Illinois Withholding Allowance Worksheet Example Form

What is the Illinois Withholding Allowance Worksheet Example

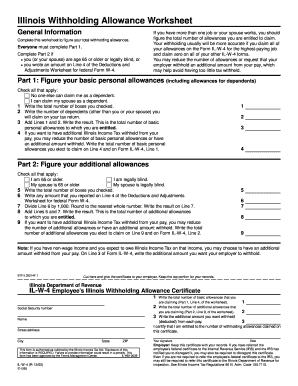

The Illinois Withholding Allowance Worksheet is a crucial document used by employees to determine the number of withholding allowances they can claim on their Illinois W-4 form. This worksheet helps in calculating the appropriate amount of state income tax to withhold from an employee's paycheck. The number of allowances claimed can affect the overall tax liability, making it essential for individuals to understand their eligibility and how to accurately complete the worksheet.

How to use the Illinois Withholding Allowance Worksheet Example

Using the Illinois Withholding Allowance Worksheet involves several steps. First, employees should gather necessary information, including their filing status, number of dependents, and any additional income. Next, they will need to follow the instructions on the worksheet, which guide them through calculating the total number of allowances based on their specific situation. It is important to ensure that all information is accurate to avoid under- or over-withholding of taxes.

Steps to complete the Illinois Withholding Allowance Worksheet Example

Completing the Illinois Withholding Allowance Worksheet consists of the following steps:

- Begin by entering personal information, such as name, address, and Social Security number.

- Identify your filing status, which can be single, married, or head of household.

- Calculate the number of allowances based on the number of dependents and other qualifying factors.

- Review the instructions carefully to ensure all calculations are correct.

- Once completed, transfer the total number of allowances to your Illinois W-4 form.

Legal use of the Illinois Withholding Allowance Worksheet Example

The Illinois Withholding Allowance Worksheet is legally recognized for determining state income tax withholding. To ensure its legal validity, it must be filled out accurately and submitted to the employer as part of the Illinois W-4 form. Compliance with state regulations is essential, as incorrect or fraudulent information can lead to penalties or fines.

State-specific rules for the Illinois Withholding Allowance Worksheet Example

Illinois has specific rules governing the use of the Withholding Allowance Worksheet. Employees must adhere to the guidelines set by the Illinois Department of Revenue, which outlines eligibility criteria for claiming allowances. It is essential to stay updated on any changes in state tax laws that may affect the number of allowances one can claim to ensure compliance and avoid unexpected tax liabilities.

Required Documents

To complete the Illinois Withholding Allowance Worksheet, individuals typically need the following documents:

- Personal identification, such as a driver’s license or Social Security card.

- Previous year’s tax return for reference on income and deductions.

- Documentation of dependents, including birth certificates or Social Security cards.

- Any additional income statements that may affect withholding calculations.

Quick guide on how to complete illinois withholding allowance worksheet example 42276470

Effortlessly Prepare Illinois Withholding Allowance Worksheet Example on Any Device

Managing documents online has gained immense popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the appropriate form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without interruptions. Handle Illinois Withholding Allowance Worksheet Example on any device with the airSlate SignNow applications for Android or iOS and simplify any document-based procedure today.

How to Edit and Electronically Sign Illinois Withholding Allowance Worksheet Example with Ease

- Find Illinois Withholding Allowance Worksheet Example and click on Get Form to initiate the process.

- Utilize the tools we provide to fill in your form.

- Highlight relevant sections of the documents or obscure sensitive information using tools designed specifically for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors requiring reprints of documents. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Illinois Withholding Allowance Worksheet Example and ensure exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois withholding allowance worksheet example 42276470

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Illinois withholding allowance worksheet?

The Illinois withholding allowance worksheet is a vital document used by employees to determine the correct amount of state income tax to withhold from their paycheck. By accurately completing this worksheet, individuals can ensure that they meet their tax obligations while avoiding over-withholding. airSlate SignNow simplifies this process by providing easy-to-use e-signing solutions.

-

How can airSlate SignNow assist with completing the Illinois withholding allowance worksheet?

airSlate SignNow offers a user-friendly platform that allows users to fill out and e-sign the Illinois withholding allowance worksheet seamlessly. Our efficient templates and guided features help reduce errors and save time during tax preparation. By using airSlate SignNow, businesses can streamline their document management processes.

-

Is airSlate SignNow suitable for businesses of all sizes when handling the Illinois withholding allowance worksheet?

Yes, airSlate SignNow is an excellent solution for businesses of all sizes looking to manage their Illinois withholding allowance worksheet efficiently. Whether you are a small business or a large corporation, our platform scales to meet your needs. We provide robust features that enhance collaboration and document management.

-

What are the pricing options for using airSlate SignNow for the Illinois withholding allowance worksheet?

airSlate SignNow offers competitive pricing plans that cater to various business requirements, including those needed for processing the Illinois withholding allowance worksheet. Our flexible subscription options enable users to choose the right plan for their document management needs without high upfront costs. Visit our website for detailed pricing information.

-

Can airSlate SignNow integrate with other software for the Illinois withholding allowance worksheet?

Absolutely! airSlate SignNow features integrations with popular software applications that can help automate the process of handling the Illinois withholding allowance worksheet. By connecting with your existing tools, we ensure a smooth workflow and efficient data management, enhancing your overall productivity.

-

What benefits does airSlate SignNow provide for managing the Illinois withholding allowance worksheet?

Using airSlate SignNow for the Illinois withholding allowance worksheet brings various benefits, including faster document turnaround, reduced paperwork, and enhanced accuracy in completing tax forms. Our powerful platform allows for secure e-signatures and easy tracking of document status, which saves time and eliminates the hassle of manual processes.

-

How secure is the information submitted through the Illinois withholding allowance worksheet on airSlate SignNow?

Security is a top priority for airSlate SignNow. When submitting the Illinois withholding allowance worksheet, your information is protected by advanced encryption and security protocols. We ensure that sensitive data remains confidential and complies with relevant regulations, providing peace of mind to users.

Get more for Illinois Withholding Allowance Worksheet Example

- Contractors license board guam form

- Fictitious business name filing in person id required only arcc form

- Rfa 809 form

- Georgia medical documentation form 1 georgia department of

- Supplier quality agreement template form

- Supplier service level agreement template form

- Suppliers agreement template form

- Supplier supply agreement template form

Find out other Illinois Withholding Allowance Worksheet Example

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online