-to-use interface that simplifies filling out the K Ben 3119 Form. With user-friendly templates and guided prompts, you can navigate through the form efficiently, whether you're a novice or an experienced user.

-

What security measures does airSlate SignNow have for the K Ben 3119 Form?

airSlate SignNow prioritizes security, utilizing encryption and access controls to protect your K Ben 3119 Form. Our platform complies with industry standards to ensure your sensitive data is safe from unauthorized access, giving you peace of mind during document handling.

Get more for K Ben 3119 Form

- Form sev fee

- Prha housing application form

- Wood county hospital financial assistance form

- Application for marriage license pagkuha na pahintulot form

- Duvcw membership app page23 duvcw form

- Illinois early childhood education form

- Completed example rta form 18a pdf reset form print

- Commercial hvac service contract template form

Find out other K Ben 3119 Form

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe