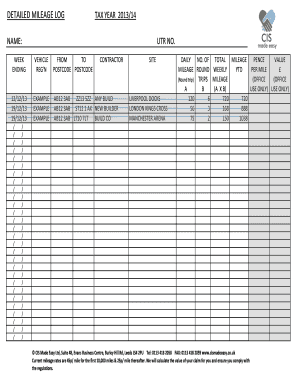

Mileage Log for Taxes Form

What is the mileage log for taxes?

A mileage log for taxes is a record used by individuals and businesses to track the miles driven for business purposes. This log is essential for claiming deductions on tax returns, particularly for self-employed individuals and business owners. The Internal Revenue Service (IRS) requires accurate documentation to substantiate mileage claims, making a well-maintained log crucial for compliance and potential tax savings.

How to use the mileage log for taxes

Using a mileage log for taxes involves consistently recording relevant details about each trip. Key information to include is the date of travel, starting and ending locations, purpose of the trip, and total miles driven. This information helps substantiate your claims when filing taxes. Many individuals find it helpful to use a digital mileage log template, which can simplify the process of tracking and organizing this information.

Steps to complete the mileage log for taxes

To effectively complete a mileage log for taxes, follow these steps:

- Choose a format: Select between a digital or printable mileage log for taxes template.

- Record trips: For each business trip, note the date, starting and ending locations, and purpose of the trip.

- Calculate total miles: Determine the total distance traveled for each trip.

- Maintain consistency: Regularly update the log to ensure accuracy and completeness.

- Review and save: Before filing taxes, review your mileage log for any errors and ensure it is saved securely.

Legal use of the mileage log for taxes

The legal use of a mileage log for taxes hinges on its accuracy and completeness. The IRS requires that taxpayers maintain a contemporaneous record of their business mileage. This means that the log should be kept up-to-date and reflect actual travel. Failing to provide a thorough and accurate log can lead to disallowed deductions and potential penalties during an audit.

IRS guidelines

The IRS provides specific guidelines regarding the use of mileage logs for tax deductions. Taxpayers must adhere to the following:

- Document all business-related travel, including the date, destination, and purpose.

- Use the standard mileage rate set by the IRS or actual expenses incurred for vehicle use.

- Keep the log for at least three years, as this is the typical period for IRS audits.

Examples of using the mileage log for taxes

Examples of using a mileage log for taxes can vary based on individual circumstances. For instance, a self-employed consultant might log trips to client meetings, while a small business owner may record travel to purchase supplies. In each case, accurate logging helps substantiate deductions on tax returns, ensuring compliance with IRS regulations.

Quick guide on how to complete mileage log for taxes

Easily prepare Mileage Log For Taxes on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents efficiently without delays. Manage Mileage Log For Taxes across any platform with the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to edit and electronically sign Mileage Log For Taxes effortlessly

- Locate Mileage Log For Taxes and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you would like to share your form, via email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device. Edit and electronically sign Mileage Log For Taxes and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mileage log for taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a mileage log for taxes?

A mileage log for taxes is a record that tracks the distances driven for business purposes, ensuring you can claim the proper deductions on your tax return. Keeping accurate mileage logs is essential for maximizing your tax benefits while remaining compliant with IRS regulations. airSlate SignNow offers an efficient way to create and manage your mileage logs seamlessly.

-

How can airSlate SignNow assist with my mileage log for taxes?

airSlate SignNow simplifies the process of maintaining a mileage log for taxes by providing easy-to-use templates and signing features. You can quickly document your business trips, track mileage automatically, and securely store your logs. This ensures you’re always prepared during tax season without the hassle of complicated record-keeping.

-

What features does airSlate SignNow offer for mileage tracking?

airSlate SignNow includes features such as customizable mileage tracking templates, digital signatures, and document storage that specifically cater to your mileage log for taxes. You can easily input trip details, calculate deductions, and generate reports. These features make it more convenient to stay organized and ensure accuracy in your logs.

-

Is there a cost associated with using airSlate SignNow for mileage logs?

Yes, airSlate SignNow operates on a subscription basis, providing various pricing plans tailored to different business needs. Each plan offers valuable features for managing your mileage log for taxes, making it a cost-effective solution for businesses of all sizes. You can choose a plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with other tools for better mileage tracking?

Absolutely! airSlate SignNow supports several integrations with popular accounting and business management tools. By integrating with these platforms, you can enhance your mileage log for taxes processes, synchronize data, and streamline your overall workflow. This means less manual entry and more accuracy in your logging system.

-

What are the benefits of using airSlate SignNow for my mileage log for taxes?

Using airSlate SignNow for your mileage log for taxes provides numerous benefits, including ease of document management, digital signing, and secure cloud storage. It saves you time and minimizes errors, ensuring your tax reporting is accurate. This efficiency helps you focus on your business while optimizing your tax savings.

-

How do I get started with tracking my mileage for taxes using airSlate SignNow?

Getting started is simple! Sign up for an airSlate SignNow account, select the mileage tracking feature, and customize your mileage log for taxes. Once set up, you can begin logging your trips immediately. The user-friendly interface makes it easy to input details and keep your records organized.

Get more for Mileage Log For Taxes

Find out other Mileage Log For Taxes

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF