Form 8804

What is the Form 8804

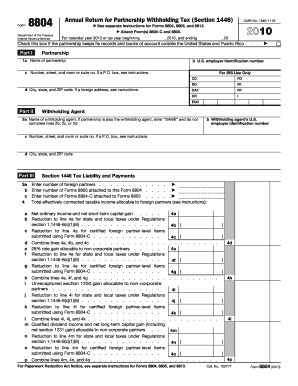

The Form 8804 is a tax document used by partnerships to report their tax liability under the Foreign Investment in Real Property Tax Act (FIRPTA). This form is specifically designed for partnerships that have foreign partners and are required to withhold tax on certain distributions. The form helps ensure compliance with U.S. tax laws and assists in the proper reporting of income generated from U.S. real property interests.

How to use the Form 8804

Using the Form 8804 involves several steps, primarily focused on accurately reporting the income and tax withheld for foreign partners. Partnerships must calculate the total amount of tax owed based on the income generated from real property. The form must be filled out completely, detailing the partnership's income, deductions, and the amount withheld from distributions to foreign partners. It is essential to ensure that all information is accurate to avoid penalties and ensure compliance with IRS regulations.

Steps to complete the Form 8804

Completing the Form 8804 requires careful attention to detail. Here are the steps to follow:

- Gather necessary financial documents, including income statements and records of distributions to partners.

- Calculate the total income generated from U.S. real property interests.

- Determine the amount of tax that needs to be withheld from foreign partners.

- Fill out the Form 8804, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submission.

Filing Deadlines / Important Dates

Partnerships must be aware of the filing deadlines associated with Form 8804. Generally, the form is due on the 15th day of the fourth month following the close of the partnership's tax year. For partnerships operating on a calendar year, this typically means the form is due by April 15. It is crucial to adhere to these deadlines to avoid late filing penalties and interest charges.

Legal use of the Form 8804

The legal use of the Form 8804 is governed by IRS regulations, which mandate that partnerships with foreign partners comply with withholding tax requirements. This form serves as a formal declaration of the partnership's tax obligations and must be filed accurately to maintain legal standing. Failure to file or incorrect filings can result in penalties, making it essential for partnerships to understand their obligations under U.S. tax law.

Key elements of the Form 8804

Key elements of the Form 8804 include the partnership's identifying information, the total income from U.S. real property interests, the amount of tax withheld, and details about each foreign partner. Accurate reporting of these elements is vital for compliance and helps facilitate the proper processing of tax obligations. Additionally, partnerships must ensure they maintain thorough records to support the information reported on the form.

Quick guide on how to complete form 8804

Effortlessly Prepare Form 8804 on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can easily access the necessary template and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage Form 8804 across any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to Edit and eSign Form 8804 with Ease

- Locate Form 8804 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of the documents or obscure sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method to send your document—via email, SMS, or invite link, or download it directly to your computer.

Eliminate worries about lost or misplaced files, laborious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs within a few clicks from any device you prefer. Edit and eSign Form 8804 to ensure effective communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8804

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8804, and who needs to file it?

Form 8804 is a tax form that must be filed by partnerships to report their income and any taxes owed. This form is essential for partnerships with foreign partners who may be subject to U.S. tax laws. Understanding and correctly filing Form 8804 ensures compliance with IRS regulations.

-

How can airSlate SignNow help with Form 8804?

airSlate SignNow simplifies the process of preparing and signing Form 8804 by providing a user-friendly electronic signature solution. With our platform, you can easily create, send, and manage your Form 8804 documents securely and efficiently. This streamlines your tax filing process and reduces potential errors.

-

What are the benefits of using airSlate SignNow for Form 8804?

Using airSlate SignNow for Form 8804 offers several benefits, including enhanced security, faster processing times, and reduced paper usage. Our platform also allows for easy tracking of document status and provides a legally binding eSignature. This makes managing your compliance documents much simpler.

-

Is there a pricing plan for using airSlate SignNow for Form 8804?

Yes, airSlate SignNow offers several pricing plans to accommodate different business needs, making it an affordable solution for managing Form 8804. Our plans vary based on features, number of users, and document volumes. You can easily choose a plan that fits your budget while ensuring compliance with tax requirements.

-

Can I integrate airSlate SignNow with my existing software for Form 8804 management?

Absolutely! airSlate SignNow offers integrations with popular accounting and tax software to facilitate seamless management of Form 8804. This means you can automate the workflow from document creation to signing, minimizing manual intervention and enhancing your efficiency.

-

What features does airSlate SignNow offer specifically for Form 8804?

airSlate SignNow provides several features tailored for Form 8804, including customizable templates, document tagging, and real-time status tracking. These features enhance usability, ensuring that your Form 8804 is completed correctly and efficiently. You can also access audit trails for compliance verification.

-

How does airSlate SignNow ensure the security of my Form 8804 data?

At airSlate SignNow, the security of your Form 8804 data is a top priority. We implement several security measures, including encryption, secure storage, and authentication protocols. This ensures that your sensitive financial information remains protected throughout the signing and submitting process.

Get more for Form 8804

- Small employer application form

- Property tax notice of protest form 50 132

- Csi form 13 1a substitution request after the bidding negdocx

- Rent payment ledger landlord protection agency form

- Foodbeverage substitution request form schools utah gov schools utah

- Latin alive book 1 pdf form

- Subletting tenancy agreement template form

- Subletting apartment agreement template form

Find out other Form 8804

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation